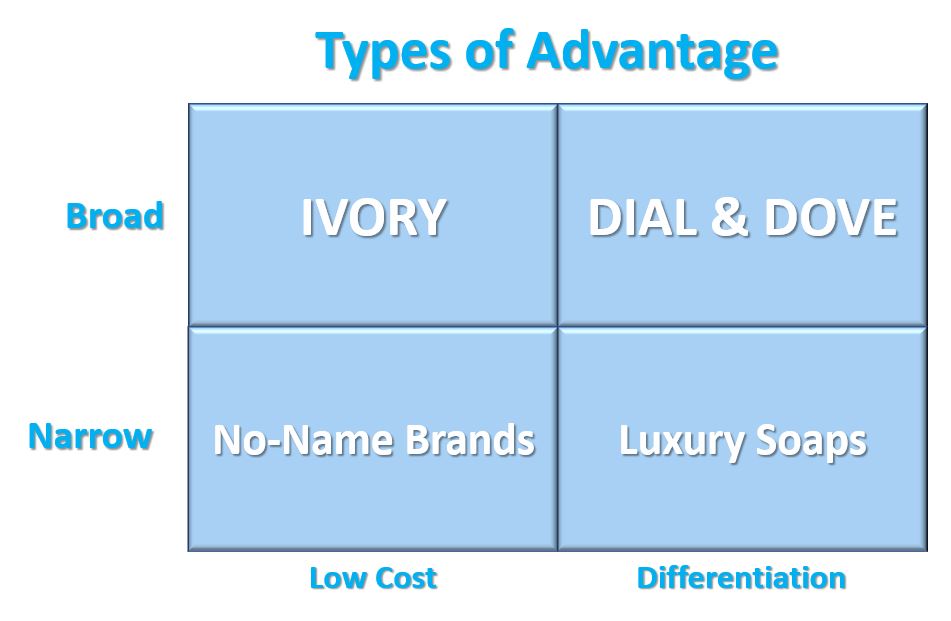

Types of Competitive Advantage

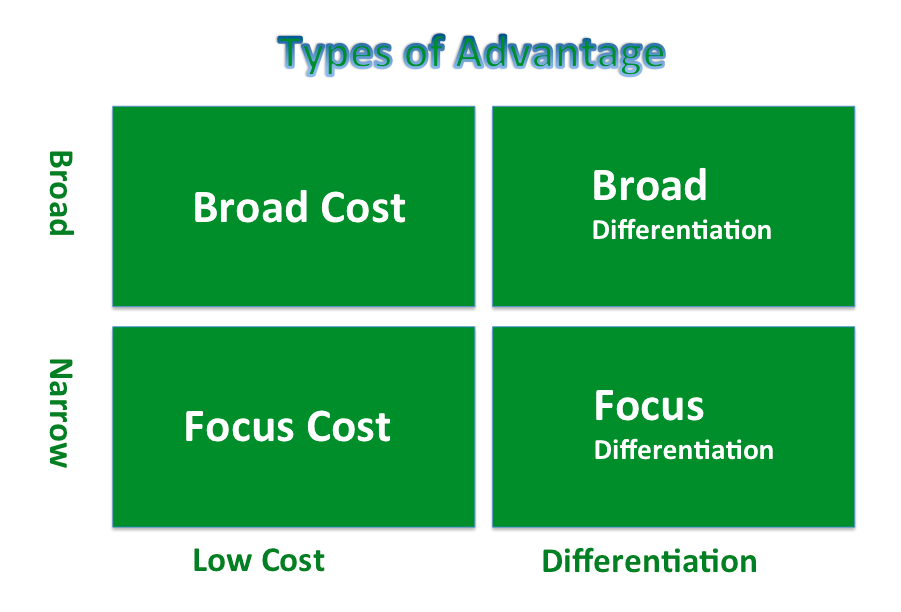

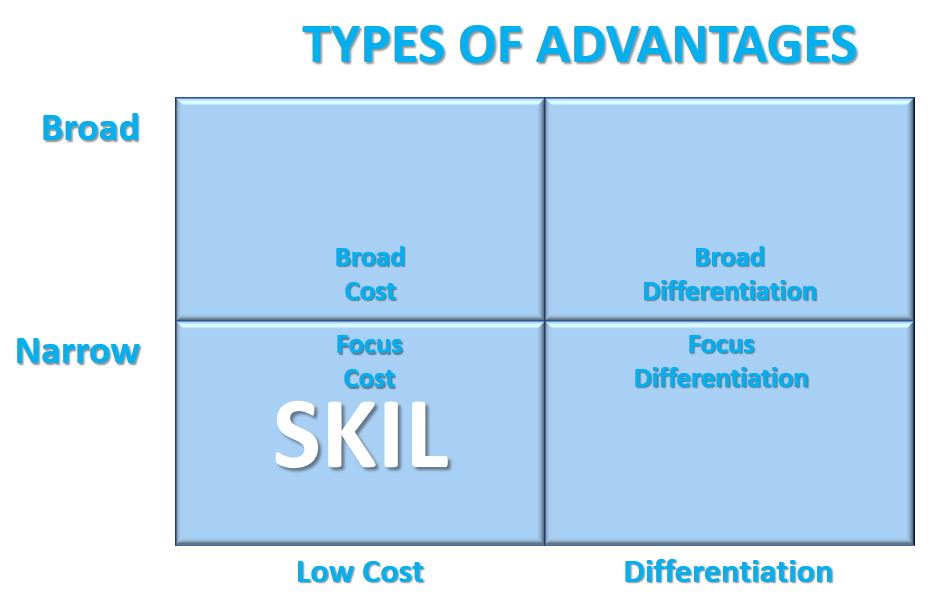

You can be a cost leader (the cost leadership approach) or you can be differentiators in either the broad target or narrow targeted dynamic. Regardless, you will need to focus: a) cost focus or b) differentiation focus. The ultimate road to failure is to be “all things to all people”; that is the recipe for disaster.

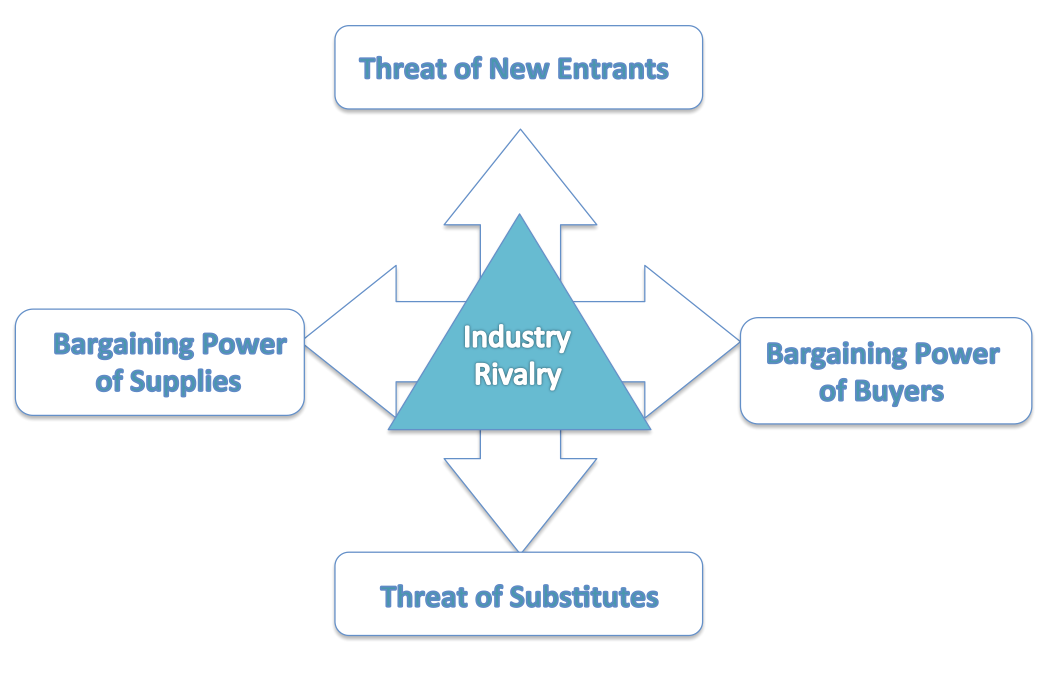

Determinants of Industry Profitability

You need to understand these core-influencing factors before you dive into a potential product market.

The “Five Forces” are the following:

- Rivalry among existing industry: rivalry can be cut throat some not so much.

- Bargaining power of buyers: buyers might be price sensitive, might want more service they don’t pay for etc.

- Threat of substitutes: a product that can do the same thing: if you do steal then plastic is a problem for you.

- Threat of new entrants: if entry is easy than it will reduce value.

- Bargaining power of suppliers: employees, machinery they can bid up their own prices. They can strip the profitability of an industry.

So success is a function of these strengths. You need to determine the industry success levels. Each of these competitive forces is shaped by the underlying determinants in that industry.

Intensity of Rivalry: are companies cutting prices or attacking competitors in ads?

Industry growth: how fast is it growing?

Product differences: is each product the same thing or are there value adds?

Brand Identity: does each company have a distinct brand strategy?

Switching Costs: are there switching costs from one to the other high or low?

Barriers to Exit: is there are lot of infrastructure required to realise profits?

Diversity of Competitors: are the competitors more different than the product?

Pharmaceutical Industry Case Study

The pharmaceutical industry is highly profitable with the margin around the 20% mark in this industry. Why is this industry such a great game to be in?

The pharmaceutical industry is highly profitable with the margin around the 20% mark in this industry. Why is this industry such a great game to be in?

Buyers: there are really 3 buyers: doctors, insurance folks and customers.

Entrants: It’s very hard to get into the industry; to get your drug accepted it needs sales man to persuade the doctors to use it. You need to have a sales force. Also, the average cost of a new drug development is 100 million dollar. 60% test to get government approval. Only when you have innovation like the pill does a new entrant change the landscape and a new player can enter the market.

Suppliers: not very strong. Commodities have little room..

Substitutes: very tough to get an alternative built up in a specific industry.

Rivalry: process is gentlemanly in pharmaceuticals; they don’t’ have to compete on price; the buyers aren’t price sensitive.

- Therefore, every one of the Five Forces is favourable. The Pharmaceutical industry very evidently

Airlines Industry

Government regulation fundamentally effects this industry. Government IS not the included in the Five Forces as a Sixth Force. But it probably should be. The difference might be that government effects the other five forces in significant ways.

Government regulation fundamentally effects this industry. Government IS not the included in the Five Forces as a Sixth Force. But it probably should be. The difference might be that government effects the other five forces in significant ways.

Buyers: prices are fixed.

Rivalry: limited new flights.

Entrants: no new airlines;

With the deregulation of the Airlines in the Reagan era:

Entrants: very low now as allowed by government.

Buyers: are price sensitive, very low, customers are willing to switch.

Rivalry: it’s intense, you might cut costs.

Suppliers: pilots can go on strike.

The underlying structure is not favourable therefore no very exciting.

Industries are not static. Industry structure can change for better or worse Changes;

1, technology causes the shift.

2, companies can shape industry structure.

Industry trend is significant for industry structure if it affects one or more of the Five Forces.

Pharmaceuticals are under threat

Pharmaceuticals are under threat

1, Buyers might start to care about price, government and insurance have tried to lower price. Costs have grown twice as fast.

2, Generic drugs has also been a huge problem. Once a drug goes off of patent, it’s legally possible get another prescription.

3, Biotechnology is reducing the cost of developing new drugs; lower the cost of entry. Genentech with the pill has innovated using none other than horse urine.

Some industries change can be positive. There is change.

- Hub and Spoke route system. Better marketing, airlines are competing as hubs thus this has raised a barrier. You need to get slots in those hubs.

- Information management system. Modern computers have allowed the sorting to be automated. It takes millions of dollars to develop this technology of managing technology.

- There are these rewards programs which will keep you loyal. You need to differentiate and have started to change that equation.

Lessons from Industry Analysis

- We have learned that industry analysis is the beginning strategy. You need to understand that industry and what that industry functions as it does. Which ever force is most significant, you need to focus your creative energies;

- Focus on how the industry might change;

- Watch out for industry change;

- Companies can change their destiny;

- Companies can actually destroy their industry: if you don’t think through your moves you might actually undermine your industry.

Competitive Positioning

How does a company achieve superior performance in an industry? To be superior you need to have a sustainable competitive advantage. Advantage is sustained in two ways:

- competitors can’t compare;

- continuous improvements before your competition catch up.

There are few companies in a position to catch up with Google in search for example. Bing is fast but even so, it still lacks the scale and user relationship that Google has created. Google has grown alongside the internet in an organic manner.

How Do You Get A Competitive Advantage

There are 2 types of competitive advantage:

There are 2 types of competitive advantage:

- Low Cost: lower cost in designing, marketing and producing.

- Differentiation: able to provide a unique benefit this is superior product and price.

It’s very important to determine which on these two a company is trying to achieve. Every company has a fundamental goal. Gain advantage in a narrow arena. You want to lead to generic strategies.

You could be broad & low cost. You can seek to be low cost or differentiated. The worst strategic error is to be stuck in the middle. If you aren’t willing to be designated then you will be stuck. These companies are always the below average in any industry.

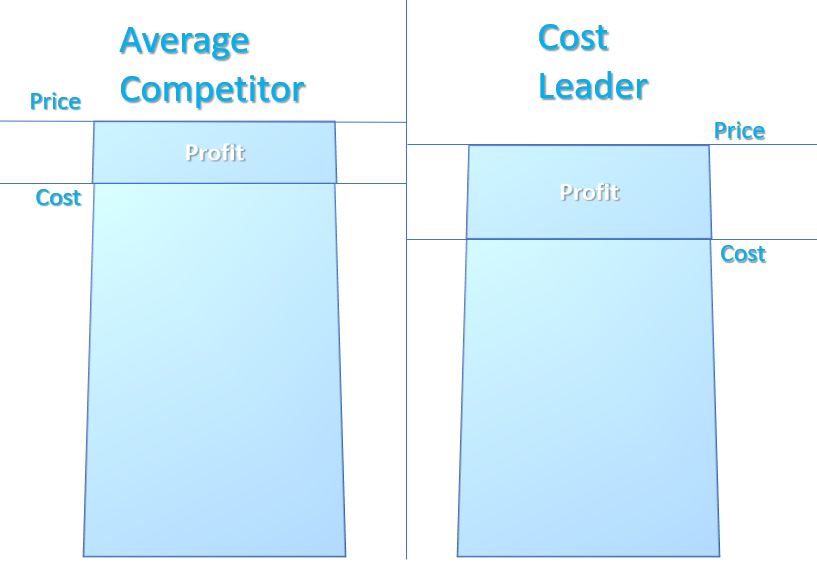

Cost Leadership | How To Create Value On A Tight Budget

The low cost producer uses economist of scale to help lower costs. You want to basically amortize your research and development in order to focus in on the high value generation. They find ways to exploit cost advantage through resources.

Any company seeking to gain a cost advantage needs a good product. Acceptable in features, but the low costs doesn’t want the frills. You focus on a good basic product. Your advantage is about getting a cost gap over all competitors. You gain the low cost position, and then you can command prices and get a low cost performer.

Prices relative to competitors and the cost position relative to competitors.

You are being the low cost and get a low cost advantage. But if you get too low then you won’t get a cost advantage.

The standard no-frills product -> needs to command price near industry standards. Low cost – higher returns unless not comparable to the average, which leads to discounts. Proximity: cost advantage is already great or parity similar products / a different combination. You need to be the cost leader many firm miss this point but they end-up racing to the bottom > this needs preemption unless major technological change allows for radical position change.

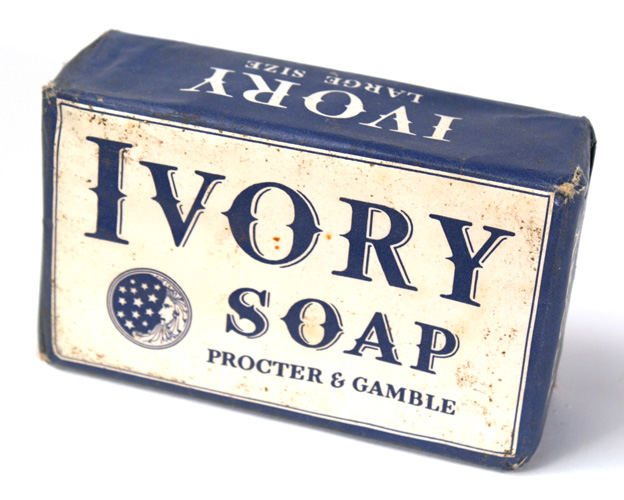

Proctor & Gamble

1.6 Billion dollars in revenue every year in the mid-1980s. Ivory is not a mundane product, soap is an example about competitive positioning. Most soaps in the 19th century were producers of expensive of luxury soaps. The basic Ivory strategy was to produce a pure mild soap. The ivory bar actually floated. Consumers were interested in the floating element. Ivory have symbol of strategy. Most soap was brown. Ivory was the first white. Ivory was heavily advertised. Harley Proctor had his own idea. He developed 99 44/100% pure soap. Proctor created these comparison ads between ivory. Proctor also had testimonials.

Ivory also used babies to promote themselves. Ivory commanded a premium prices and then dominated.

- 1950s and 60s challenged the Ivory strategy.

- Dial was a deodorant bars.

- The second was Dove: it makes your skin better 1956.

These new products had features that threatened them.

Ivory bar moved from the differentiated soap but moved to the low cost to being a cost leader in the industry. So this new ivory strategy. So you have a simple no frills soap. Ivory has a simple bar. Ivory goes for simplicity; basic approach.

Ivory also did a lot of bundling of six bars. So then Ivory could be used for the family.

Ivory doesn’t have demographic skew it’s well developed. That’s what makes Ivory unique. Ivory is always all purposes. Ivory set its prices are a low level. Ivory focused on a basic soap. Ivory cot less than the other store. Four bars of Ivory lo cost. The new Ivory strategy is worked.

What makes it so cheap? Air bubble mean less bar? No additional flavours. The pac

kaging is inherently cheaper to product. Ivory controls advertising cost. The brand image is that ivory is a very effective trafficker.

You can add these features or strategically re-position Ivory. Moving from differentiator to cost leader. The Ivory packages is about simplicity. Ivory goes for simplicity.

Ivory bundled soap for the whole family. Ivory set its prices lower than the competitive market-place. Ivory costs less than the other soaps than the store. The simple packaging are inherently cheaper to produce and Ivory controls advertising costs. Ivory is an effective traffic builder. Proctor & Gamble get scale and distribution advantages. Ivory hangers a low price, but it cost is even lower. The cost saving is very much a virtue. LOW COST LOW PRICE.

Despite Ivory’s success, there is new soap Pure & Natural.

John Pepper @ Proctor & Gamble

John Pepper @ Proctor & Gamble

Ivory became a giant brand in the 19th century. Pure, mild, floated, white. There is no product life cycle is totally an issue of the people managing the business.

First step, you need to understand what customers actually want. You need to talk to consumers, group testing is valid. Ivory’s histories central brand have changed.

We like continuity of management, promote from within, people know eachother well. Not all working on Ivory; continuity is related to the advertising agencies. Agency advertising has been with 67 years.

Brand at Proctor & Gamble: the brand becomes a person. It brings benefits to consumers; it assumes a personality or character to it. Proctor & Gamble has chosen to not change Ivory. Proctor & Gamble didn’t want to compromise the idea. We wanted to be consistent about Ivory. Consumers want consistency.

Lessons from Ivory

What lessons are there for strategy. Soaps all go after different.

- Choose different strategy;

- Implement, but don’t flip flop and the market place doesn’t know what to do;

- Strategy must respond to market forces;

Cost Leadership II | Taking Cheapness To The Next Level Down

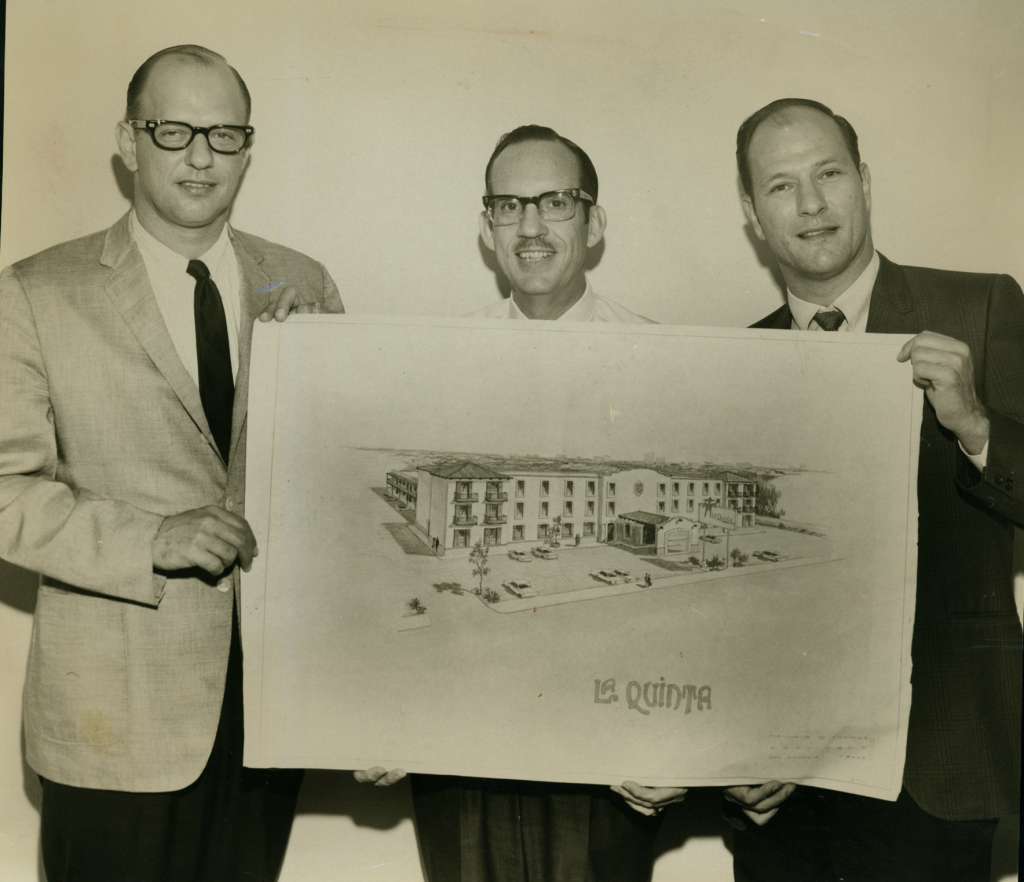

La Quinta: it’s a motel chain in the US. It has 200 locations, spread across the US. La Quintata results in 80s has been amazing. Profits have been modest in Texas. There is a dramatic expansion of competitors.

From a strategy point of view: customers, are satisfied, competitors can’t match them. La Quinta’s strategy is an example as an effective lodging companies; there are wide ranging needs; high rollers and the have a wide range of services. Room service for the tired executive. La Quinta has chosen to find a particular kind of customer.

From a strategy point of view: customers, are satisfied, competitors can’t match them. La Quinta’s strategy is an example as an effective lodging companies; there are wide ranging needs; high rollers and the have a wide range of services. Room service for the tired executive. La Quinta has chosen to find a particular kind of customer.

They focused on the commercial man, sales, auditor (who has to travel to the same places) Spends 17 nights a year in a La Quinta organization.

Location: good access and excellent visibility; located where business people go a lot. La Quinta builds beside Kenny’s. But they don’t want to go into the motel business. Most lodging establishments loose money on their in-house restaurants.

Building: sound proofing; very quite rooms made out of concrete.

Cost of $40 very cheap. Why they stay here; it’s consistency. Simple no frills. I don’t care about room services; folks are travelling: I’m busy I keep myself moving. The operating costs are held down as well. The room is as large as the competition, but the costs are lower. There is a corporate fetish for cost control; construction costs are held down.

Cost of $40 very cheap. Why they stay here; it’s consistency. Simple no frills. I don’t care about room services; folks are travelling: I’m busy I keep myself moving. The operating costs are held down as well. The room is as large as the competition, but the costs are lower. There is a corporate fetish for cost control; construction costs are held down.

A La Quinta is managed by a husband and wife team. The employees live in the apartment on the premise. The couples are loyal to the company; they stay at the company. The final bonus is that the couple and the other employees provide a great deal of personal attention. There is extensive training 12 weeks of training. Makes simple repairs.

Sam Barshop: President of La Quinta

We are constantly updating our services. We started with TVs then we put in cable. Our customers are the boss not me. Marriot Hotels is great and it has the Courtyard concept: they going after. Marriot is the GM of hotels. Motel6 is a good company, they know what they are doing. We are working on minutes in cleaning a room, working on nickels and dimes. We build a building extremely cost effectively, we know what the land cost. We know our product really well. Wall Street should not run your business.

We are constantly updating our services. We started with TVs then we put in cable. Our customers are the boss not me. Marriot Hotels is great and it has the Courtyard concept: they going after. Marriot is the GM of hotels. Motel6 is a good company, they know what they are doing. We are working on minutes in cleaning a room, working on nickels and dimes. We build a building extremely cost effectively, we know what the land cost. We know our product really well. Wall Street should not run your business.

Lessons from La Quinta

Competing with a focused strategy. La Quinta illustrates that you should choose a particular target segment. It has to have unusual or distinctive needs.

- Choose target segment with distinct needs.

- Service target exclusivity.

- Always under temptation to get a few more customers.

- If your company starts to broaden strategy it will loss its base.

- Fin a segment that has lower needs: non-luxury and then find those customers.

- Invest where needed: All concrete construction, booking system that was simple, renovated the properties.

- Cost leadership is part of the company; everyone is worrying about the cost.

Charles F. Knight – Emerson

The lowest cost producer is not the answers. Six key points to define what we do:

The lowest cost producer is not the answers. Six key points to define what we do:

- quality;

- know competitor costs;

- receptivity to change; going after productivity in your plants.

- Formalized cost reduction program;

- Strong communications related to those productions; the enemy isn’t management but the competition

- Commitment of capital to make it happen.

http://en.wikipedia.org/wiki/Emerson_Electric_Co.

If you have the highest quality in the entire system, if you have the best quality, you also had the lowest cost. How do you understand the costs of our competitors? We learn about what the competitors product and cost. Emerson uses their competitors to keep minions in line in effect. People want to win: once they see who the target is and resources. This includes productivity & cap & spending. This is not something that you put in a box, Emerson has had half about 100 Fortune then it won’t work for you.

Conclusions: Cost Leadership

- Create a good product; willing to make choices like frills and features;

- Cost leaders draw advantage from many sources;

- Study the Competition;

- Cost is literally built into the organisation: everyone is worrying about costs;

- Cost leaders manage costs downward.

- Many managers have a misconception about cost strategies “real managers don’t compete on costs” but those misconceptions have to be minimized.

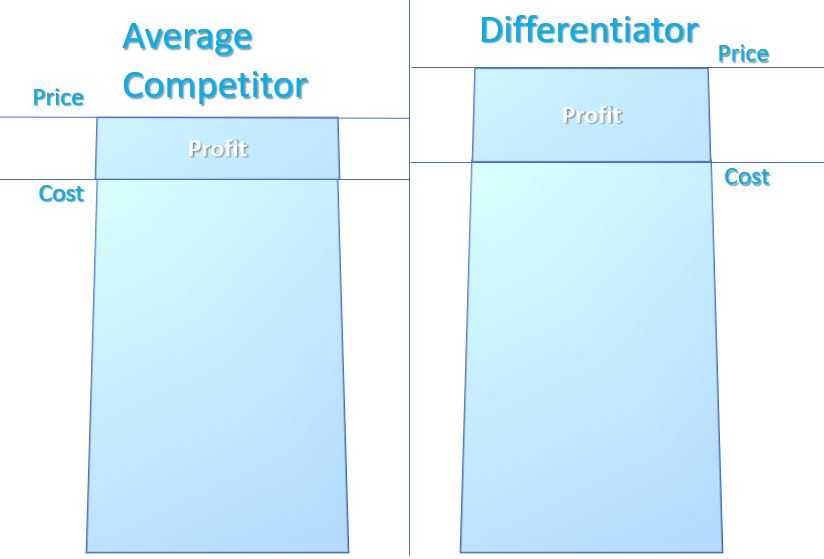

Differentiation Strategy

Find a need and find a unique value. You need to spend extra in R&D. The differentiator is trying to command superior prices. Differentiation is premium price / unique USP meets unique needs of consumers. Kinds of differentiation include:

- the produce is different;

- the delivery system;

- marketing approach;

- broad range of factors.

Example is Caterpillar: durability, service, spare parts, excellent dealer networks.

Price Premium must be great than the cost of differentiation. You need to reduce cost in areas where they do not differentiate. Differentiation.

Price Premium must be great than the cost of differentiation. You need to reduce cost in areas where they do not differentiate. Differentiation.

The balance is that the premium is greater than anything. The premium must be greater than the cost of being unique. You should cut costs to the bone if they refuse to pay for it. The differentiator only spends as much is necessary as to command the premium.

Often customers can’t tell how you are different; you need to make sure the customer knows that the customer is getting the benefits. Differentiation is about identifying what the buyer needs and then provide unique performance to meet those needs.

Differentiator is trying to command premium prices. You need to ensure that the relative price and relative cost.

Differentiator is trying to command premium prices. You need to ensure that the relative price and relative cost.

American Airlines (Broad Differentiation)

How have they survived thanks to de-regulation. Most airlines have been pre-occupied with cost. American expanded internationally to Spain, France.

American Airline

On time and excellent service. Do you get you there in time: American Airline value. Overbooking is really upsetting for bumping. Now American Airline has fewer bumped passengers than any other airline. The Travel Agency was a crucial arm for the Airline and is a client. The distribution channel; effective differentiate.

Sabre has automated ticket but it got a preferable distribution channel. A successful differentiator must communicate to it’s competitors. America seeks to communicate its differentiation strategy. American Airlines is a major advertiser in newspapers. American Airline had Advantage with frequent traveller program: we would get award free travel. You have 60% seats are full so free seats aren’t a huge problem anyway. Differentiation is higher prices of course.

American Airline in traduced the supersaver program. It’s about controlling a larger control of the price for cheap-skates while also keeping the posh fliers happy with premium pricing for their foot massages. Low fare market and high fare market are being covered by the supersaver program and the Advantage programs.

Vital Steps

Measurement: message the standards. How long it takes for a bag to get to you. Tracking 21 areas of quality shoppers in their system. Recruiting: the people need the right skills and the right attitudes. Relationship with Emloyees: mutual respect, American had 2 tiered labour system. Newer employees are tied to market forces will senior staff aren’t.

Technology: Sabre is the largest realt time data tracking system int eh world. American Airlines has placed Sabre at the heart of seat booking. This all allows American to

R.L. Crandall CEO of American Airlines

The long-term coherence of American airlines has been committed to the shared throughout the management, we are more consistent at differentiating ourselves.

The long-term coherence of American airlines has been committed to the shared throughout the management, we are more consistent at differentiating ourselves.

You tend to need to do this differentiation over a long period of time. Crandall we communicate with our people, we explained the plan. 33% of my time is spent in things in communication excercises.

We looked at the fleight in the airlines, got rid of whole fleets of airplanes. We used to fly point to point, moved to hub and spoke model. We seriously cut cost without having any effect on product quality you can’t really do. But you can make cuts in costs when there is pockets of cost that don’t make any real contribution to quality.

Do you need 3 pieces of lining or just 2 pieces of linin. We looked at the weight of the airplanes: so you can eliminate costs that don’t make any sense, anything that doesn’t add value should be thrown out that weight.

America Airline: you can find out any price of any airline ticket with a phone call. You need a quality score for those hotels. These are the kinds of adds that we would run. Finally we sold that to the department of transportation.

Lesson from American Airlines

- Challenge of creating value for the buyer;

- Value readily perceives the value: American was interested in onboard and arrival times were of high value.

- Communicate value: you need to let people know about that. That’s why they wanted the government to publish statistics on travel performance.

- Differentiations is costly: American was willing to differentiate via cost. They were trying to minimize extra cost of services; so they are trying to reduce the extra cost.

- Differentiators Worry About Cost: they are constantly looking to cutting out bad fleets of planes and remove heavy objects that don’t matter for quality. So they have to make a tradeoff between cost and.

- Be a moving target: competitors will be constantly trying to emulate what you do.

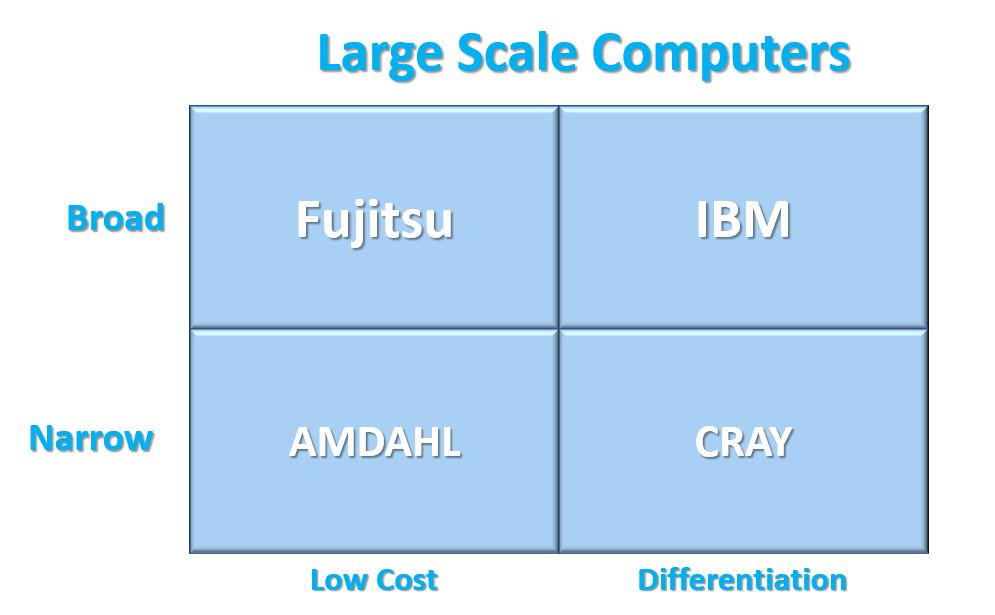

Differentiation (Narrow/Focused Strategy)

Cost focus: seeks focus on cost for a subgroup OR differentiation focus: a firm seeks differentiation in its target segment. Cost focused looks at the behavior of consumers based on segment of iPhone users.

“Stuck in the Middle”: fails to achieve any strategy. Not making choices about competition. Laker Airways had a clear cost focus shift to some frills. A firm is better off finding new industries in which to grow where it can use its generic strategy again or exploit interrelationship.

“Stuck in the Middle”: fails to achieve any strategy. Not making choices about competition. Laker Airways had a clear cost focus shift to some frills. A firm is better off finding new industries in which to grow where it can use its generic strategy again or exploit interrelationship.

A firm must make a choice: among them or it be stuck in the middle. Three conditions for meeting both cost leadership and differentiation.

- Compeitotr are stuck in the middle.

- Cost is strongly Affected by share or internatliosnhip.

- A firm pioneers a major innovation like Apple computer Ince new machines forging compeative relation with suppliers.

Ford wenf to a low-cost streaty in the 1920. GM differentiate strategy based a wide line, features, premium prices.

Smirnoff produces new brand due to eroding competitive advantage.

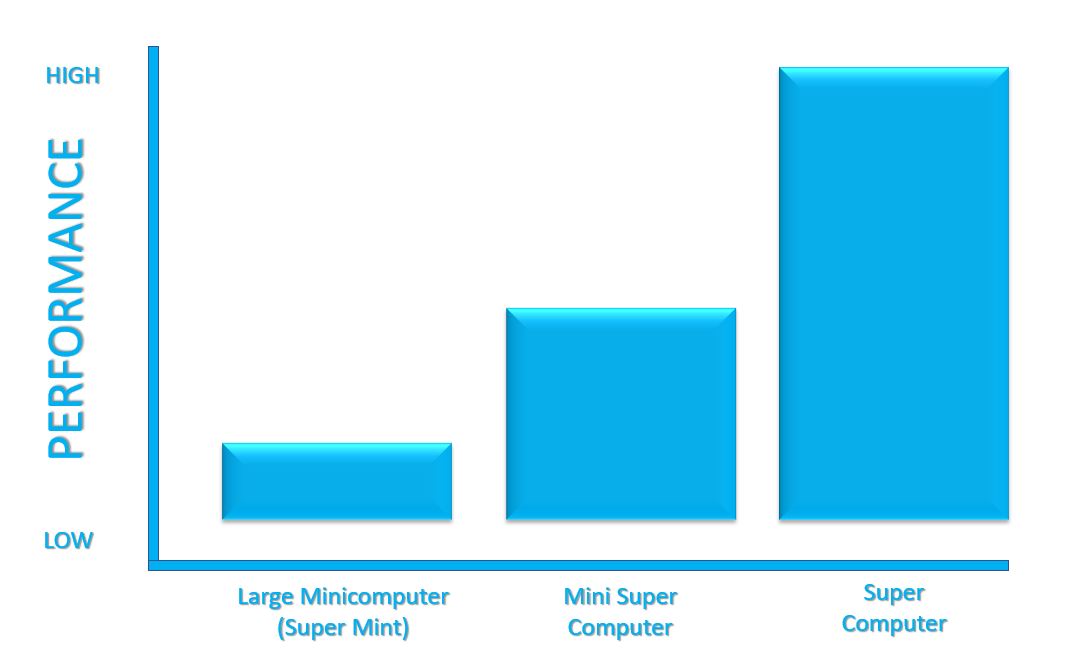

Cray Research: http://en.wikipedia.org/wiki/Cray_Research

Founded in 1972 in 1976. Cray sales are on the rise and they have had an equity increase of 25% year on year. Has doubled the average of an unstable system. Has been differentiating in IBM. Pundits have been predicting Cray Researchers demise. IBM and Japanese Companies product a wide range.

Founded in 1972 in 1976. Cray sales are on the rise and they have had an equity increase of 25% year on year. Has doubled the average of an unstable system. Has been differentiating in IBM. Pundits have been predicting Cray Researchers demise. IBM and Japanese Companies product a wide range.

Cray Research: only builds the most power. They are a differentiated super computer in the world because they build supercomputers and they believe that their product makes sense. It turns out to be absurd now, but at the time Michael Porter rated their strategy highly without thinking much about mainframes were shrinking to desktop computers to mobile phones and that was the high order bid.

CEO thought: scientists what more robust technology and the need to create an addiction for the engines. Super computers + a proprietary operating system and the Cray is designed to interface without computer equipment (except Apple computers).

The sales process is tough: a supercomputer costs 15 million dollars! They have a highly trained sales force in 85 sales-force.

They also have R&D to prove how effective the machine actually might be. It take 9 months to build a Cray, these computers are building computer error free. The computers are hand made. Along with every Cray goes 5 employees who manage the machine inhouse. Most problems are then dealt with on the spot. This means Cray has remarkable uptime. They are running 99% of the time.

Cray’s Pricing Strategy: they place it on the value: they are the most expensive computer, it creates so much value. They use this technology to manage the design of airplanes, cars and oil rig.

They are over 100 million dollars in R&D every year. R&D 15% of revenue is research and development. This comes off the top. Cray demands superior people.

They interview wildly win the organization. Cray is looking for people who can work across lines. Not a hierarchy and flat. There is a Cray machine year book actually details the construction with picture of engineers building the computer.

Chipawaha Falls; there is this constant dialogue: we have no secrets from our employees. Customers call the engineers directly: they don’t want to have .

The Customers Sell for Cray

The referrals they get from other customers. What about the competition? Cray Researchers: their engineers talk to our engineers so it’s a long-term relationship. When Cray Researchers are asked about performance, we disclose the plans openly: unless they know where we are going then they aren’t happy. The customer goes behind the scenes. There are no impediments between customer and engineer. IBM has ignored the super computer market. Japanese super computers in the US is really weak.

Mini-Super Computers

The mini-super computers is a challenging segment. It could be a billion dollar market by 1990. The size of the customer base for Cray Research has gone from 90 companies to 1000 companies so they will not be entering the mini-super computer.

John Rollwagen: Cray Research CEO & Chairman

There is a vast computer industry: why are you focused on this one objective? Historically, Seymour Cray has been the dominant figure. The strategic reason for focus is that we think that we should continue the specialization in this one field.

Why didn’t Cray Research not enter the mini-super computers?

It’s always better to have a broader market. Cray Research was even asked by partners to look. They called the product Quarter Horse in 1984, they fleshed out the business plan and reduce the cost and maintain performance. The final analysis was that we shouldn’t do it. If we do this we will lose our focus and it takes all our attention to stay focused. It’s always easy to see that you add products to the main product until you lost the essence of the product.

We want to have the most powerful computer in the world: The first risk is that if we don’t make the super power then we are screwed. The second risk is that people don’t want to buy super computer. The rational thing to do is to spread. Rollwagen believes in just do this thing focused on the high end.

The Cray Research Strategy:

- Differentiation creates value for the customer to justify the premium price, but it’s cheap the unique benefit that Cray Research buys.

- More than physical product: it’s the ability of the customer to use the product: insight customer engineers.

- Communicate differentiation: credibly improve;

- Be A Moving Target.

- Sharp focus on target segment.

- Find segment with greater needs.

- Stay focused: Cray has kept their advantage.

Cray Research built its strategy around the super computer. Period.

Broad Lesson

- Successful strategy must worry about their own position and industry structure.

- Don’t ignore industry structure!

- Choose a different strategy!

- Dare to make trade-offs

Competitive Strategy in Practice

Culture effects competitive advantage it is a means of achieving competitive advantage. Build, Hold, Harvests. There are risk of the generic strategies.

Risk of cost leadership not sustain because

- competitors imitate;

- technology changes;

- other bases for cost leadership erode;

Risk of Differentiation is not sustained:

- competitors imitate;

- ase for differnetiaiton becomes less important to buyers.

- Cost proximity is lost / differentiation focuses achieve greater differentiation in segments.

Risk of Focus: the focus strategy imitated the target segment becomes structurally unattractive.

Case Study: Skil Corporation

Practical tools industry, had a wide product line and a global market position. It was faced with Black&Decker. Also having to deal with new and severe competitors. Skill Corporation was deteriorating.

Practical tools industry, had a wide product line and a global market position. It was faced with Black&Decker. Also having to deal with new and severe competitors. Skill Corporation was deteriorating.

Emerson Electric were going to turn Skil Corporation….Harvard Class Room Notes

- Black & Deck has lower prices & better brand and aggressive marketing strategy. Black & Decker is across the board.

- Skill Corporation was very much not a cost oriented company or a marketing specialist. They don’t have a brand name.

- Might want to trim the product line, build the advertising budget; differentiate from the consumer tool.

- Skill might lose hardware stores. It’s key to look at the distribution channels that is difficult for hardware. Hardware store is dependent on high margins.

- No chance to be strong at 7% market share. If you focus exclusively on circular saws.

- Skill Corporation showed try to drop with a channel that is more powerful because they have K.Marts and other distribution.

What Skil Corporation Did…

- Distribution Channels: reduce the number of distribution channels it wanted to serve. Skill decided to de-emphasis those channels. Skill chose not to sell to mass merchandisers.

- They streamlined the product line and sales force. They were able to keep their product out of the mass markets.

- Black&Decker sold to all the channels which meant the mass merchandisers could also get that saw down the street for cheaper.

- Skil also cut 50% of the products and that meant lost revenue by 20%.

- Skil tried to fundamentally re-design the product line. Circular Saws; there were once 7 different housing: 6 encaps. But today they only do one of each.

- Skil also reduced the number of parts from 69 costs to 30 parts the cost reduction was substantial.

- Skill also went global with the product.

- Dramatic change 10 of the 13 plants were closed and then 3 factories became the world source for each of the product lines. They reduced the number of products and product families. Skill was able to dramatically improve the automation.

- Skil made the automation flexible. Able to produce any of Skils product within 15 minutes.

- There was also Just-In-Time to reduce the inventory space. So the space to process the inventory was repurposed.

Lessons from Skil Corporation

- Market share has increased profitability. Then it’s also on the highest levels of any of its competitors.

- Don’t imitate, you should choose new positioning going after consumers and industrial.

- Focus on the target, serving the target market: dare to trade-off! Stop producing certain products and certain distribution. Need to exploit the sub-optimisation of their competitors.

The Process of Developing Strategy

- Practical actions are the toughest part.

- Know what you are and be the best version of yourself.

Conclusion for Competitive Advantage

- Create a formal strategy;

- Use a multi-functional team;

- The organization must understand the strategy;

- Be consistent over time;

- You won’t get competitive advantage if you change strategies.

- Use proper measurement; find underlying measures;

- Don’t look at financials alone to measure;

- Test strategy continually.

- Strategic thinking is a scares resource; many companies follow and have a tendency to follow. No company ever masters this skill you can always learn more about themselves and their competitors.

![]() The above is a synopsis of Competitive Advantage by Michael Porter complete with analysis and criticism.

The above is a synopsis of Competitive Advantage by Michael Porter complete with analysis and criticism.