Chainsaw Al & the Sunbeam Case:

To unpack this story, first we need to look at the industry; Sunbeam is not particularly profitable in 1996 and they need a new CEO. Sunbeam is a seller of BBQs, dough mixers and other electronics appliances. They are selling discretionary items and counter-balance summer products with winter product lines. They are manufacturers and not retailers with a Buy/Make breakdown of 70/30. If they had inelastic demand, that would have near monopoly power. However, Sunbeam has elastic demand. They have a competitive market where prices are low. At it’s core Sunbeam is a Cost Leader with razor thin margins.

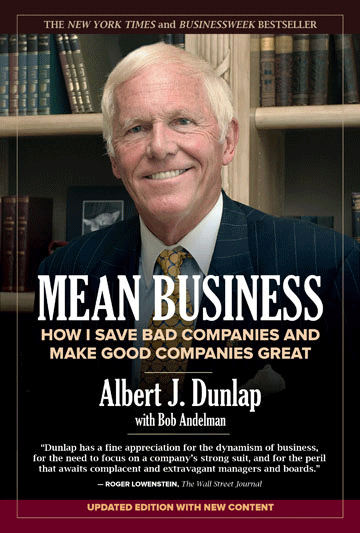

Enter “Chainsaw” Al Dunlap. A man who famously sold Scotts Paper to Kimberly Clark for $7 billion dollars. Dunlap built his career in the paper mill industry where cutting costs is relatively clear cut in the sense that those types of firms do not have the diversity of product lines that a Sunbeam has.

Incentives Alignment? Dunlap was brought on at Sunbeam to turn around that company’s profit performance. His salary was $1 million dollars. He also signed with extensive stock options which is typical of a new CEO. However, with Stock Options, you have a very serious concern around incentives. The CEO is incentivized to crave volatility since you can make more money if the stock price goes over the Option strike price. If the Option is for shares at $50, then you, as the CEO, will take risks to get it past that threshold so that you can cash out part of your options. And what’s the worst thing that could happen anyway? You miss your target then you get no funds because you wouldn’t action your Options in that scenario.

Challenges at Sunbeam

Challenges at Sunbeam

What were the changes that Al Dunlap implemented as the new CEO of Sunbeam? There are two ways to increase net income; either you increase your prices thereby driving revenue upwards or your decrease your operating expenditure thereby driving costs downwards.

So what were Chainsaw Al’s strategy?:

- Cut back on non-core businesses;

- Reduced the head count by half and engaged in divestitures of non-core businesses;

- Products and stores development;

- Centralized decision-making at head office;

- He fired the senior management at Sunbeam and replaced them with his own team from Scotts Paper;

- Aimed to increase international sales by 300%;

- Used confusion about the company direction to his advantage;

- Dunlap aimed to double revenue by 1999; Dunlap gave himself extremely myopic targets around profit margins.

- He also called to the end of any debt within the year.

- And he engaged in an effort to acquire other firms.

Chainsaw Al’s Narrative was Inconsistent and Paradoxical

- The timing is a bit odd for the strategy he applies.

- They wanted to innovate in 4 months in an industry that is Cost Leadership.

- They are divesting while also expanding product lines.

Efficiencies on the one hand: Sunbeam is looking to cut costs, cutting down on the debt in one year, you can find a cheaper way to manage labour.

Growth on the other hand: Sunbeam wants to grow the business but typically, growth phases are inefficient, the margins should be very low, once you can’t grow anymore you return to efficiencies.

Two Options in Any Company: Raise the Price, Cut Costs

- Interestingly innovation is an area where fraud can occur.

- They have the impetus to manage earnings;

- The board is eager;

- Centralizing authority gives them power

ROE: Ratios on Equity: turnover income. What’s the formula?

Return on Equity = Net Income/Shareholder’s Equity

- They want to diminish they debt as a firm.

- The more debt, the more ROE you have because debt is anti-equity!

Let’s look at the 1996 versus 1997 period:

| 1996 | Net Income ’96 | 1997 | Net Income ’97 |

| Cost of Goods Sold was 92% | SG&A is cut | ||

| Debit PP&E UP Credit Cash UP |

UP | ||

| Debit Inventory Impairment Write Down Credit Inventory UP (they sold the inventory anyway) |

Down | Debit Cash UP Credit Revenue UP |

UP |

| Debit PP&E Impairment Credit PP&E |

Down | Overproduction UP COGST Down |

UP (but 1998 will look really bad) |

| Debit A/R UP (Bill & Hold) Credit Revenue UP (Channel Stuffing) |

UP | ||

| Debit Warrantee Expense Credit Warrantee Revenue Down (too much expenses in 1996, I can take more expense) |

Down |

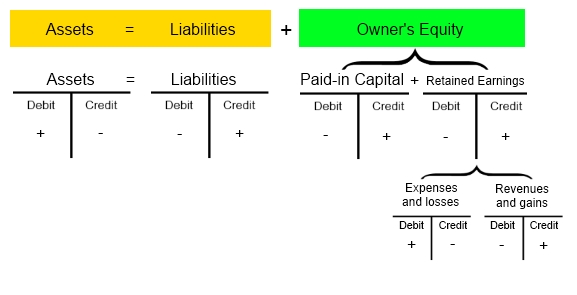

Assets – Liabilities = Equity

Assets UP – Liabilities Down = Equity UP

- Inventory (Impairments)

- Discretion when they do a write down.

Remember that profit = net income = net earnings

Accounting Adjustments

There are some commonly occurring distortions. In particular asset distortions, liability distortions and equity distortions. Beyond question is the fact that income statements effect the balance sheet and vice versa. So any distortion in overstating revenue will also appear in the balance sheet in overstating equity.

Recall that the Income Statement is basically:

+ Sale

- VC

- FC

= Profit

i.e. sales minus expenses = Net Income

While the balance sheet is effected by what is highlights in the box:

Current Assets Current Liabilities

Long Term Assets Long Term Liabilities

Shareholders’ Equity

Recall basic Accounting Principle | The Only Formula You Need

Assets – Liabilities = Equity

If Assets (increase) – Liabilities (decrease) = Equity (increase)

Sales Returns: the product might be returned before I recognize the revenue.

Bally’s Gym: there may be a collectability issues. So you have membership policies that you lock down in a contract and so you recognize revenue immediately. You then have liberal credit policy where customers who didn’t want to go the gym still paid for it because of the 12 month contracts. However, what started happening is that the level of default was much higher. All the Gym’s were following Bally’s lead. However, you can only recognize revenue when you get the cash now as a result.

The Valeant Case: potential channel stuffing in 2015; when you have an entity that you technically own called Philidor and you sell product to that entity for $100 millions at a cost of $0, then the right hand is selling to the left hand. This is not clear that performance is working up to code.

The Alibaba Case: Alibaba “Single Day” have massive sales on November 11th of each year. However, the SEC needed to investigate them because they were recognizing revenue on November 11th as a barometer for Alibaba growth however, they were not also mentioning the rate of returns for these singles day items. They are overstated revenues because of the inadequate reserving for bad debts.

Conversely – understated because of cookie jar reserves (new CEO effect). The same effect occurs at Amazon’s Prime Day.

Asset Distortions

Receivables (channel stuffing and under-reserving)

Why might receivables be distorted: Firms using liberal interpretation of revenue recognition rules related to performance, measurement and collectability. It’s because of:

(1) overstated underlying revenue via techniques such as channel stuffing.

2) they may be overstated because a firm may be taking inadequate reserves from bad debts.

Conversely, receivables might be effected if the firm is engaged in “cookie jarring” by deferring revenue that was earned or taking on more expenses through excessive reserved for bad debts.

Receivables matter for firms where the business is providing credit to customers as an important aspect of doing business.

Where are Receivables crucial:

- Any business where credit to customers is crucial;

Telltale Signs

- Worsening receivables turnover from customers.

- Others competitors are increasing reserves/customers doing badly

Case 1: Channel Stuffing at Diageo

Case 1: Channel Stuffing at Diageo

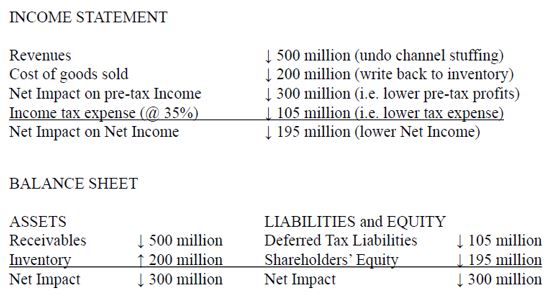

Diageo: accused of channel stuffing. This liquor manufacturer is pre-booking revenue based on accelerated shipments to distributors, thereby overstating revenues, receivables and profits. So you need to undo the distortion: the adjustments we will make in the statement are as follows: You can pay lower taxes after adjusting.

So the impact on the balance sheet is considerable. With receive-able going down by $0.5 billion. So there is a $105 million income tax expense The adjustments lower the deferred tax liability; the implicit assumption is that no effect on the income tax reporting. If income tax is affted the impact will be income tax payable instead of deferred income taxes.

***The market anchors on earnings*** at the expense of long-term growth.

The market is overly focused on earnings.

Balance Sheet:

The inventory didn’t change that much with Sunbeam.

Case 2: Lucent Under-Reserving Adjustment

Case 2: Lucent Under-Reserving Adjustment

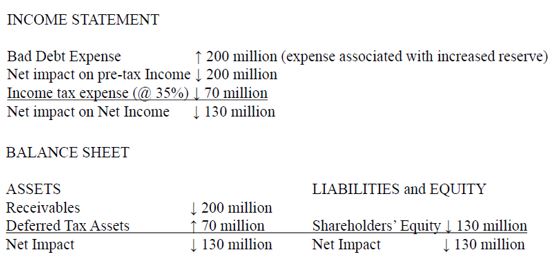

Lucent was effected by the dot-com bubble burst. Most customers were in the high tech space and went bankrupt. Lucent as a result increased their reserves only marginally. So if you assume that you would take an addition $200 million adjustment what will make? Deferred Tax Assets $70 million UP

This is an estimate; I want to minimize my bad debt as an estimate, so it’s a future benefit. There is an increase in deferred tax liabilities, we will have an increase in deferred tax assets.

Making adjustments for understated receivables: the adjustments. An analyst might undo this by increase net income, writing up the net receivables, reducing deferred tax asset

Accounting Adjustments

Inventory

Inventory ->

Why might inventory be distorted?

- Overstated because of impairment charges not taken

- Conversely – understated because of excessive impairment (new CEO effect)

- Overstated because of deliberate overproduction which results in allocated fixed costs being capitalized as a part of inventory.

Where crucial:

Any business where inventory levels are high and obsolescence/style is crucial (manufacturing, retail, electronics)

Telltale Signs

- Worsening inventory turnover

- Others taking impairments/slowdown in demand

Case 3: Making Adjustments for Overstated Inventory:

In the fourth quarter of 2014, Blackberry states it was going to take a pre-tax impairment charge of $1.6 billion dollars> due to the failed launch of the Z series handsets. If the tax rate is 20% how would you adjust the income statements and balance sheets? Inventory Turnover is Low in February. Blackberry takes a huge impairment: Reduce Inventory $1600 Down for the Z series handsets.

You will save on taxes, you don’t get the tax benefit if you XXXXX

Not a distortion per se – as they actually take the charge (often firms delay this)

So you have this pre-tax expense “20% with a Deferred Tax Assets of $320 Million.

An example where there might be a problem; Lehman Brother had a huge exposure and was not making any write offs that was a sign of problems there.

Accounting Adjustments

Fixed Assets (on Balance Sheet)

There are two main reasons that a firm’s balance sheet is distorted.

- Ongoing (differences or changes in depreciation): The first is continuous or ongoing and happens because a firm’s depreciation policy might be systematically different from the industry.

- Episodic (impairment charge delayed/not taken): Is that more episodic and happens because a firm does not impair or write down fixed assets.

Where crucial:

Fixed asset intensive business (manufacturing, mining, fast food, airlines).

Telltale Signs

- Worsening fixed asset turnover

- Others taking asset write-downs: if a peer firm is taking an asset write-down, an analyst should ascertain if this firm should also have an asset write down.

- Return on Assets: ROA consistently lower than cost of capital it may be a sign of impaired assets (asset not generating adequate returns).