Chapter 8 Creating a Simpler, Safer, Fairer Financial System

Key Takeaway

The Problem with Humans versus Objects – Determinism:

Carney makes the classic case that value measurement losses sight of intrinsic or objective reality and then there is a burst of the bubble and wealthy people lose their shirts. This touches on the central thesis of Random Walk Down Wall Street. Many economists have this instinct to try to explain reality by convincing themselves and then others that people are perfectly rational actors. Carney points out that this rational actors theory is wacky: adding that economists envy physicists and engineers, economists love neat equations and want a deterministic model of reality but that’s just too bad, economist! Determinism, meaning that any input will have a predetermined outcome in the model, doesn’t work when the subject of your experiment has agency/choice. Try telling a toddler that they are rational! Lol.

Sir Isaac Newton said it best: “I can calculate the motions of celestial bodies, but not the madness of people. ” Now, fun fact, Newton wrote that having lost a huge investment by speculating in the famous South Sea Company which basically involved misleading investors into thinking that the British empire had opened up South America to trade when in reality, they were actually capped at 1 ship per port per year in South America….But of course, human being aren’t going to let facts get in the way of investment momentum that drives prices up! Get on the train, folks! And again, because humans are awesome, we will #$ck with you’re predictions whether you like it or not.

Case in point, not everything that is going up is a bubble. Value that is disconnected from fundamentals of accounting are more likely to be a bubble says Carney but there are no guarantees. The investment could be a castle in the sky or just a really good investment…

2008 – 2016 UK:

The lost decade in the UK where there was political fragmentation of the economy is from 2008 to 2016, according to Carney. The real household income did not grow in the UK for that decade (technically 8 years…but whatever). There was a decline of trust in experts. Finance lost its integrity, prudence and became more protectionist. It came crashing down on the poorest in the financial crisis as discussed in the previous chapter. The G20 had to make radical adjustments and reforms. Value was disconnected on the way up and re-calibrated on the way down.

When Queen Elizabeth II asked:

“Why did no one notice the credit crisis?” The answer: signed by 33 distinguished economists said ‘it was the failure of the collective imagination of many bright people in the UK and internationally to understand the risk of the system as a whole.’

So another factor is certainly, the lack of systems thinking! What I do may not have a positive / negative impact on me, but it could have a positive / negative impact on others.

The decline in the trust for experts comes from experts being:

- too academic and therefore disconnected to practical reality…

- simply creating bearers for others to understand their view point and choosing to capture value instead of communicating valuably.

- Unable to see the credit crisis coming…

- Lack of systems thinking / solidarity / or, in other words, the reliance on the invisible hand / free market as infinitely wise.

The fault lines were:

- too much debt;

- excessive reliance on markets for liquidity;

- Complexity in derivative markets;

- Huge regulatory risk,

- Misaligned banks and imitators.

Getting Global Support for Reforms: G20 finance ministers backstopped the entire system.

G8 treasury leaders. They didn’t think that the system would self equilibrate as a solution. As such, they created a new plan with the FSB (financial stability board). It is the United Nations for finance. Mario Draghi had an immediate impact on the financial system as the chair. The FSB developed over 100 reforms. And Mark Carney succeeded Draghi as chair of the G20.

Chairing the G20 Finance Stability Board comes with several important lessons:

- You must have a clear vision; you need political backing. FSB has the power to recommend reforms, however the national legislatures must put these reforms in place…

- You must get the best people you can around the table. Bureaucracy is not helpful here. The group is composed of central bankers, regulators, finance ministers….

- You must build consensus that entrenches ownership. Dany Rodrik sees an intractable problem here: a trilema of economics, democracy and sovereignty…We have a seeding or pooling influence. No country is obligated to implement these reforms however it is in everyone, globally that these reforms be implemented at the national level. Commercial banks were happy that “heads they win tails we lose” with the bail out but there were positive reforms made via FSB.

Mark Carney’s Three Lies of Finance:

Financial crises happen frequently, if you hear someone say any of these lies, then take note:

- “This time, it’s different”

- “Markets always clear”

- “Markets are always moral”

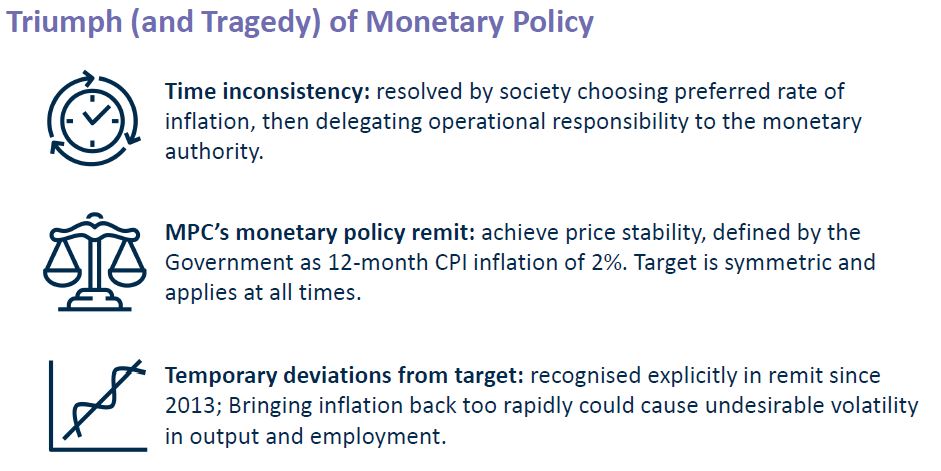

- “This time, it’s different”: what’s happening today is fundamentally different from all prior human history….Nope, don’t believe this lie. Usually, a new innovation is compelling because of its initial success, complexity and opacity. Solving the stagflation of the 1979s and 80s with new monetary stability that were democratic, effective, evident remits, strong governance….The Great Moderation from the 1990s to 2008s also paralleled, technological growth, non-financial consumption, such that it was easy to become complacent. And people assumed housing prices can only go up. This optimism is known at the business cycle. Carney refers to this as the Minsky moment: where lending is abruptly pulled back when financial experts realize there is a correct brewing and thus causes the economic downturn to more severe. In 2008, “Minsky went mainstream.” (186, Value(s)).

- “Markets always clear”: at the right price, excess supply and demand will clear (ie. the supply will meet demand). Labour markets are efficient and clear? Sorry, nope they are rigid and sticky. If money is efficient, then they will reach equilibrium? Sorry, nope markets are incredibly ineffective in reality. Markets do not always clear because life is not a textbook. You can’t describe the real world because people are too complex for any mental or predictive model. Synthetic credit risk; the risk was spread all up. Panic ensues with risk being pooled. The real world is far more complex, we cannot anticipate all of human activity at any given time. Calculating every scenario is impossible, Newtonian physics doesn’t quite work in every scenario and physics doesn’t even involve tricky human beings.

- Keynes in General Theory shows that when having his students rank the prettiness of faces in exchange for a prize, it’s more important to calculate what the average opinion believes the average opinion is. Keynes noted that this is what happens in markets where everyone else was thinking, the derivative of the derivative of what other people will do matters more (subjective utility). Keynesian saw the instability is on spontaneous preferences, the full consequences are only based on animal spirits. The belief that markets are always right was what enabled the last bubble and the next bubble. Markets are populated by people however, fickle people.

- Cass Sunstein argues that 1) preferences in public differ to what is in our heads, 2) social obligations impact our acceptance of new things. For example, if 1000 people protest something, then we will be more amenable to that something as well. Read: Robert Schiller’s Narrative Economics. Critical mass opinion happens in finance as well. The Minsky cycle works on average and average opinion. How do markets become more differentiated? There is a spontaneous urge to make a decision rather than a complex weighted calculation of the mathematical benefits x the probabilities of a given consequence of the decision…

- “Markets are moral”: FICC (fixed income, currencies and commodities markets) have a lot of fraud in them even though they determine the cost of resources, food, housing, government debt prices etc. The commodity squeezes in rye in 1868, cocoa in 2010, and ‘wash trades’ in Manhattan Electrical Supply on 1930 and the Tera Exchange in 2014 show a recurring phenomenon. There have been a lot of squeezes. Planted rumours to drive up a cost happens frequently wherever traders are bored or desperate. Tweaking LIBOR and FX involved manipulating these foreign exchange benchmarks rates for the interest across firms at the expense of retail and corporate clients in the billions. Technology evolves and laws are passed. Engineers of the subprime crisis were clubby and colluded online, globe bank misconduct costs were $320 Billion for $5Trillion of assets. People were colluding online and few were held to account. And there was no rush to take the blame. Trust in the UK went from 90% (1980) of UK citizens thinking banks were well run versus 20% (in 2008). Financial firms help the real economy. The FICC markets, markets are ever more important to people. FICC markets can go wrong with poor regulation. Carney argues you need Hard infrastructure (regulations, foreign exchange benchmark objectivity) and Soft infrastructure like corporate culture, informal codes and policy handbooks. Light banks. Central banks participate in fire insurance. Mistrust between companies and hesitate to invest in firms. FICC infrastructure is key, soft codes of infrastructure, weak banks. Relies on informality.

Carney argues that the solutions are the following:

- Trust: G20’s Financial Stability Board helps by acknowledging that the market is amoral and will not always clear by instilling greater trust, less complexity.

- Smarter: Ensure traders remain pro-market (shouldn’t be a problem) but support smarter regulation.

- Avoid Lies: Ensure financial professionals avoid the attractiveness of the 3 lies.

- Realistic: Recognize that regulation will not bust the cycles since innovation is always happening but ensure that regulators be understanding. Implement policy that make real markets more robust with market infrastructure that creates the best markets for innovation.

- Transparency: In 2008, Over the Counter derivative trades were largely unregulated, bilaterally settled (closed door) and unreported, but now 90% of new single currency interest rate derivatives are centrally cleared in the US i.e there is transparency.

- Systems Thinking: Ensure financial professionals recognize the importance of protecting the system as a whole.

Risks in Emerging Markets are a danger for another financial crisis where the lie that markets always clear continues. China’s economic success contains a lot of shadow banking (SIVs, mortgage brokers, finance companies, hedge funds and private asset pools), there are lots of repo financing, major borrowers and banks with significant opacity. There is now a worrying amount of debt in China that could leave Ray Dalio reevaluating his career choices once again. There could be a major margin call / run on Chinese assets, with first mover. There will be mismatches of markets. There could be a rush to get out of the Chinese market: this is the risk of being trapped when the assumption that markets will always clear (buyers and sellers will find each other) is exposed as wrong. Cyber to crypto crises could also trigger another financial crisis.

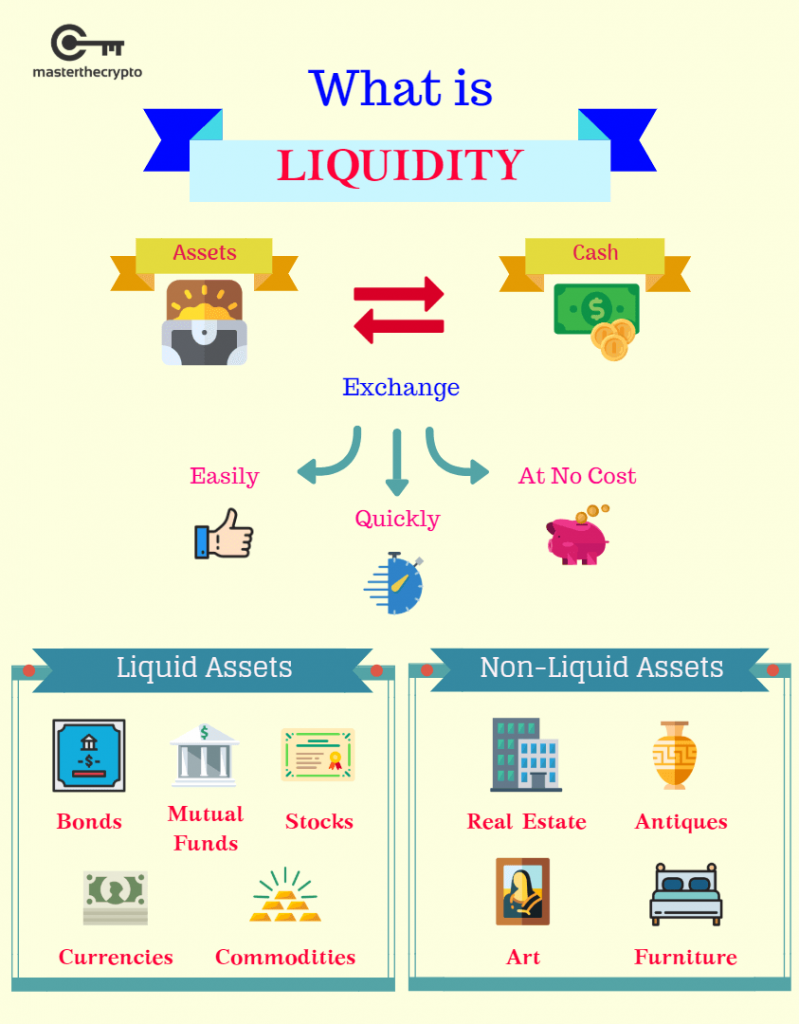

Risks in Illiquid Assets treated as if They Are Liquid:

New risk is the global assets under management of $50 trillion in 2010 to $90 trillion in 2021. But $30 trillion is promised to be liquid when it is illiquid assets. Carney’s addressed this problem of not having consistency between liquidity of funds’ asset versus their redemption terms while he was governor of the Bank of England with the help of the FCA (Financial Conduct Authority):

1) liquidity of funds’ assets should be valued as either a) the price discount needed to do a quick sale of a vertical slice of those assets OR b) a time period needed to sell the asset without a price discount.

2) Investors who redeem get a price for their investment that mirrors the discount required to sell a proportion of a funds’ within the special redemption notice period;

3) the “redemption notice period mirror the time needed to sell the required proportion of a funds’ assets without discounts beyond those caputed in the price received by redeeming investors.” (196, Value(s)).

During the 2008 crisis:

- Liquidity disappeared with cash-powered banks refusing to lend;

- There was a ‘run on repo’ which increased the haircuts on collateral to de-risk counterparties which were shadow banks that then collapsed;

- In Europe, the debt crisis compounded these problems driving up nationalist sentiments…

There is now the liquidity coverage ratio and net stable funding ratios…but there are weaknesses with US repo market troubles in 2019- 2020. The Fed’s open market operates calmed down…Carney doesn’t know where the next bubble will burst but he has a few ideas.

Bagegot’s principal of being the lender of last resort thus preventing short-term liquidity shortages from causing wide spread insolvency.

Central banks have challenges:

- Figuring out if the firm is solvent when the market is against that firm’s assets and the market can be wrong longer than that firm can stay liquid;

- What constitutes good collateral, can always lend government bonds and in the 2008 crisis, it didn’t appear to have an impact on the functioning of the system, banks horde

- The penalty rate means the firms come late because it convey weakness.

Central banks have now moved to doing transparent auctions of liquidity to many counter-parties which includes banks, broker-dealers, an central counterparties in the derivatives market. Bank of England has a contingent term repo facility….

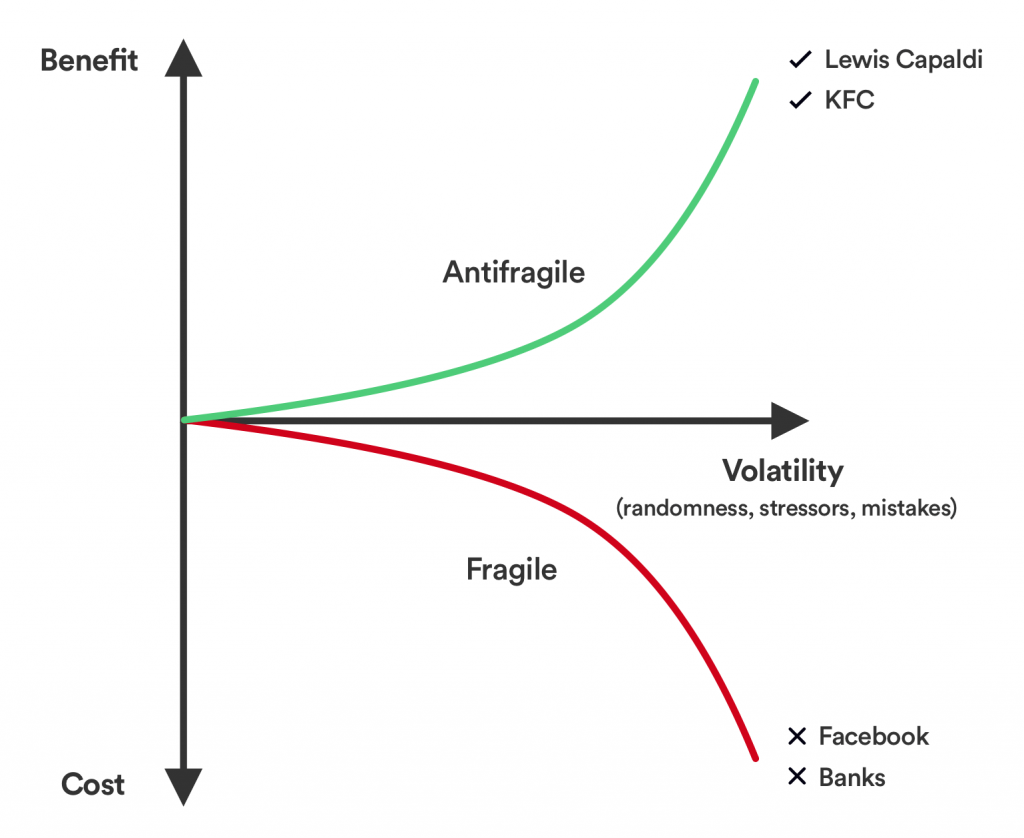

An Anti-Fragile System – This Time is Different – What Was Done to Banks:

- Public trust was harmed most by the mantra of too-big-to-fail banks.

- Banks didn’t pass lending out enough which amplified inequality.

- Privatization of profits while socializing the losses harmed trust.

- Public paid $15 trillion in bailouts, government guarantees against bank debts and special central bank liquidity projects…..

G20 FSB brought in standards to create an anti-fragile system:

- Banks are less complex.

- Banks have a ‘living will’ and are reorganized so they have a firewall between the banking that continues to serve families and business even if their investment banking division is imploding.

- Trading is less between banks thus shifting to lending to customers.

- Public funding has dropped by 90% post-crisis with market discipline…

- Senior leadership can be expected to bare the cost of failure.

- Can’t legislate virtue but can legislate incentives around how senior leaders train staff.

- Improving cyber penetration attack resilience.

- Looking for risks across the economy, thinking system level about where the next crisis is least likely to be and make sure that is focused.

- Macroprudential policy: addressing systematic risks….cyclical risk when the financial system loosens up, debt grows and complacency sets in, the Minsky effect is severe…

- Macroprudential policy: addressing systematic risks…structural risks when there is a wbe of exposures to derivatives risk, which means the need to have liquidity buffers, restrictions on mortgage lending, shutting down the shadow banking approach.

Bank of England serves the purposes “To promote the people of the United Kingdom”

Restoring Morality to Markets:

Oscillating regulation, light touch versus total regulation.

- Aligning compensation with values;

- Increasing senior management accountability;

- Renewing the vocation of finance.

Longer-Term Horizons Focus the Mind: Bonuses in the UK are now managed with compensation by delayed by 7 years. If there is misconduct then bonuses can be clawed back, according to Carney. Business mission statements tend.

FICC Markets now have new guidelines:

- have clear, proportionate and consistently applied standards of market practice;

- are transparent enough to allow users to verify that those standards are consistently applied;

- provide open access (either directly or through an open competitive and well-regulated system of intermediation);

- Allow market participants to compete on the basis of merit; and

- Provide confidence that participants will behave with integrity.

Effective markets are those which also:

- Allow en users to undertake investment, funding, risk transfer and other transactions in a predictable way;

- Are underpinned by robust trading and post-trade infrastructure enabling participants to source available liquidity;

- Enable market participants to form, discover and trade at competitive prices; and

- Ensure proper allocation of capital and risk.

Drawing on the Magna Carta:

Having the right principles is essential. Keep pace with the innovation. Senior Managers Regime (SMR) individual accountability. Values need to be exercised like a muscle. SMR makes sure senior leadership is accountable even if many of them were involves in the 2008 financial crisis. Employees must be connected to their communities.

Analysis of Part 1 and Chapter 8

- Mark Carney can look to Mario Draghi for inspiration since, Draghi is now the Prime Minister of Italy (as of 2021). Central Bankers can cross into the political sphere. Currently Draghi is trying to get bank mergers to happen in order to clean themselves up. So like Carney, using the power of politics to effect change is sometimes valuable where as a central banker, you cannot effect change. Analogies, and history does not have predictive power, Italy is very different from Canada, however it is instructive that getting into a position of power may not be a high hurdle for Carney. Finance catteacts people with no socience training, because they are looking for absolutes. These folks lean deterministic.

- A bit odd that the Senior Managers Regime (SMR) doesn’t really connect because the people who self-select to work in banking are frequently math. The problem is that the people with the experience made decisions in the financial crisis that seem to benefit themselves disproportionately company to the general public. It is similar to having doctors make decisions for hospitals, there is a conflict of interest in being in control and regulating oneself.

- Perhaps the bad behaviour is in Crypto…

- Great economic shocks cause institutions to recalibrate and reform. It isn’t the individual actors that drive such change but rather macro externalities where no one internally can be blamed that cause reform.

Citations Worth Noting for Part 1: Chapter 8:

- Carmen M. Reinhart and Kenneth S. Rogoff, This Time is Different: Either Centuries of Financial Folly (Princeton: Princeton University Press, 2009)

- Raghuram Rajan, Fault Lines: How Hidden Fractures Still Threaten the World Economy (Princeton: Princeton University Press, 2010).

- Hyman P. Minsky, ‘The Financial Instability Hypothesis’, Levy Economics Institute Working Paper No. 74 (May 1992).

- https://www.youtube.com/watch?v=PIRHM_Dz_fQ Adair Turner

- Kenneth J. Arrow and Gerard Debreu, ‘Existence of an equilibrium for a competitive economy’, Econometrica 22(3) (1954).

- Gilian Tet, Fool’s Gold (London: Little, Brown, 2009) which shows that derivatives were distributed throughout 100s of balance sheets through the pooling and distribution of that risk. Similar in essence to a decentralized ledger.

- John Maynard Keynes, The General Theory of Employment, Interest and Money (London: Palgrave Macmillan, 1936).

- Wlater Bagehot, Lombard Street: A Description of the Money Market (Cambridge: Cambridge University Press, 2011).

- Financial Stability Board, ‘Strengthening Governance Frameworks to Mitigate Misconduct Risk: A Toolkit for Firms and Supervisors’ (April 2018).