The following is an analysis of Nintendo’s strategic position in the marketplace. What we’re looking at here is analyzing how they performed in the past, what are the strategic challenges? What is the challenges of their industries, because they are in several industries actually if you think about it, and how can they improve the performance? So hopefully, you enjoy.

Nintendo-Strategic-Analysis-for-2017-&-Beyond-Infographic

As I said, it’s a strategic analysis of the consoles and handheld devices industry with Nintendo and where it fits within that. So it’s a hardware dedicated video game platform that we’re interested in understanding. That means we’re not interested in necessarily at the core of the software, which is where Nintendo actually does really well and they sell quite a lot of licensing etc. around their products and characters. It’s not the core focus, it will be on consoles. So just give an introduction, the team here, this is the team that we had and their names are below. I’ve just kind of made everyone anonymous. Because I thought it was more appropriate to do so.

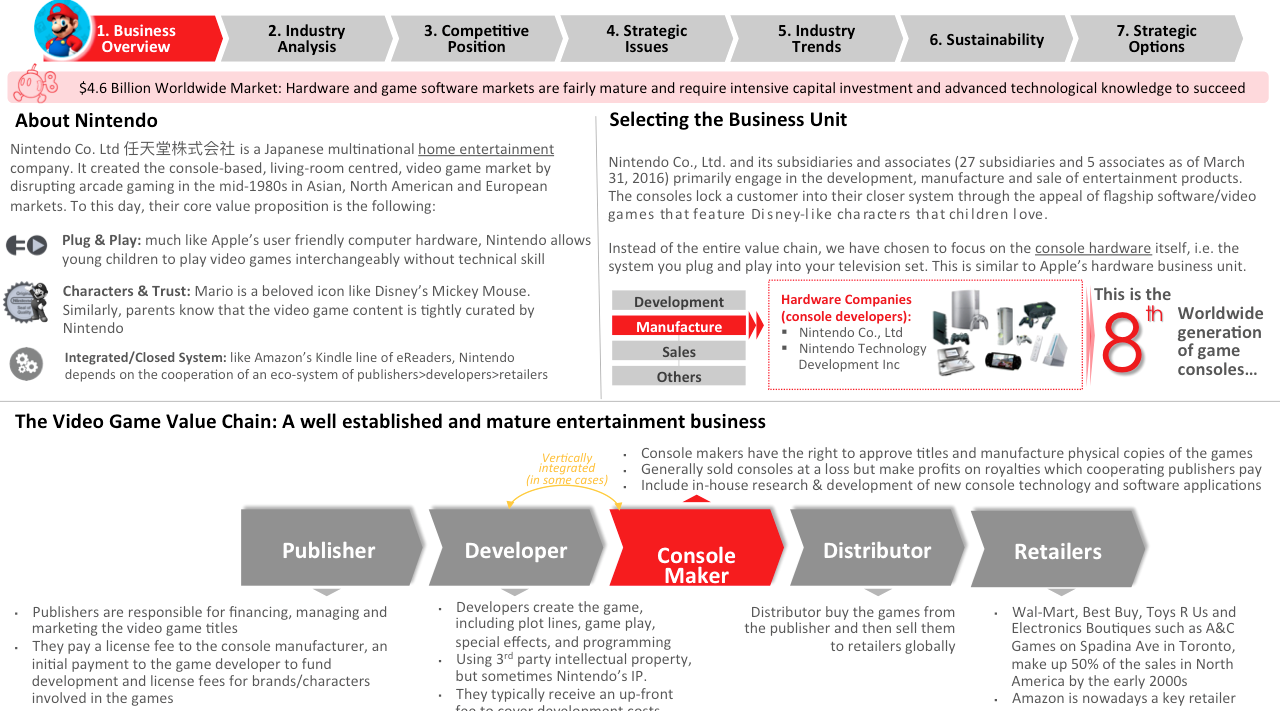

Anyway, so here we go, let’s talk about the first thing. Let’s get a bit of a business overview here. So there’s a $4.6 billion worldwide market for hardware and games and software and this industry is very competitive and it requires a lot of intensive research and development. So that’s just the general gist of the industry, so how does Nintendo fit into this? What is Nintendo, first of all? Well, if you remember maybe as a kid, at least I did on Christmas day, getting a Super Nintendo was probably the best Christmas present I ever got. It was I think 1992 and I was pretty excited about it. I didn’t really know what it was to a certain extent. Well, that’s not entirely true. I did know what it was because a buddy down the road, he had the original Nintendo system and we used to play Mario together.

Anyway, so what makes Nintendo interesting is their core value proposition. What is it about Nintendo that makes them so strong in the marketplace? And I think there’s three or four, in a sense, core areas where they dominate, and its one is the plug-and-play. So here, much like Apple, it’s a user-friendly computer interface that you can use here and Nintendo allows young children to play video games interchangeably without any technical skill whatsoever. So you can swap in games easily done, and that was quite a significant initiative in the early ’80s. You also have this element of characters and trust. So you’ve got Mario, who’s basically a Disney-like Mickey Mouse and at the same time, you have parents who know that the video game content is tightly curated by Nintendo and it’s well-put-together. Everyone loves Nintendo products for this reason, right? And you also have this integrated closed sys, so like Apple or even we use in this sentence here, Amazon’s Kindle line of e-readers, Nintendo really needs to have cooperation from a whole ecosystem of publishers because it’s a closed system. They’re very controlling of the content that’s made and of course, this is the big revolution we’ll talk about later in terms of timing. They basically disrupted the arcade industry and video computer…computer games industries in the ’80s.

In terms of business units, we know Nintendo’s quite complex. It’s got quite a few subsidiaries and it really thrives on locking customers into their closed system through the appeal of flagship characters and obviously, we can think of Super Mario Brothers as that leading experience and software that everyone wanted to play. But we wanted to focus in on the console hardware itself because that is an area where we can parse and avoid talking about the App Store and Android stores in great depth which complicates our analysis quite a bit. So in essence, were treating Nintendo here as a manufacturer and in fact, they’re on the 8th generation of consoles at this point.

I think it’s important now to talk about the value chain that exists for Nintendo. So you’ve got this idea of a pretty well-established industry now. It’s about 25-30 years…35 years old actually. And it’s gone through quite a bit of change but there’s still some fundamentals. So you have publishers, they’re the people who are responsible for financing and managing the marketing titles. They’re very much a part of getting game developers to produce good content, and then launching it on various console platforms. So you can think, of course we’re talking about Sega historically, Sony, Xbox and Nintendo. Then you’ve got the actual developers, really a critical piece obviously, the people who actually create the games. Sometimes that’s third party, but sometimes Nintendo itself creates games in-house. But no matter what, you still have to have third-party developers to really give the ecosystem as it were, right? The array of potential games you can play. You want to give it the widest breadth as possible.

And then you’ve got at the core of it, what we care about here, is the console makers themselves and that’s Nintendo’s story directly. Certainly, consoles actually are a loss leader to a certain extent. That’s kind of built into the model and there’s a lot of in-house research and development that is undertaken to make the consoles effective and innovative, so you can think of when Wii came out there was a lot of R&D that must have been at play in order to make that major leap that they did in 2006. So you also have distributors, so those are obviously kind of connected to publishers in that they sell and get the video game software, part two and the consoles, to the various marketplaces. And of course, you’ve got your retailers, so you’ve got the classics, the major players like Walmart, but you also have these small boutique electronic stores like E&C Games on Spadina in Toronto, Canada. You know, these are enthusiasts who love Nintendo.

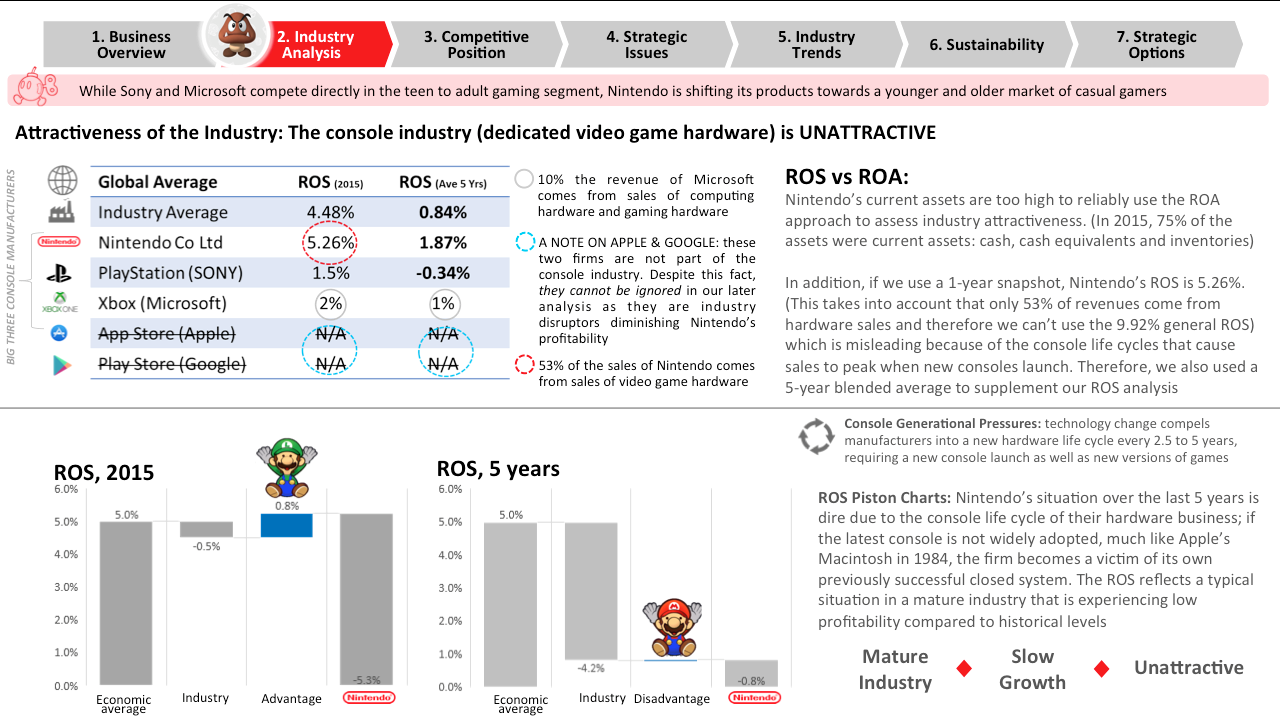

So you can actually see here then that… I’m just going to bring my cursor out, 1.87% is where they are and the industry is .84%. So the industry is unattractive but they actually are doing competitively well in an industry that is very unattractive. Still an unattractive industry, but they have a competitive advantage in an underperforming industry, interesting enough. You’ve got a 10%, so just giving a little more color to that, I don’t think it’s really worth getting into the nuance here. And again as I was saying, a return on sales is way more important than ROA. You could read that on your own time.

So looking at this in a more visual format, I’ve got this piston chart. You’ve got the industry average here… Sorry I can’t get this cursor out of the way. Maybe I’ll just remove the cursor. And then you’ve got industry average and you can see that Nintendo has a competitive advantage. If we look at just 2015 data… If you look at the ROS globally again, it’s 5% and then the industry is underperforming at -4.2% of less of the actual average there and you can see Nintendo has a disadvantage in the global economy but actually an advantage in the industry. A bit nuanced here, but basically the message is: “Stay out of consoles. Don’t go… If you’re going to start a new business, don’t try to build a plug-and-play console system for television sets”, that’s pretty much the message here.

But the console generation pressures is why arguably this is all happening. So the technology change makes every manufacturer of this hardware wary and probably weary as well because you have to basically start a new… Build a new console roughly every 2.5 to 5 years, and you’ve seen that. You’ve got your PS1, PS2, PS3, PS4, so clearly they have to generate new platforms regularly to stay relevant. And the ROS piston chart here, again just giving a little more flavor to this, it’s much like Macintosh’s 1984 situation with the Macintosh. What I mean by that is actually, the original Macintosh which was released in 1984 was actually not very successful. It wasn’t very powerful as a computer and as a result, of a lot of software developers really didn’t line up to build on the Apple Macintosh platform. Now, as a result, Apple struggled greatly. They even got rid of Steve Jobs, one of the founders of Apple in 1985 because of the struggles the company was under. So if you’re going to make a closed system, you better make sure your product is very very good. This is why consoles are just so unattractive if you’re unsuccessful in your product. Of course, Nintendo’s in this business because, you know, secretly if you can create a really great console and get lots of buy-in from software developers, you’re in the money as it were.

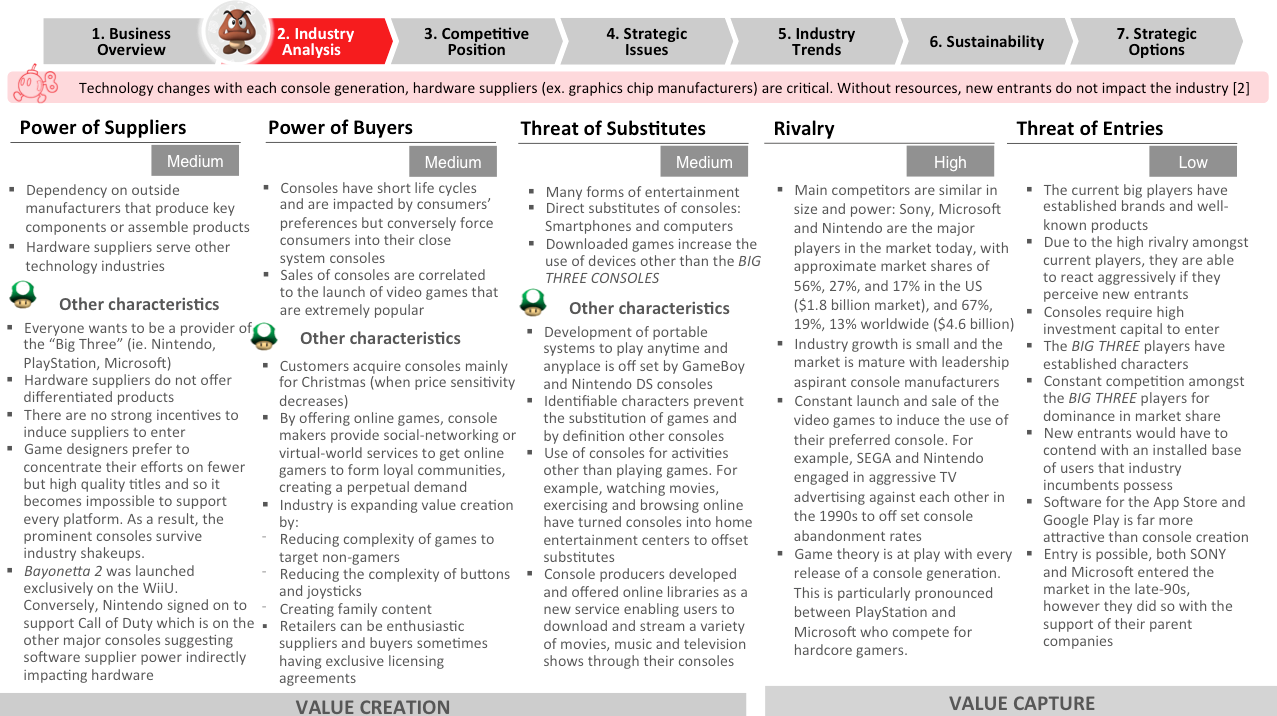

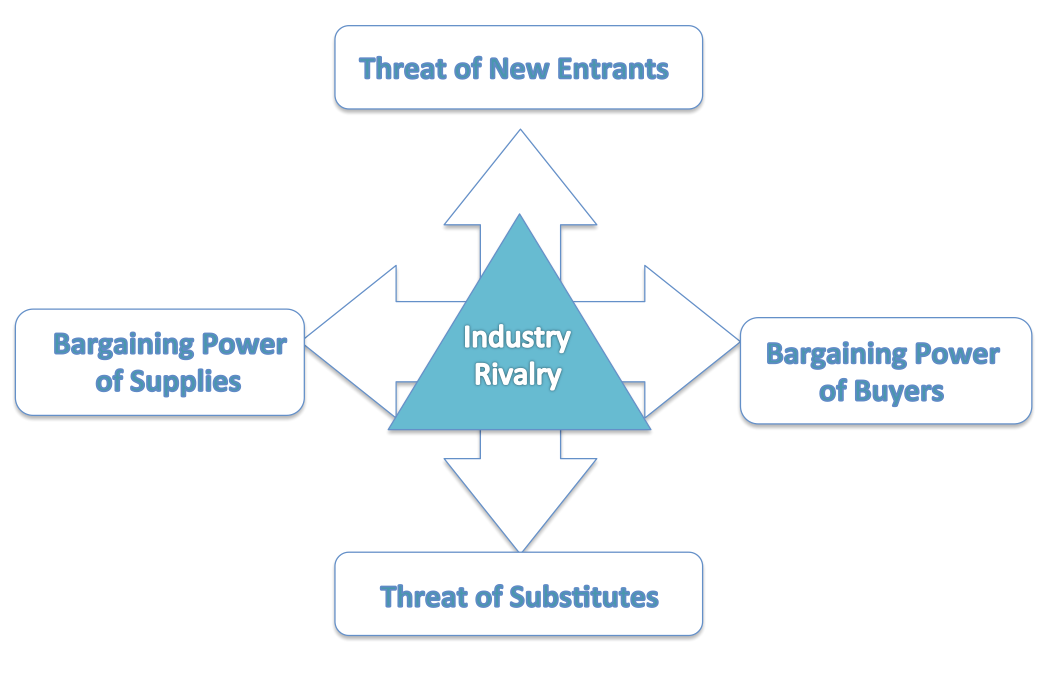

Expanding a bit on this, Michael Porter’s five forces are probably one of the most critical tools for analyzing any business, so we will just go through it really quickly here. Buyer power is medium… Sorry. As a Power of Suppliers’ medium, Buyers Power’s medium, Threat of Substitutes medium, Rivalry is high and Threats of Entry are low.

Let’s go through this quickly. So there’s a high dependency on outside manufacturers that produce key components or simple products. You also have the sort of everyone wants to work for the big three if you’re going to be producing software products or hardware, sorry. Again sorry, confusing… We’re working on the hardware suppliers issue here so the cables, the actual plastic casing and all this has to be accounted for, so they don’t necessarily have that much to pop supplier power, but another supplier would be the game developers themselves. So you might actually have a game that launches exclusively on the Wii U as is the case with Bayonetta 2. Here clearly they don’t have that much as a supplier power. They’re giving it up, they’re saying, “Nintendo you’re so great, we want to work with you”, so the relationship isn’t, you know, like Nintendo completely owns the suppliers that they work with. They can affect Nintendo’s success, and as I said earlier if they don’t want to play, if they don’t want to cooperate with you and build games for your platform, you’re in serious trouble.

On the buyer’s level, so buyer power, consumers are constantly looking for the next console, so they can kind of mess around with your goals, but at the same time they’re really loyal. A lot of people love Nintendo consoles, so it’s a bit of a mixed conversation here and sales of consoles are really all about the video games that are launched which are extremely popular. In fact, I remember when the Nintendo 64 came out, I was really excited about Goldeneye because that was an amazing game that my cousin had bought and was playing on his Nintendo 64, so I had to get a Nintendo 64 for that reason.

Threats of substitute is another key idea. Here it’s a… just to make sure you understand it, the threat to go do something else with your money, your time. So there’s obviously lots of substitutes now, particularly with smartphones and computers which we’ll talk about a bit. And then there’s the development of portal system,s which is good because you know, Gameboy and Nintendo DS actually really do well in this space, but there is always that threat. There’s so many other places and areas of activity that you can apply for entertainment and so as part of this, Nintendo’s responded by trying to create “a home entertainment centre” around their product.

Rivalry is really interesting. I mean, you can recall perhaps there was Sega company which eventually was disband. Basically, they in the 1990s were really competitive against Nintendo and really critical of Nintendo’s Super Nintendo and the Sega Genesis advertisements were really aggressive and even to this day, you can see a lot of game theory between the different players. So Sony and Xbox, they’ll try to time the release of their latest console in line with what their competitor is going to do. So it’s kind of a prisoner’s dilemma situation if you’re familiar with that theory.

And then you’ve got the Threats of Entry, it’s really not that high. People don’t want to go create consoles, particularly because of the fact that it is so difficult to do but an important point at the very bottom that I wanted to highlight is that entry is possible. In fact, that’s what Sony and Microsoft did in the ’90s. Of course, entry is possible when you’re a huge successful business already, when you look at Microsoft in particular and Sony as well. And I also want to point out at the bottom there, I don’t know if you can see that flashing thing there, okay.

So value creation, those three: the supplier, buyers, and substitutes. That’s the places, those are the ideas, factors that inhibit or allow for the creation of value. So and then if you look at the value capture side of things it’s the rivalry and entry that is really critical. So clearly the value capture area is a bit weak in this particular industry because of the intense rivalry when they’re competing to steal literally, take away customers or hopefully have customers buy both platforms or, you know, multiple platforms.

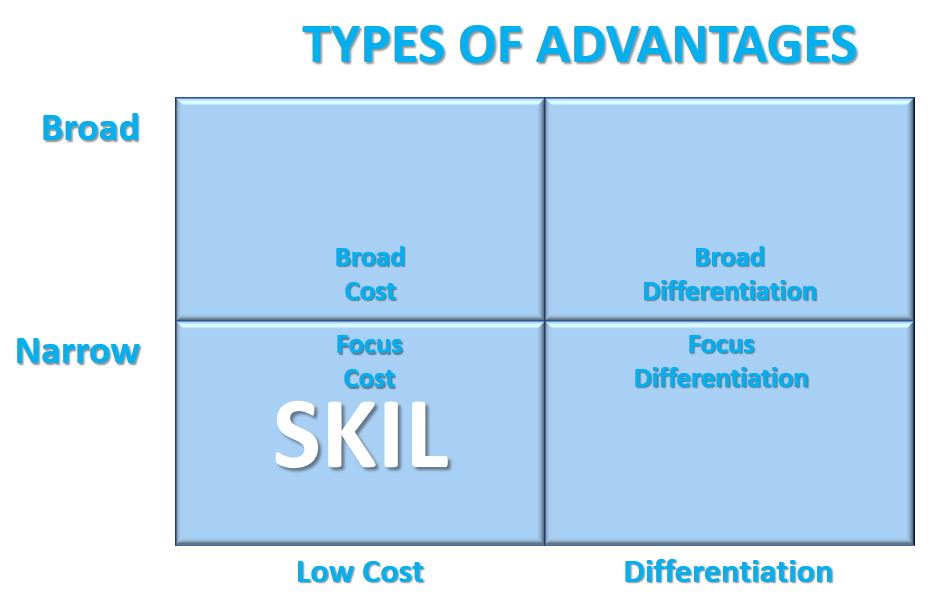

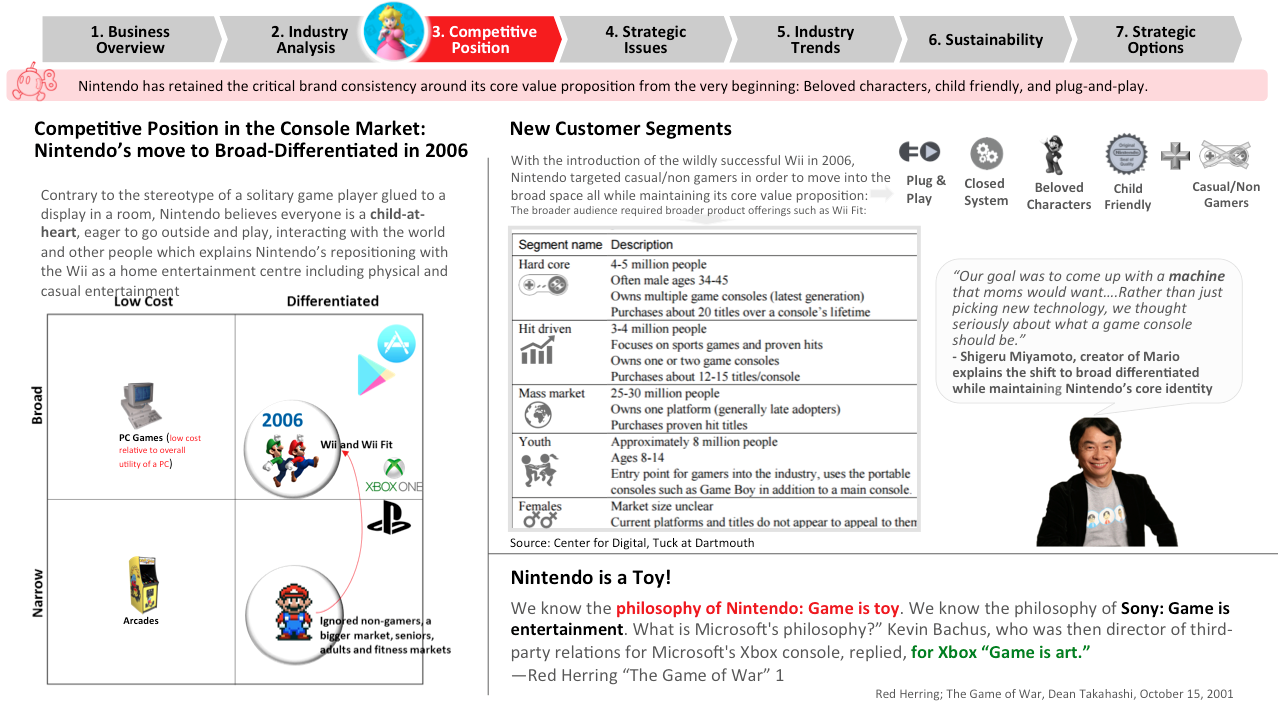

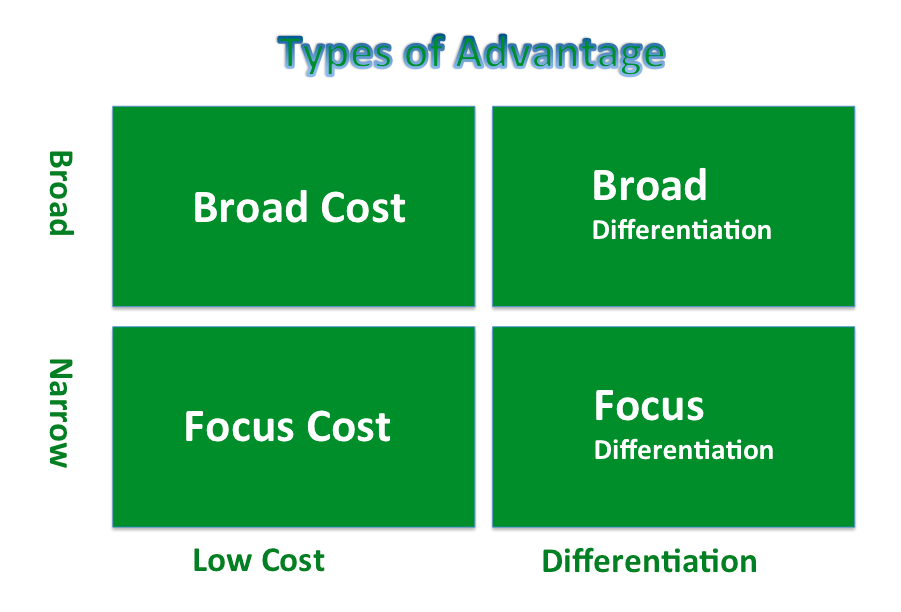

So I think we need to dive a little deeper on Nintendo’s brand identity and so again, I’ve already emphasized it’s about beloved characters, child-friendly and plug-and-play components, but I wanna understand what they did recently that’s quite fascinating. They’ve kind of moved to broad differentiated and again, we have to give a little background around what Michael Porter talks about here. If you can see at the bottom here you have four quadrants, so you’ve got on the left, you got broad and narrow and at the top, you’ve got low cost and differentiated. These are different businesses or positions that you could take as a business, so you could see that the arcades were narrow and low-cost. So they were only focused on, you could only literally play one game on an arcade machine and it was relatively low cost. It’s not like customers had to buy an arcade to play it. No, you actually had arcades, literally the places where you could play these games and for the longest time, I’d say Nintendo was quite narrow and differentiated. When we see differentiated, we mean premium so more expensive, exudes premium characteristics like distinctiveness whereas low-cost is not as distinctive so, clearly they are… They were for the longest time narrowly differentiated and then 2006 they said, “Why don’t we include…expand our market”, “Let’s go after adults”, “Let’s go after seniors”, “Let’s try to have fun with that” and that’s exactly what they did.

So customer segments is really important, I think. As you can understand, with the introduction of the Wii, Nintendo was really targeting on non-gamers quite a bit and if you look on the right I’ve got a quote here from Miyamoto, the creator of Mario and other major successful characters from Nintendo, was basically saying, “We’re trying to make it from machine that everyone, parents can love” this is what the brand is. And I think earlier on, I think in the business overview section I had sort of the value propositions of Nintendo, and here I’m saying that we’ve actually added one.

So you’ve got the plug-and-play closed system, beloved characters, child-friendliness but then you also have the non-gamers casual gamer segment. That’s what Nintendo said, “We’re going to take over in 2006 with the Wii” and they were very very successful in doing so. And again, their philosophy is it’s a toy. They are very much a playful company in that sense and the Wii contributed to the idea of who they are rather than detracting from it. They actually made a lot of sense for them, so you’ve got…and this is a really tough market. You have to have, you know, strategic issues here.

So there are a lot of strategic issues that they have to deal with and I’ve mentioned it earlier. As mentioned, you know, this decision of the short life cycles of their platform. So you have a lot of other issues as well like excess and industry…inventory. So for example of your console’s really unsuccessful and you produce a million versions of this device and only half a million are actually sold, then you’re in serious trouble and you have too much inventory, and as we’ll discuss later, there’s a resource intensive console life cycle again, so you’re constantly propping up and preventing the industry from going into decline through releasing a new console or literally distracting yourself which is what they did with the Wii. And that was really a critical move, by the way. So the traditional gaming to new neo-gaming, this is kind of how they managed to keep themselves propped up, and you can read a little more on this on the bottom. I’m not gonna go through this in detail.

They have some obvious strategic challenges. You’ve got cannibalization I’ll just mention, where you have handheld devices and then now Nintendo is considering working a lot more with other platforms like smartphones, very similar to what Apple had to do with iTunes for the PC, and of course as I mentioned again and again, the closed system disadvantages, I should say closed by the way. Nintendo is a premium game developer with exclusive hardware and so if you people don’t buy into it then you really suffer and there’s a nice little quote at then end there just to round this whole section up.

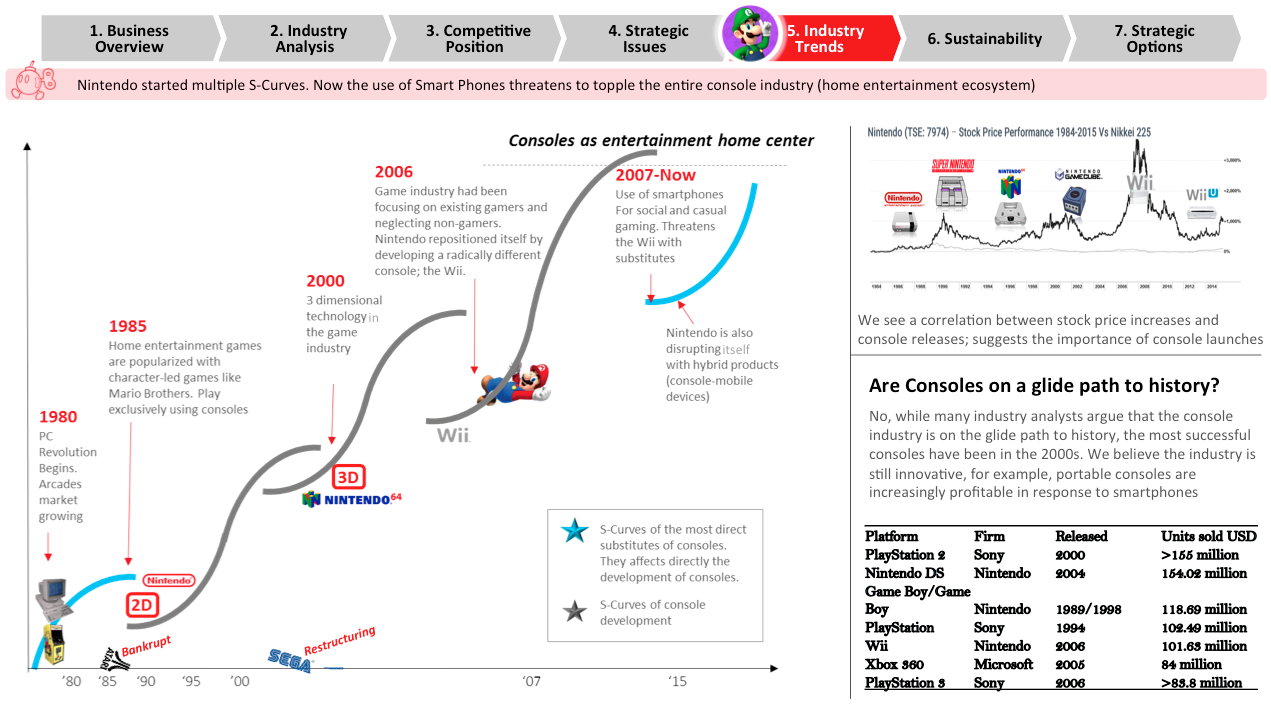

Industry trends, so Nintendo started multiple S-curves and I think it’s quite interesting just to see how they might have been…they might be about to be toppled by smartphone but it’s not totally clear what the future holds.

So here’s the story, you’ve got way back in 1980, you’ve got the PC revolution and arcades, the market is growing. And then the home entertainment games industry kind of explodes with Atari and Nintendo. Atari goes bankrupt pretty quickly but Mario Brothers and the Nintendo system is very successful and throughout the ’90s in 1995, you have a Nintendo 64 and you’ve got a lot of success. So that should be shifted over this thing here, probably should be over here but what… No worries. So you’ve got multi-dimensional games, 3D games, and then take a look at this. Basically they jump their own curve, their S-curve and bring in and reposition Nintendo radically with the Wii and that’s sort of been the curve they’re going on, and now we have… We are seeing further hybrids. Nintendo’s bringing out its own hybrid called Nintendo Switch, but smartphones are clearly disrupting them and this is in a very short period of time here, this is 2006 and 2007. So things are changing fast.

An interesting sort of look at what the consoles did. You had Nintendo, you had Super Nintendo, Nintendo 64, GameCube, the Wii, and the Wii U, you can clearly see the stock prices impacted by the success and innovativeness of a console. So clearly Nintendo’s Super Nintendo was I remember when I got it at Christmas like I mentioned earlier, it was a pretty big deal for me, and then Wii was also quite revolutionary because it was saying, “Let’s have casual gaming rather than hardcore gaming as the true value proposition of Nintendo.”

And I think the big challenge now is to understand, is this actually a glide path to history? Are the consoles as an industry in complete decline? And I think actually the answer is no, I think there’s still space here. But principally, I think also that the space is portable. People want to have the portability that a Nintendo DS or Gameboy allowed. Given that everyone is so used to smartphones now, the smartphone culture which has emerged in effect since 2007 since the release of the iPhone has been shaped by this drive towards portability. And actually, if you look at the performance of the consoles historically, Gameboy is actually one of the most well received consoles and Nintendo DS as well. So more so, than even the PlayStation Sony, the original CD-based PlayStation and PlayStation 2 was quite successful. So there’s a story here that people… The customers do like handheld devices and Nintendo needs to respond to that.

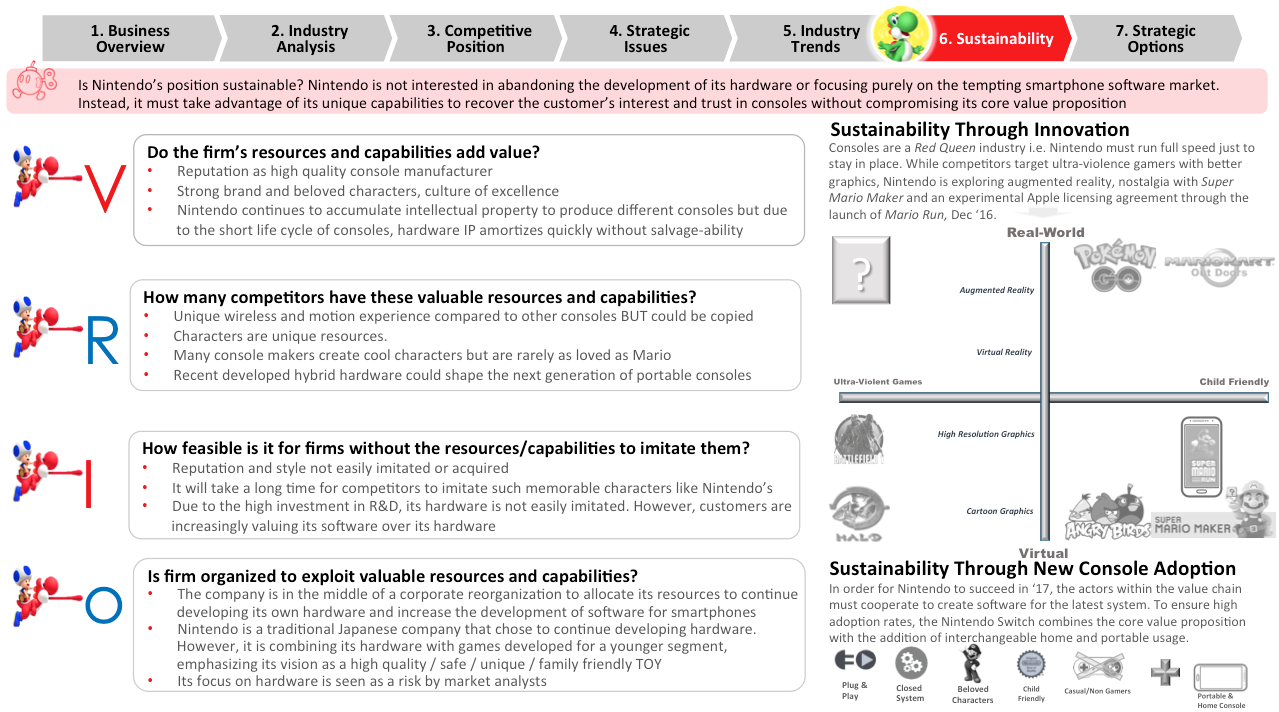

So now we want to look at sustainability. What is Nintendo going to need to do in the next couple years in order to remain relevant and grow as a business? Is it sustainable? Should they just abandon hardware, get rid of consoles and just focus on licensing their various characters? That’s a very legitimate question to ask, it’s a really legitimate question to ask because if you look at that industry as we already looked, at it’s not that great.

So we applied the VRIO approach here, so we’re asking the question is this valuable company? Obviously, they’re valuable. It’s a great manufacturer, well-known IP. Do they have the resources and capabilities? Yes, they’ve got the resources and capabilities, and is it easy to imitate them? No, it’s not easy to imitate Nintendo. They’ve got such a great reputation and style. I mean, I can imagine people could, it’s not that unbelievable to imagine but when it comes to the console, I don’t see that many big opportunities in the space. Although you could argue that with the Raspberry Pi anyone can build the console pretty quickly and do something cool with it. So I mean, I expect maybe the console industry to actually be disrupted independently of the software components, eroding of smartphones, eroding Nintendo’s profitability, but you also have the are they organized question? So is the firm organized? Nintendo is organized to succeed. I mean, they have had difficulties with CEOs not knowing where to go, being incredibly dependent on the success of consoles, the console that they launched, so those are also major issues but generally I think they’ve they focused on hardware which is has been a risk, but that’s their true identity. It’s a combination of software and hardware like an Apple. So, and as you can see with Apple, if you get things right the sky’s the limit in terms of profit.

Sustainability through innovation. So I just want to walk through these ideas about what Nintendo’s doing. They’re an industry where it’s a Red Queen industry, in a sense that you have to be running full speed at all times just to stay in place in the console industry because all these competitors, there they’re coming up with great new consoles to compete against you. And so I created sort of this quadrant system here. You’ve got on the vertical axis, you’ve got the real world to virtual and then to the left is ultra violent and the right as child-friendly. Clearly, Nintendo occupies that right side, the child-friendly side with Super Mario Maker and Pokemon Go which is augmented reality. So I can expect in the near future maybe they’ll do Mario Kart outdoors. I think that’d be hilarious, people running around in parks playing Mario Kart. And the competitors on the other side, there they’re just dominating in Halo, Battlefield, really graphic intensive games, high-resolution graphics.

So an interesting thought will be where do they go with this augmented reality? Do you think you can imagine people running around pretending to shoot each other? Probably not a good idea. But anyway… And then just to emphasize this is Mario’s Super Mario Run which is now available on Apple devices, so smartphones obviously. Big deal because for the longest time Nintendo refused to work with Apple’s platform, predominantly because of the terms and conditions and the commission that Apple gets for every company that has software on their platforms.

So I guess just to close off on this section, sustainability through new console adoption is critical. You need to get everyone on board and as I’m saying here, in order to succeed in 2016 everyone needs to switch to Nintendo Switch, and why I think Nintendo Switch is exciting because they are taking into account the revenue realities that, yes, Gameboy and Nintendo DS were the most successful Nintendo platforms. So if they’re the most successful Nintendo platforms then maybe we should make our console portable. That’s exactly what they’ve done here, so you’ve got plug-and-play, a closed system, as usual, beloved characters, child-friendly, casual gamer plus the new core proposition has to…core value proposition has to also take into account portability. So clearly, they’re making some great strides in the right direction. Of course, it all depends on execution. It depends on the execution for Mario Run, it depends on the execution for Nintendo Switch games, are the games any good? That has yet to be seen yet, so no judgment either way but that’s going to be critical. The actual customer experience has to be first and foremost.

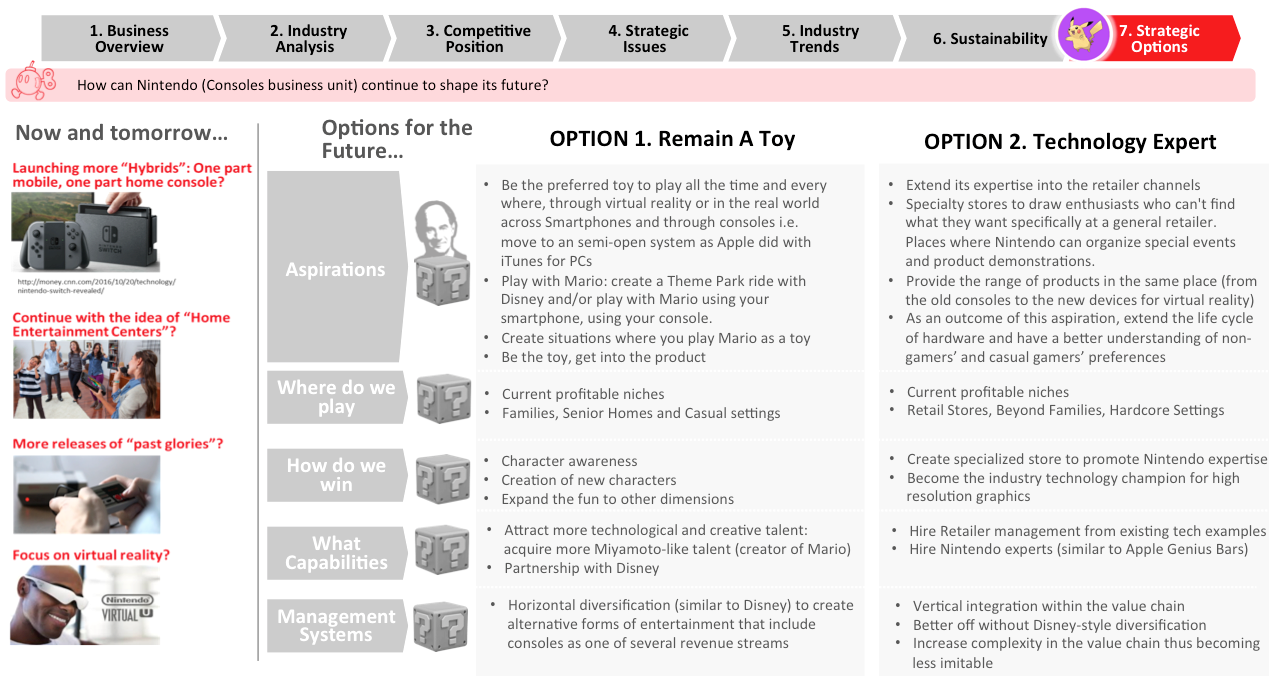

Finally, I just want to talk about strategic options. You’ve got the sort of, you know, general launching more hybrids, which is what they’re doing with the Switch, continue with the idea of the home entertainment center with the Wii Karaoke you can see here, you know, there’s potential areas that they could work on. They certainly have also done some work on past glories and they could look into virtual reality like everyone else is trying to do, just to introduce some additional value to a really challenging industry with consoles. So one framework that I’ve applied here is Roger Martin’s five questions framework. And we’ve positioned this as two options, so you’ve got remain as a game, toy company, or become a technology expert. This is sort of a throwaway thought about what Nintendo could do. And I think they generally seem to be doing the right things as you might have noticed with the sustainability section, they seem to be kind of doing exactly what we’re talking about.

But this section just all popped up at once. There’s a lot of words here but the questions you have to ask for any strategic decision is what are your aspirations as a company? What do you want to achieve? If you want to remain a toy then you want to be the preferred toy to play at all time and you want to make sure that Mario is marketed even to the level of theme park ride and create situations where you play Mario as a toy and he’s a fun character. If your aspiration is to be a technology expert, Nintendo would have to go and extend its expertise into retail channels and probably go build some Nintendo stores in every urban center and have intense video game parties or what not.

Where do you… Where we play? Which is important, but what areas does our company need to play to win? So with the option one, remain a toy, the current profit profitable niches and then also a family in senior homes and casual settings. Same thing with the option to how do we win? This is kind of a key question, the character awareness, creation of new characters, expand the fun to other dimensions.

Option two, if you want to be a technology expert, you’d want to specialize in stores and promote Nintendo expertise, become the industry technology champion for high-resolution graphics, which is not what they’re doing as you know. What capability do they need to make this happen? They need to attract more technology and creative talent, acquire more Miyamoto-style talent, you know, the creator of Mario. If they want to be a technology expert they should hire retailer management from existing tech examples, IE, you know, hire someone from Apple Store who runs the logistics around that and get some experts actually in those stores like the Apple Genius Bar. Get some Nintendo geniuses.

Finally, management systems. What management systems do they need to succeed? In option one, if you want to remain a toy company you want to have that horizontal diversification to create different plat…different areas of your marketing and that includes a theme park, for example. We’ll throw that idea out there because Nintendo is so similar to Disney, it’s kind of shocking. And finally option two for technology experts, what would you do with the management system? What management systems do you need? You need that vertical integration within the value chain, so actually try to absorb the publishers and developers a bit more. Don’t try to diversify, so don’t go into theme parks or cruise ships or whatever you want to do with your loved characters. Stay within your niche and focus on the technology, and own the value chain, thereby making it more difficult to imitate.

So, in conclusion, that’s the whole presentation. Thank you very much for listening to this. If you have any comments or questions, awesome. Please leave them below the video. If you liked this video please subscribe to Professor Nerdster and thank you very much for your time.

References

1.Nintendo Annual Report 2016. (2016, April). Retrieved November 30th, 2016, from

2.Shah, Nick. MBA Fellows Project: The Video Game Industry, And Industry Analysis from a VC Perspective. Tuck, Dartmouth. Center of Digital Strategies. (2005). Retrieved November 30th, 2016, from The Videohttp://digitalstrategies.tuck.dartmouth.edu/digital/assets/images/05_shah.pdf

3.Microsoft X-Box’s Gamble. Tuck, Dartmouth. Center of Digital Strategies. (2002). Retrieved November 28th, 2016, from http://digitalstrategies.tuck.dartmouth.edu/cds-uploads/case-studies/pdf/6-0011.pdf

4.Krishnan, Vijai. Gaming: Corporate Strategy in a Multi-Screen World. (April, 2013). Retrieved November 28th, 2016, from http://digitalstrategies.tuck.dartmouth.edu/digital/assets/images/Krishnan.pdf

5.Business Case: Nintendo’s disruptive strategy: implications for the video game industry. Harvard Business Review, 2008.

6.Game Industry Magazine. (2016, April). Retrieved November 30th, 2016, from http://www.gamesindustry.biz/articles/2014-09-08-the-end-of-the-console-era-as-we-know-it

7.Nintendo President Challenge. Fortune. (2016). Retrieved December 8th, 2016, from: http://fortune.com/2015/09/16/nintendo-president-challenges/

8.Pokémon Go. Fortune. (2016). Retrieved December 8th, 2016, from: http://fortune.com/2016/07/18/pokemon-go-may-force-nintendo-to-change-its-long-term-business-strategy/

9.List of Best Selling Game Consoles. (2015). Retrieved December 8th, 2016, from https://en.wikipedia.org/wiki/List_of_best-selling_game_consoles

10.Extensive Industry Analysis Interview with Erika Szobu: Youtube Personality (https://www.youtube.com/user/erikaszabo) at A&C Games on Spadina Ave, December 12th, 2016

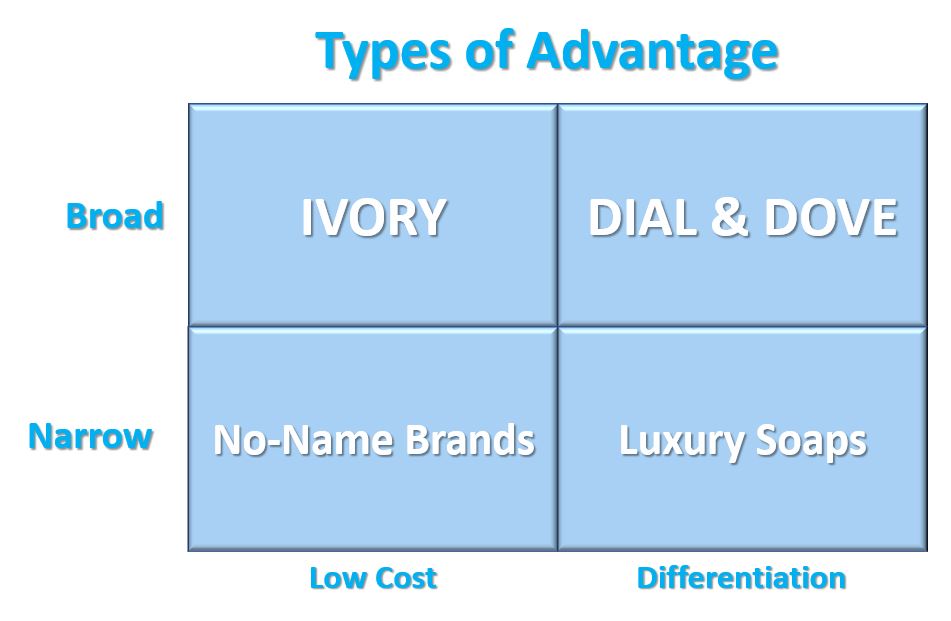

John Pepper @ Proctor & Gamble

John Pepper @ Proctor & Gamble From a strategy point of view: customers, are satisfied, competitors can’t match them. La Quinta’s strategy is an example as an effective lodging companies; there are wide ranging needs; high rollers and the have a wide range of services. Room service for the tired executive. La Quinta has chosen to find a particular kind of customer.

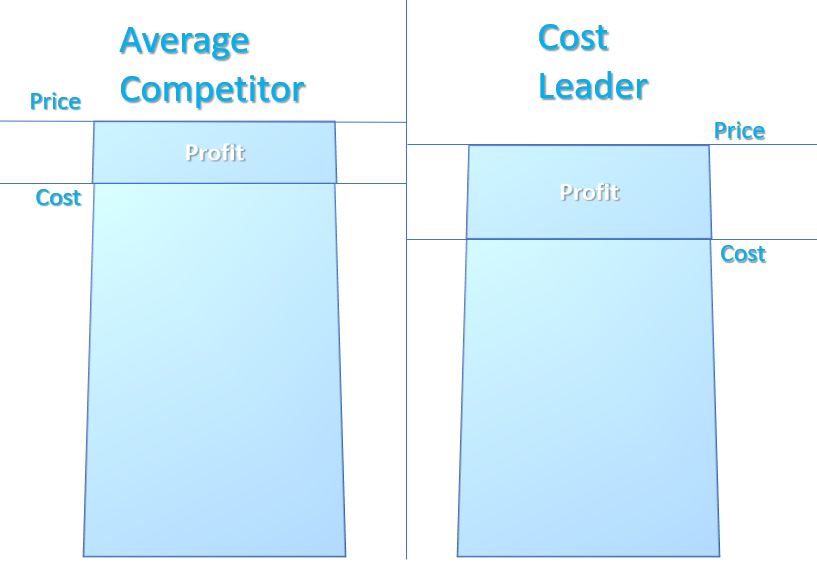

From a strategy point of view: customers, are satisfied, competitors can’t match them. La Quinta’s strategy is an example as an effective lodging companies; there are wide ranging needs; high rollers and the have a wide range of services. Room service for the tired executive. La Quinta has chosen to find a particular kind of customer. Cost of $40 very cheap. Why they stay here; it’s consistency. Simple no frills. I don’t care about room services; folks are travelling: I’m busy I keep myself moving. The operating costs are held down as well. The room is as large as the competition, but the costs are lower. There is a corporate fetish for cost control; construction costs are held down.

Cost of $40 very cheap. Why they stay here; it’s consistency. Simple no frills. I don’t care about room services; folks are travelling: I’m busy I keep myself moving. The operating costs are held down as well. The room is as large as the competition, but the costs are lower. There is a corporate fetish for cost control; construction costs are held down. We are constantly updating our services. We started with TVs then we put in cable. Our customers are the boss not me. Marriot Hotels is great and it has the Courtyard concept: they going after. Marriot is the GM of hotels. Motel6 is a good company, they know what they are doing. We are working on minutes in cleaning a room, working on nickels and dimes. We build a building extremely cost effectively, we know what the land cost. We know our product really well. Wall Street should not run your business.

We are constantly updating our services. We started with TVs then we put in cable. Our customers are the boss not me. Marriot Hotels is great and it has the Courtyard concept: they going after. Marriot is the GM of hotels. Motel6 is a good company, they know what they are doing. We are working on minutes in cleaning a room, working on nickels and dimes. We build a building extremely cost effectively, we know what the land cost. We know our product really well. Wall Street should not run your business. The lowest cost producer is not the answers. Six key points to define what we do:

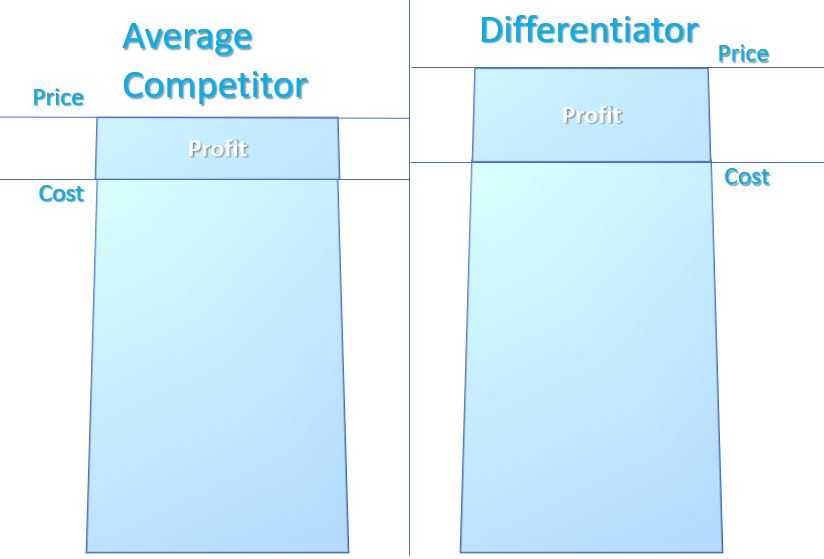

The lowest cost producer is not the answers. Six key points to define what we do: Price Premium must be great than the cost of differentiation. You need to reduce cost in areas where they do not differentiate. Differentiation.

Price Premium must be great than the cost of differentiation. You need to reduce cost in areas where they do not differentiate. Differentiation. Differentiator is trying to command premium prices. You need to ensure that the relative price and relative cost.

Differentiator is trying to command premium prices. You need to ensure that the relative price and relative cost.

The long-term coherence of American airlines has been committed to the shared throughout the management, we are more consistent at differentiating ourselves.

The long-term coherence of American airlines has been committed to the shared throughout the management, we are more consistent at differentiating ourselves. “Stuck in the Middle”: fails to achieve any strategy. Not making choices about competition. Laker Airways had a clear cost focus shift to some frills. A firm is better off finding new industries in which to grow where it can use its generic strategy again or exploit interrelationship.

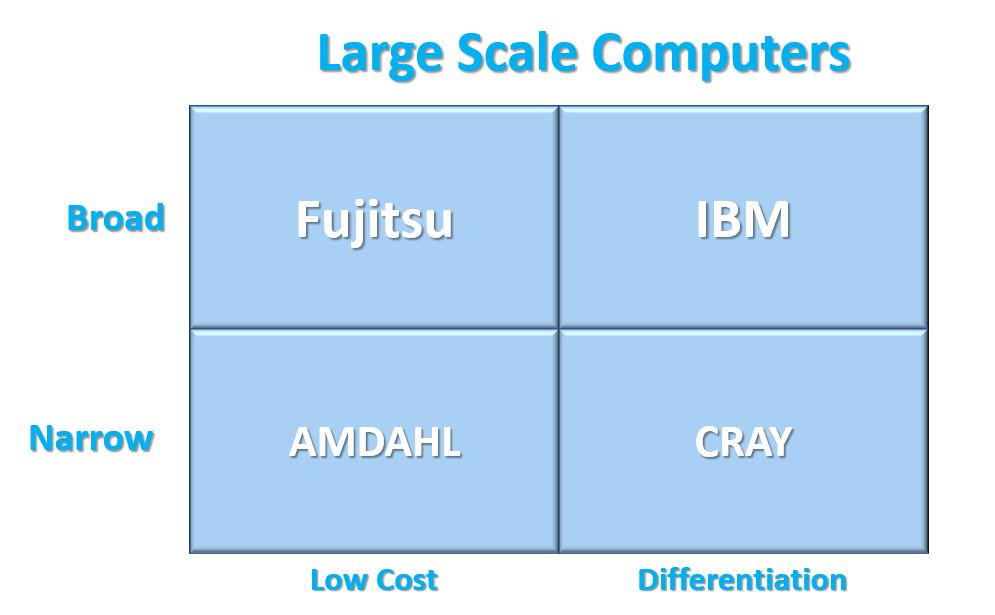

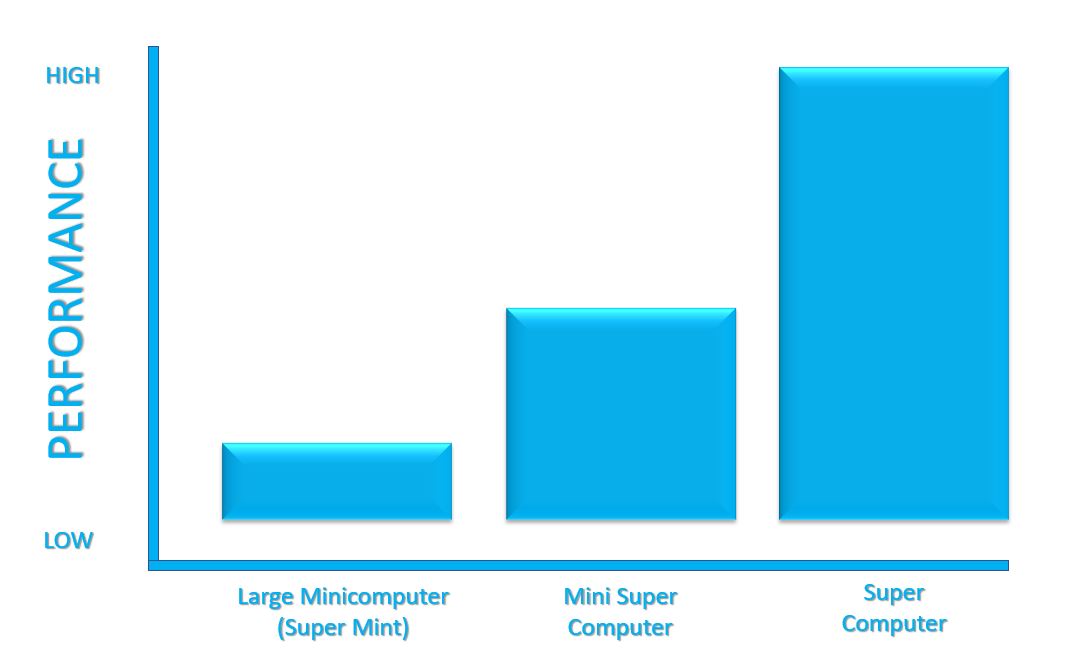

“Stuck in the Middle”: fails to achieve any strategy. Not making choices about competition. Laker Airways had a clear cost focus shift to some frills. A firm is better off finding new industries in which to grow where it can use its generic strategy again or exploit interrelationship. Founded in 1972 in 1976. Cray sales are on the rise and they have had an equity increase of 25% year on year. Has doubled the average of an unstable system. Has been differentiating in IBM. Pundits have been predicting Cray Researchers demise. IBM and Japanese Companies product a wide range.

Founded in 1972 in 1976. Cray sales are on the rise and they have had an equity increase of 25% year on year. Has doubled the average of an unstable system. Has been differentiating in IBM. Pundits have been predicting Cray Researchers demise. IBM and Japanese Companies product a wide range.

Practical tools industry, had a wide product line and a global market position. It was faced with Black&Decker. Also having to deal with new and severe competitors. Skill Corporation was deteriorating.

Practical tools industry, had a wide product line and a global market position. It was faced with Black&Decker. Also having to deal with new and severe competitors. Skill Corporation was deteriorating.