Accrual Accounting versus Cash Accounting

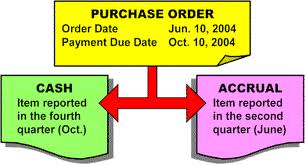

Accrual basis = immediate recognition.

Cash basis = when the case is received.

Before we dive into earnings management as a subtopic within business analysis and valuation, it is helpful to understand the difference between Accrual and Cash Accounting. The cash basis is only available for use for companies has no more than $5 million sales per year.

The accrual basis is used by larger companies because matching revenue and expenses in the same reporting period so that the true profitability of an organization can be discerned.

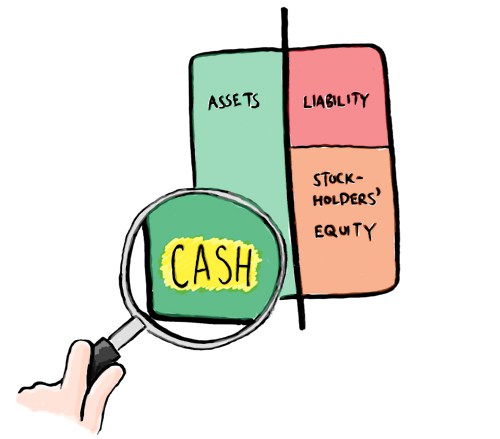

Cashflows are harder to manipulate. The big difference between the two is when the transactions are recorded.

Cash basis: Revenue is recorded when cash is received from customers, and expenses are recorded when cash is paid to suppliers and employees.

Cash basis: Revenue is recorded when cash is received from customers, and expenses are recorded when cash is paid to suppliers and employees.

Accrual basis: Revenue is recorded when earned and expenses are recorded when consumed.

Revenue recognition is delayed under the cash basis until customer payments arrive at the company. Similarly, recognition of expenses are paid under the cash basis until such time as supplier invoices are paid.

Revenue recognition: a company sells $10K of green widgets to a customer in March which pays the invoice in April. Under the cash basis, the seller recognizes the sale in April, when the cash is received. Under the accrual basis, the seller recognizes the sale in March, when it issues the invoice.

Expenses recognition: a company buys $500 of office supplies in May, which it pays for in June. Under the cash basis, the buyer recognizes the purchase in June, when it pays the bill. Under accrual basis, the buyer recognizes the purchase in May, when it receives the supplier’s invoice.

Creating Cookie Jars: by deferring revenue that was genuinely earned or by taking additional expense by taking on excessive reserves for bad debts (we’ll explore this in a future post)

Debt Covenants: Keeping ratios within certain ranges. Debt/Equity. Lender have a capped upside. So lenders like covenants; What if you are ear to violating your covenant? Then you might adjust the bonus threshold.

Opacity of the Firm: capital markets & stakeholders. Competitive consideration: opaque firms will use the argument that they can’t divulge financial statement performance to the same degree as other firms because of their competitors.

You have to sit in awe of the most in genius management invention of all: Plausible Deniability!

STEP 2: ACCOUNTING ANALYSIS:

How to adjust financial statements for distortions?

How firms communicate with financial statements and how regulations and managerial discretion affect statements for distortions. There are several steps to Accounting Analysis:

Step 1: Identify Principal Accounting Policies:

Key policies and estimates used to measure risks and critical factors for success must be identified. IFRS require firms to identity critical accounting estimates. For example banks issue credit risk and interest rate risk. For airlines, depreciation is important because their biggest asset are the planes themselves. Therefore, for airlines, depreciation is a critical accounting policy. It is also where the accounting manipulation can occur.

Step 2: Assess Accounting Flexibility

Step 2: Assess Accounting Flexibility

Accounting information is less likely to yield insights about a firm’s economics if managers have a high degree of flexibility in choosing policies and estimates. If the firm is using GAAP accounting; there is limited flexibility for example look at how restrictive R&D and Marketing cost are under GAAP. How much of the flexibility has management already used? For other areas under GAAP, there is a lot of flexibility for example credit risk. Is the company being aggressive or conservative? A firm that is conservative now has the potential to be aggressive.

Step 3: Evaluate Accounting Strategy

Flexibility in accounting choices allows managers to strategically communicate economic information or hide true performance. How has their accounting differed from competitors? Are the accounting strategies changing regularly; think of CGIs accounting policy changes in the last decade. Does the firm have realistic assumptions in the past.

Issues to consider include:

- Norms for accounting policies with industry peers

- Incentives for managers to manage earnings

- Changes in policies and estimates and the rationale for doing so

- Whether transactions are structured to achieve certain accounting objectives.

Step 4: Evaluate the Quality of Disclosure

Managers have considerable discretion in disclosing certain accounting information. Is the firm providing adequate information about their strategy and explain the economics of its operations? Are those accounting policies justified adequately? Is the firm providing equally helpful disclosures in bad times? Firms that are more transparent are potentially far less likely to conduct earnings management.

Issues to consider include:

- Whether disclosures seem adequate;

- Adequacy of notes to the financial statements

- Whether the management report section sufficiently explains and is consistent with current performance

- Whether accounting standards restrict the appropriate measurement of key measures of success

Step 5: Identify Potential Red Flags

Unexplained transactions that boost profits. Here are a few examples.

- Unusual increase in inventory or A/R in relation to sales

- Increases in the gap between net profit and cash flows or tax profit

- Use of R&D partnerships, SPEs or the sale of receivables to finance operations

- Increasing Gap between Net Income and Cash Flow from Operations: firm may be fiddling with accruals.

- Unexpected large asset write-offs (suddenly just write something off)

- Large year-end adjustments

- Qualified audit opinions or auditor changes

- Related-party transactions (Valeant and Philidor)

Maybe we should list MORE!!!!…..

Red Flags in Accounting used for Earnings Management by (some) CEOs and CFOs Today

Note that Earnings Management is not illegal in some cases, in fact, it’s a strategy used by many companies believe it or not. Just like a Prime Minister who announces a snap election, a CEO can engage in earnings management (the manipulation of Financial Statements) behind a wall garden that only he or she and their team is privy to…..The following at POSSIBLE red flags, it’s hard to tell in reality, but here are things to look for with publicly traded companies:

![]() Income smoothing: Companies love steady trends in profits, rather than wild changes in profits No kidding! Income smoothing techniques (i.e. declaring high provisions or maybe deferring income recognition in good time) led to lower wild changed in reported earnings. Items to look out for is a pattern of reporting unusual losses in good operating years and unusual gains in bad ones.

Income smoothing: Companies love steady trends in profits, rather than wild changes in profits No kidding! Income smoothing techniques (i.e. declaring high provisions or maybe deferring income recognition in good time) led to lower wild changed in reported earnings. Items to look out for is a pattern of reporting unusual losses in good operating years and unusual gains in bad ones.

![]() Achieving forecasts: Is there a pattern of always meeting analysts’ earnings forecasts, an absence of profit warnings, or interim financial statements consistently out of line with year-end statements? Is a company making changes in accounting policies that revise profits upwards in years when underlying earnings have fallen, and vice-versa? Could be a redflag!

Achieving forecasts: Is there a pattern of always meeting analysts’ earnings forecasts, an absence of profit warnings, or interim financial statements consistently out of line with year-end statements? Is a company making changes in accounting policies that revise profits upwards in years when underlying earnings have fallen, and vice-versa? Could be a redflag!

![]() Profit enhancement: Current year earnings are boosted to enhance the short-term perception of performance which is what shareholders and analysts crave!

Profit enhancement: Current year earnings are boosted to enhance the short-term perception of performance which is what shareholders and analysts crave!

![]() Accounting-based contracts: When accounting-based contracts are in place such as loan covenants, any accounting policy that triggers a shortcoming can circumvent the debt covenants….

Accounting-based contracts: When accounting-based contracts are in place such as loan covenants, any accounting policy that triggers a shortcoming can circumvent the debt covenants….

![]() Gap between earnings and Cash flows: Is there a large gap between earnings and cash flows? Is that gap increasing? If so there may be poor accruals.

Gap between earnings and Cash flows: Is there a large gap between earnings and cash flows? Is that gap increasing? If so there may be poor accruals.

![]() Reported income and taxable income: Is reported income vastly different from taxable income, with no explanation or disclosure? That’s a problem.

Reported income and taxable income: Is reported income vastly different from taxable income, with no explanation or disclosure? That’s a problem.

![]() Ratios: Do obsolescence analyses reveal old inventories or receivables, declining gross margins but increasing net margins, inventories/receivables increasing more than sales, or more leverage ratios?

Ratios: Do obsolescence analyses reveal old inventories or receivables, declining gross margins but increasing net margins, inventories/receivables increasing more than sales, or more leverage ratios?

![]() Unusual financial statement trends: What is the relationship between revenue and (earnings per share) EPS growth? Is there a weird pattern of year-end transactions? What is the timing and recognition of exceptional items? What is the relationship between provisions for bad accounts and profits? It’s within a CEOs discretion due to asymetric information.

Unusual financial statement trends: What is the relationship between revenue and (earnings per share) EPS growth? Is there a weird pattern of year-end transactions? What is the timing and recognition of exceptional items? What is the relationship between provisions for bad accounts and profits? It’s within a CEOs discretion due to asymetric information.

![]() Accounting policies: Have there been recent changes in accounting policies, such as off-balance sheet financing, revenue recognition or expense capitalization? Furthermore, have the nature, purpose and effect of any changes been adequately explained?

Accounting policies: Have there been recent changes in accounting policies, such as off-balance sheet financing, revenue recognition or expense capitalization? Furthermore, have the nature, purpose and effect of any changes been adequately explained?

![]() Incentives for management: Are there incentives for managers to boost short-term profit to increase compensation (i.e. bonuses based on EPS and share option plans).

Incentives for management: Are there incentives for managers to boost short-term profit to increase compensation (i.e. bonuses based on EPS and share option plans).

![]() Audit qualifications: Are any auditors’ adjustments outlined in an audit report significant?

Audit qualifications: Are any auditors’ adjustments outlined in an audit report significant?

![]() Related party transactions: Are these material and to what extent are directors affected

Related party transactions: Are these material and to what extent are directors affected

![]() Manipulation of Reserves: Has there been under-provisioning in poor years, over-provisioning in good year, a manipulation of reserves, aggressive capitalization of costs, overly optimistic asset lives, accelerating expenses and increased write-downs in good years, and exceptional gains timed to offset exceptional losses?

Manipulation of Reserves: Has there been under-provisioning in poor years, over-provisioning in good year, a manipulation of reserves, aggressive capitalization of costs, overly optimistic asset lives, accelerating expenses and increased write-downs in good years, and exceptional gains timed to offset exceptional losses?

![]() Revenue recognition: Has there been a premature recording of revenues, recognizing sales prior to physical movement of goods, recognizing service revenue from service contracts prior to service being performed, upfront recognition of sales that should be spread over multiple periods, percentage of completion estimates out of line with industry norms?

Revenue recognition: Has there been a premature recording of revenues, recognizing sales prior to physical movement of goods, recognizing service revenue from service contracts prior to service being performed, upfront recognition of sales that should be spread over multiple periods, percentage of completion estimates out of line with industry norms?

![]() Transaction timing: On the revenue side, have deliveries been sped up near the year end? On the cost side, have discretionary expenditures, such as maintenance and R&D, been delayed to future periods?

Transaction timing: On the revenue side, have deliveries been sped up near the year end? On the cost side, have discretionary expenditures, such as maintenance and R&D, been delayed to future periods?

![]() Regulated industries: Is there a pattern of engaging in accounting practices whose principal purpose is to influence regulatory decisions (i.e. lowering reported profits where the perception of excessive profits could prompt unfavorable regulatory action)?

Regulated industries: Is there a pattern of engaging in accounting practices whose principal purpose is to influence regulatory decisions (i.e. lowering reported profits where the perception of excessive profits could prompt unfavorable regulatory action)?

![]() Internal accounting: In a multi-division company there may be incentives to shift profits to divisions (or subsidiaries in relatively low tax jurisdictions) to reduce the overall tax burden.

Internal accounting: In a multi-division company there may be incentives to shift profits to divisions (or subsidiaries in relatively low tax jurisdictions) to reduce the overall tax burden.

![]() Commercial pressures: In the anticipation of mergers, takeover bids or IPOs, there could be pressure to create a favorable perception by, for example, lowering credit standards to temporarily boost sales OR pumping up the value of the company at the risk of harming long-term customer relationships.

Commercial pressures: In the anticipation of mergers, takeover bids or IPOs, there could be pressure to create a favorable perception by, for example, lowering credit standards to temporarily boost sales OR pumping up the value of the company at the risk of harming long-term customer relationships.

![]() Other: When a company has foreign operations and is re-translating overseas subsidiaries’ results, a functional currency is determined for each entity. However, has the company taken advantage of ambiguous situations or facts, manipulating the selection to generate favorable currency gains or minimize currency losses? Has a company allocated joint costs among long-term contracts to create the appearance that no contract has produced losses, thereby avoiding an immediate loss provision?

Other: When a company has foreign operations and is re-translating overseas subsidiaries’ results, a functional currency is determined for each entity. However, has the company taken advantage of ambiguous situations or facts, manipulating the selection to generate favorable currency gains or minimize currency losses? Has a company allocated joint costs among long-term contracts to create the appearance that no contract has produced losses, thereby avoiding an immediate loss provision?

The existence of these potential red flags do not indicate anything wrong per se, but should lead a prudent analyst to undertake diligent investigations to see if they are justified by company-specific factors. If distortions do exist, an analyst should, to the extent possible, undo the distortions to better evaluate a company’s financial performance within a historical and competitive context.

Step 6: Undo Accounting Distortions

- Taxable income

- Cash flow statement information

- Management Guidance: no one is forcing management guidance, except management themselves. What MG is specifically, is when a C-suite manager provides insight into the company to investors or analysts. If you are close to the target. I’d like to get that bump rather have a small loss. You want to cross the Threshold of Zero.

Elon Musk: Leaked Email in August 2016

So if you Tweet the kind of things that provoke strong reactions, that are basically the standard musings I might have made as teenager, you probably have no problem manipulating financial analysts! Expectation management is a tactic that Musk and other CEOs will leverage when the short-term performance for what is a long-term Bezos-style play (Tesla) . Elon Musk (graduated of Queen’s University in Kingston, Canada and whose mother is a Saskatchewanian) is of course a bat-shit crazy badass. In August of 2016, he was saying his Tesla Q4 expenditure will be huge, in the run up to new production line, so he’s providing a small negative estimate of profitability to his own employees and then intentionally leaking the email to the press to get the word out to financial analysts. Leaks in politics = leaks in business.

“Here’s the full text that Bloomberg has published:

I thought it was important to write you a note directly to let you know how critical this quarter is. The third quarter will be our last chance to show investors that Tesla can be at least slightly positive cash flow and profitable before the Model 3 reaches full production. Once we get to Q4, Model 3 capital expenditures force us into a negative position until Model 3 reaches full production. That won’t be until late next year.

We are on the razor’s edge of achieving a good Q3, but it requires building and delivering every car we possibly can, while simultaneously trimming any cost that isn’t critical, at least for the next 4.5 weeks. Right now, we are tracking to be a few percentage points negative on cash flow and GAAP profitability, but this is a small number, so I’m confident that we can rally hard and push the results into positive territory. It would be awesome to throw a pie in the face of all the naysayers on Wall Street who keep insisting that Tesla will always be a money-loser!

Even more important, we will need to raise additional cash in Q4 to complete the Model 3 vehicle factory and the Gigafactory. The simple reality of it is that we will be in a far better position to convince potential investors to bet on us if the headline is not “Tesla Loses Money Again”, but rather “Tesla Defies All Expectations and Achieves Profitability”. That would be amazing!

Thanks for all your effort. Looking forward to celebrating with you,

Elon”

“Gap in profitability” So he can’t miss this target badly. In the end, he sold a large build up of environmental credits: so that they could hit Tesla’s target thus satisfying the analysts who wanted to short the stock.

- Dead giveaways that this is for analysts? Um, technical language that his employees without financial training might not dig.

- Also, just being a total douche communicator because he probably doesn’t like analysts.

Research & Development GAAP versus IFRS

As a side note: Under IFRS, R&D is significantly more complex. Under US GAAP you will have your R&D costs expense as they are incurred. Under IFRS, research costs are expense but IFRS has broad-based guidance which require companies to capitalize development expenditures, for internal costs, when certain criteria is met. In IFRS, intangible assets are capitalized and amortized under IFRS but expense under US GAAP. Therefore, this difference means that for IFRS; you need to distinguish research activities with development activities.

Research costs are costs created to plan an investigation or undertake research with the aim of gainin new scientific or technical knowledge. Example, search activities for alternatives for concrete rail ties.

Development costs are incurred in the application of the research findings or knowledge to plan or design for the production of new or substantially improved products before the start of commercial production. Example, testing a new smart phone OS to replace the current OS.

Under IFRS, here was when you would start to capitalize development phase of a project. When it is technically feasible to complete the intangible asset so that it will be available for sale. Its intention to complete the intangible asset and use it is another trigger.