Challenges of finding a Pure Play: it’s not easy to find a firm that is exactly like the other firms you are comparing. Loblaws & Metro: Outlets like No Frill (Loblaws). But what is days o inventory different at Metro: their days of inventory is shorter.

Challenges of finding a Pure Play: it’s not easy to find a firm that is exactly like the other firms you are comparing. Loblaws & Metro: Outlets like No Frill (Loblaws). But what is days o inventory different at Metro: their days of inventory is shorter.

- Loblaws

- Joe Fresh

- Shoppers (long shelf life)

Product Mix is different for Loblaws than Metro.

Risk and Profitability Analysis

- Analyze Firm’s operating profitability and risk

- Compare performance over time (Time Series Analysis)

- Compare performance across firms (Cross-Sectional Analysis)

- Look at the components of profitability

- Look at different kinds of risk.

Principles of Ratio Analysis

- Focus on the inputs

- Importance of prior analyses

- Be aware of events that can affect comparability –M&A, accounting changes, changes in strategy (e.g., Loblawsvs. Metro)

- Consistency in approach

- Use Ending Balance Sheets

- Most common, fits the data availability in most cases

- Use Average Balance Sheets

- Most economically meaningful as Balance sheets are snapshots

- Use Beginning Balance Sheets

- Beginning assets/liabilities used to drive the operations

- Useful for forecasting and valuation

- Do not rely on 3rdparty ratios

- Calculate all ratios yourself

Measures of Short-Term Risk

- Working Capital = Current Assets –Current Liabilities

- Would we prefer a positive or negative amount of working capital? A.) Positive B.) Negative

Working Capital = Current Assets minus Current Liabilities.

Positive working capital: CA – CL > 0 is the ideal.

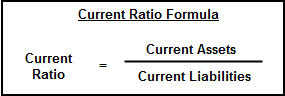

Ratio #1: Current Ratio

- Current assets / Current liabilities

- Current Ratio = Current Assets/Current Liabilities

- Measure of ability of the firm to pay short-term liabilities on time

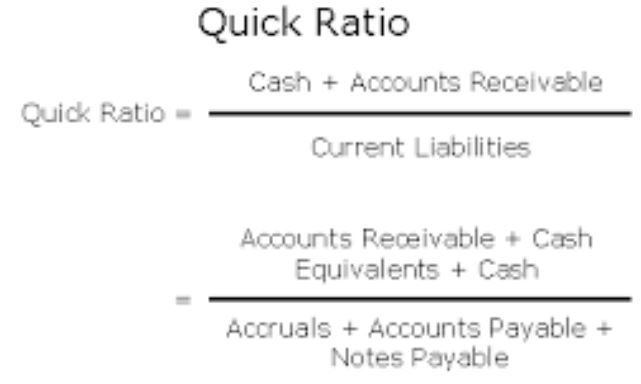

Ratio #2: Quick Ratio

- Current highly liquid assets / Current liabilities

- Current highly liquid assets (i.e., cash, marketable, account receivable) – no inventory or prepaid expenses.

Prepaid expenses = the rent. Which firm might have a current and quit ratio that differ dramatically?

- A big 4 auditing firm: very little prepaid, no inventory

- Airline: no inventory, provide services with a fixed asset.

- Dell: eRetailer movement inventory trying to be just in time. Small amount of inventory.

- Loblaws: it has a problem where inventory is in fact liquid: they have a high turnover.

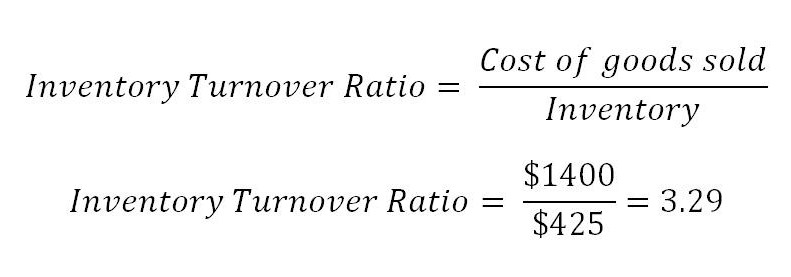

Ratio #3 Inventory Turnover

- Inventory Turnover = COGS/ Average Inventory

- Days Inventory = (Average Inventory / COGS) x 365

Indicated how fast firms sell merchandise. If inventory turn over twice a year, then they average one-half of a year in inventory (and a days inventory of 182.5). Why do we typically want a higher inventory turnover?

For what sort of firm might a higher days inventory be preferred.

- Wine Makers you want a higher days inventory

- Grocers for fruit you want it to be shorter.

- Fashion retailer there is the potential for fashion obsolescence.

- Apple Inc: technology obsolescence. (you don’t want the iPhone to be in your inventory).

Raw Materials

RW Work in Progress

|_____________|________________________________|______________________| Finished Goods

Picked Grape Juice

CA/CL (4) C+ A/R+M/S < .19

CL highly illiquid assets

You don’t sell in a pinch, not very liquid. You might have some short-term obligations to the bank.

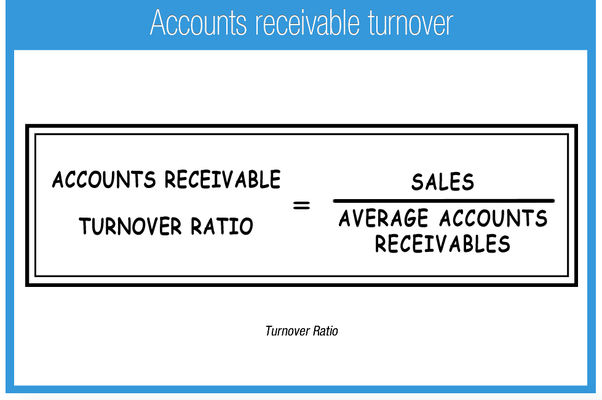

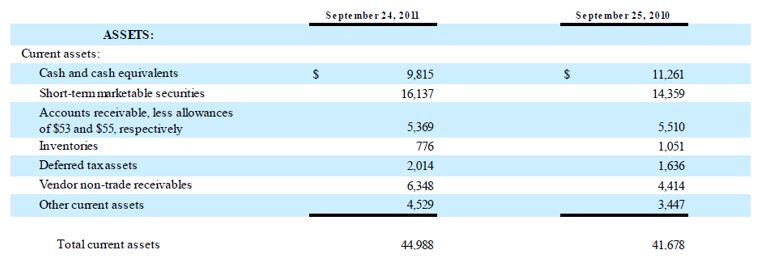

Ratio #4 Accounts Receivable Turnover

- Accounts Receivable Turnover = Sales

Average Accounts Receivable

- Days Accounts Receivable = (Average Accounts Receivable/Sales) x 365

Measures how quickly a firm collects cash. If A/R turns over twice a year, then days accounts receivable is 182.5 or on average one-half of a year to collect receivables. High turnover and fewer days to collect A/R is generally preferred.

For what sort of firms might it be normal to have higher days accounts receivable:

- Lemonade Stand no extension

- Consumer goods companies that allow customers to pay in instalments

- Companies that only accept cash or VISA

- Companies whose suppliers do not extend them credit.

If you are extending credit: you would need a line of credit if your suppliers have no extension of credit.

In 2011, Apple $108 Billion in sales

(Average Accounts Receivable/Sales) x 365

5.36B + 5.5B =

2

108 billion x 365 = 18.38. Apple has perfect just in time inventory

Ratio #4.5: Turnovers to “Days”

Payables turnover = Purchases / Accounts Payable.

Where purchases = COGS + Change in Inventory

- Accounts Payable

- where purchases = COGS + change INV

- Turnover tells us how many “cycles” there were in a year.

- If Inventory Turnover = 3, that means over 365 days, I “churn” my inventory completely 3 times.

- Hence at any time, I have 365/3 =121.7 days of inventory

In general

- Days Inventory = 365/(Inventory t/o)

- Days Receivable = 365/(Receivables t/o)

- Days Payable = 365/(Payables t/o)

- Cash Cycle = Days Inventory + Days Receivable – Days Payable

- The smaller this is, the less the need for working capital

- Other people’s money

Days Inventory + Days Receivable – Days Payable

Days Inventory + Days

|____________________|___________________|

Days Inventory + Days Receivable

|____________________|___________________|

35 Days 45 Days

Example of Dell

Dell has a negative cash cycle. Dell always have cash and don’t need financing. General contractors get paid by customers and then collect interest. If this is negative, this mean you do not have external financing opportunities.

Example of Bug in a Rug

Shipping from France means you will need a line of credit. Example Rug Canada Inc. Bug in a Rug toys.

Days Inventory + Days Receivable – Days Payable

Days Inventory + Days Receivable

|____________________|___________________|

- Days 45 Days

Days Payable

60 Days

You need a line of credit because you are shipping from France. And you have to make payments to France BEFORE you even get paid from customers.

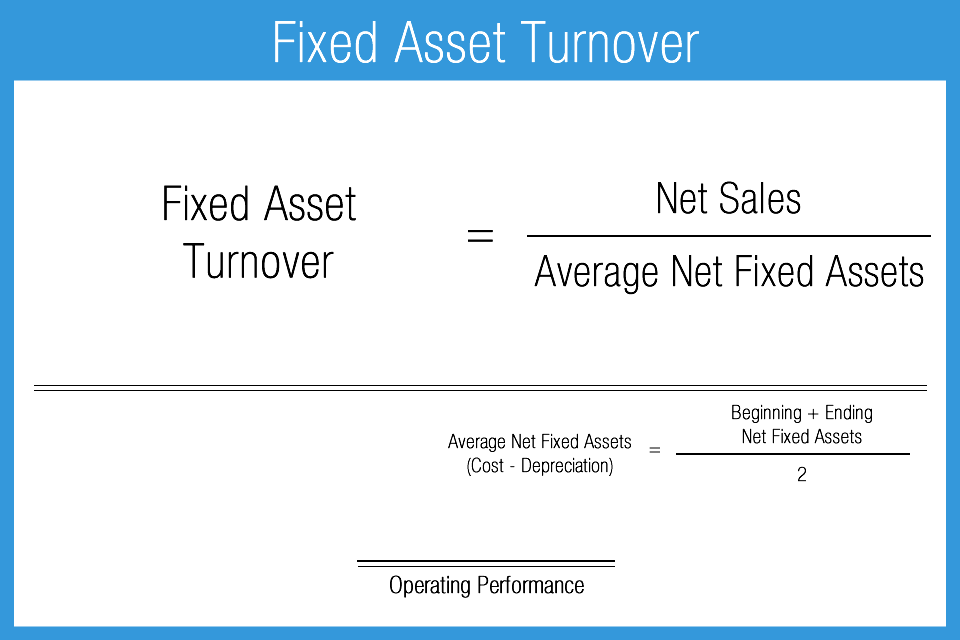

Ratio #5 Fixed Asset Turnover

Only include tangible assets (no goodwill).

Fixed Asset Turnover = Sales

Average Fixed Assets

- Measures the relation between investment in long-term or fixed assets (such as property, plant, equipment) and sales. Note fixed assets refer to tangible assets (i.e., no goodwill or patents).

- Efficient use of fixed assets would be associated with high sales.

- If fixed assets turn over every four years, then each dollar invested in fixed assets is generating a quarter of a dollar in sales per year.

- A high turnover is preferred to a low one.

For what type of company might a high fixed asset turnover ratio simply be a function of the industry the firm is in, as opposed to efficient use of capital assets on management’s part?

- McKinsey fixed assets are low Sales high

- Air Canada High Fixed Assets

- A Construction Company: high fixed asset, fixed assets, maybe it’s customer assets. Intangible impacts performance. Have stars, better reputation

- A Supermarket: fixed asset tells you about performance

Ratio #6: Total Assets Turnover

- Total assets turnover = Sales

Average total assets

1.) its accounts receivable turnover, inventory turnover, and fixed asset turnover have increased.

2.) The beginning and ending balance for all assets in year 1 were the same.

3.) Sales and COGS were the same in year 1 and year 2,

Year 1 Year 2

Sales = Sales

COGS = COGS

Sales Sales

A/R > A/R (down)

What must be true.

COGS COGS

INV < INV (down)

Sales Sales

FA < FA (down)

What are some possible explanations as to why total asset turnover decreased year-over-year?

- A) accounts receivable has increased year-over-year

- B) Cash has increased year-over-year

- C) inventory has increased year-over-year

- D) Goodwill decreased year-over-year

- E) Prepaid expenses have decreased year-over-year

Total Asset Turnover

- What transaction might account for an decrease in total asset turnover without being inconsistent with the other ratio changes from the previous page?

Has the firm:

- Sold some land for its value on the balance sheet

- Collected more cash this year than last year from customers who bought products on credit

- Declared but did not pay a dividend

- Took out a loan

- Depreciated some equipment

You will need to do this with your group projects. No more debt lead to higher interest

Leverage and Risk

Should firms with volatile operating profitability finance their operations with debt as opposed to equity? A.) Yes B.) No

No, more debt leads to higher interest

Given the points above, which firm should be most likely to finance with debt as opposed to equity?

- A utilities company

- An airline: has sticky wages, operating leases, lots of fixed costs. Air Canada debt is large.

- A tech start-up: no debt on capital, all financed.

- A junior mining company: financed by Equity = stock exchanges. Not with Debt.

- A utilities company: inelastic demand, cost +5% profitability is regulated.

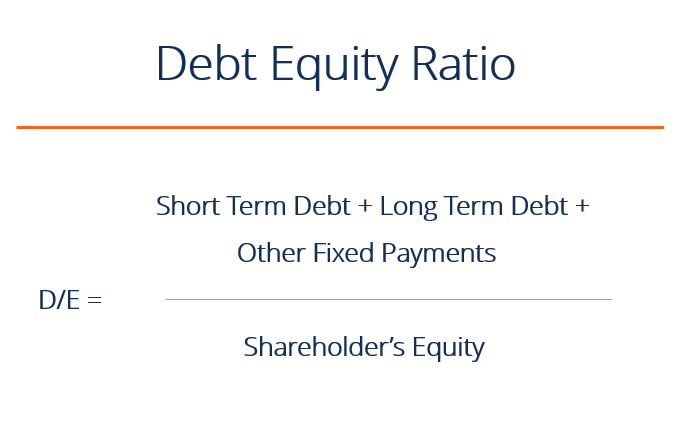

Ratio #7: Debt-to-Equity Ratio

- Debt (long term, short term, cap. Leases)

Total Equities

- Percentage of total financing provided by creditors (debt) as opposed to owners (stock)

Manchester United: net income $137million

$160 million why?

It look like a massive interest expense.

Revenue

Cost

Op II 160

Interest -279

Net Income -137

Ronaldo was sold. Measures of Long-Term Risk

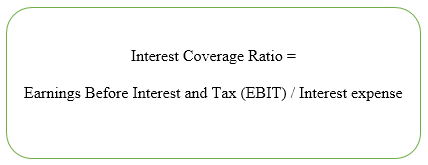

Ratio #8: Interest Coverage Ratio

- Earnings Before Interest and Income tax /interest expense

- This is the number of times interest is covered by income

- Indicates the relative protection that operating profitability provides to debtors

- Really should be higher than 1, if not much higher than 1

Which of the following transactions or outcomes do not ultimately increase the D/E ratio?

- A firm issuing a bond

- Issuing dividends: Debt/Equity DOWN

- A net loss for the period

- A firm repurchasing its share

- All of the above increase the D/E ratio.

Imagine a firm has a strict debt convenant that forbids the D/E ratio from going above a certain point. How would this effect the transactions listed in A – E?

Debt convents shift to existing debt holders.

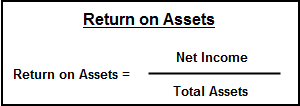

Ratio #9: Return on Assets

- ROA disaggregates into the product of two ratios:

- ROA = Profit margin ratio x Total assets turnover

ROA = Net Income x Sales

Sales Assets

ROA tells us something about the firm’s operating strategy.

Profit margin ratio = Net Income

Sales

Total assets turnover = Sales

Average total assets.

ROA = NI/Sales x Sales/Assets

- Operating Strategy

- Profit Margin Ratio = NI/Sales

- (Tell us about the market monopoly higher rates)

- Total Asset Turnover = Sales/Total Assets

- Costco NI/Sales (DOWN ALL) x Sales/Assets (UP ALL)

- GM NI/Sales (DOWN ALL) x Sales/Assets (DOWN ALL) so they improved cost structure

- SPACEx NI/Sales (UP ALL) x Sales/Assets (DOWN ALL)

- Microsoft NI/Sales (UP ALL) x Sales/Assets (UP ALL)

- ROE = NI/Sales x Sales/Assets x Assets/Equity

- ROE = ROA x Leverage Ratio

The leverage ratio tells us something about the firm’s financing strategy

ROE = L (Up) + E

E

- Causes the numerator to go up: it depends on what happens to equity.

- Leverage ratio = Ata/AE

- Financial Strategy is revealed.

Example HOME

H EQ ROA ROE

1M 1M 1.1M 100k/1m = 10%

1M 0 1.1M 100k/1m = 10%

900K -10% -10%

1M infinity – 0%

ROE

ROA is negative amplified it to negative infinity.

ROE > ROA

Ratio #10: Return on Equity (ROE)

ROE can be disaggregated into 3 ratios:

ROE = profit margin X total asset turnover X Leverage Ratio

ROE = ROA X leverage ratio

The leverage ratio tells us something about the firm’s financing strategy

As a firm’s debt increases, what happens to its ROE?

A.) it increases

B.) it decreases

C.) it depends