Liabilities vs. Assets: the money you give away is a liability, whereas the money they have given you is an asset. Banks have huge short-term liabilities – a.k.a. money in their customers’ accounts which can be withdrawn at anytime. For a bank, a loan is an asset because it is means repayment while money held for customers are liabilities for a bank.

Liabilities vs. Assets: the money you give away is a liability, whereas the money they have given you is an asset. Banks have huge short-term liabilities – a.k.a. money in their customers’ accounts which can be withdrawn at anytime. For a bank, a loan is an asset because it is means repayment while money held for customers are liabilities for a bank.

Decision Trees: Making decisions in business is not always that easy. If you drill for oil in a certain spot in Alberta, Canada, you will have to spend $10 million in drilling costs. From this exploration, there are two possible outcomes. There is a 30% chance that you will find nothing and a 70% chance that you will make $20 million. Multiply the outcomes by a percentage, and you get $0.0000000 versus a positive $14million. So the investment is possibly worth $14million. Probabilities have to be accurate to make this a valid measure….

![]() Learn Excel: Regression Analysis is used to determine why someone who lives close to the bank, chooses or doesn’t choose to use that service over another. Do older people use online banking? Regression is essentially a Large N study or large number of pieces of data study, where you will be asked to make sense of this data, and simplify those trends. These questions can be analysed using a rather useful little program. Excel is essential for an MBA program. Learn as much Excel as possible before you start your MBA.

Learn Excel: Regression Analysis is used to determine why someone who lives close to the bank, chooses or doesn’t choose to use that service over another. Do older people use online banking? Regression is essentially a Large N study or large number of pieces of data study, where you will be asked to make sense of this data, and simplify those trends. These questions can be analysed using a rather useful little program. Excel is essential for an MBA program. Learn as much Excel as possible before you start your MBA.

Why You Should Consider An MBA: The people who go to business school are in two camps, those who know exactly why they are there, and those who know only somewhat. The first group have taken time off from the standard McKinsey or banking backgrounds and they want to make a specific career change. The second want a change in their life but are not sure which kind. An MBA will teach you the language of business which is invaluable. You will not be the intellectual elite, the artistic, or creative elite. An MBA prepares you to be the “competent elite.” (Laurence Shames) Many people hate MBAs because they engage in too much cost-benefit analysis, and too little humanity.

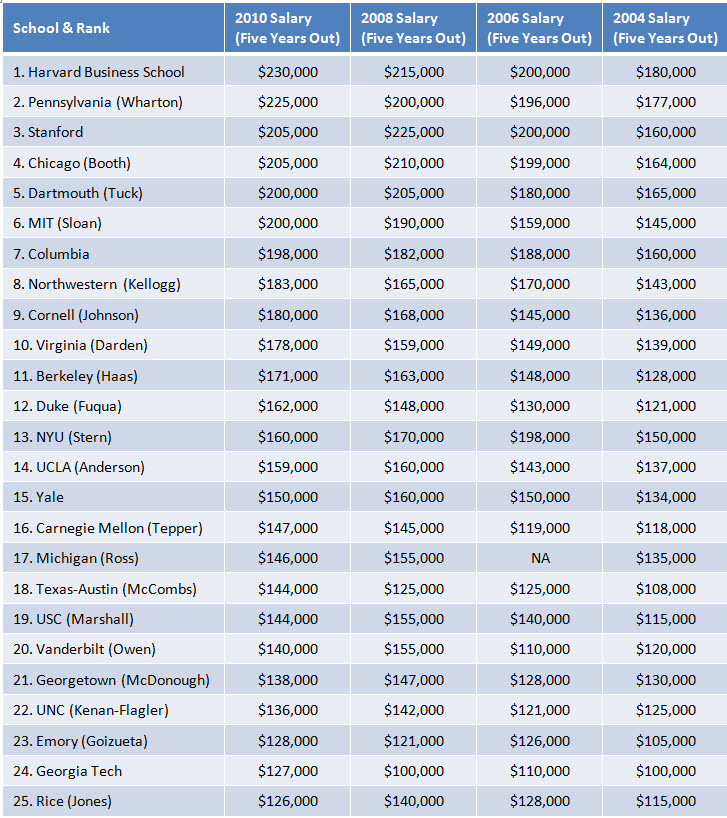

The Top US Schools: Stanford is known as a place for Silicon Valley entrepreneurs. Kellogg is famous for marketing: building a brand is what Kellogg people do. Wharton is for financiers, Columbia is similarly plugged into New York, Sloan School is for engineers, and scientists.

The Top US Schools: Stanford is known as a place for Silicon Valley entrepreneurs. Kellogg is famous for marketing: building a brand is what Kellogg people do. Wharton is for financiers, Columbia is similarly plugged into New York, Sloan School is for engineers, and scientists.

In Order To Apply: You will be expected to explain 1) why you want to come to a business school? 2) why that particular business school? 3) what have you done in life that makes you think that a business education would be worth the time of that school, and yours? Describe a leadership situation, a difficult moral decision, the intentions of coming to that business school…

Course Structure: Harvard MBA is broken down into 10 courses, finance 1, accounting, marketing, operations, and organizational behaviour, then finance 2, negotiating, strategy, leadership, and corporate accountability, and a macroeconomics course called Business, Government, and International Economics, known to all as ‘Biggie.” Grades are curved: so if you get 94%, and everyone else gets 95% you are screwed. In an MBA, participation is 50% of the grades. Like all professional programs, you have to know what you want, and what you are good at before you proceed.

Course Structure: Harvard MBA is broken down into 10 courses, finance 1, accounting, marketing, operations, and organizational behaviour, then finance 2, negotiating, strategy, leadership, and corporate accountability, and a macroeconomics course called Business, Government, and International Economics, known to all as ‘Biggie.” Grades are curved: so if you get 94%, and everyone else gets 95% you are screwed. In an MBA, participation is 50% of the grades. Like all professional programs, you have to know what you want, and what you are good at before you proceed.

This is very educational content and written well for a change. It’s nice to see that some people still understand how to write a quality post. Thanks for sharing this.