American Express Case: the story of American Express Canada

Key Takeaways: Ivey MBA, Howard Grosfield CEO of Amex Canada Article

- Total Service Experience: replace cards easily over night in the event of a lost card.

Recognize me: be valuable; engaged employees = engaged customers. Empower me: to pay the balance in full! Enable me: leverage technology integrate service provisions.

- Luxury AMEX Card: differentiated from the Diner’s Club Card (Visa). AMEX has high fees, the rolling debt balance is very bad.

- Amex is more expensive for merchants however Amex has better customers: wealthier customers. The merchant network is weaker (charge them a higher fee) but the customers are better.

- Centurion Services: centurion members have access to professional assistance every minute of the day. It’s the Concierge: dedicated team of highly skilled professionals. Centurion webs: privileges platform.

- Product Expansion

- Branding / Positioning

- Strategic Diversification

- Distribution / Co – Branding

- Product Innovation

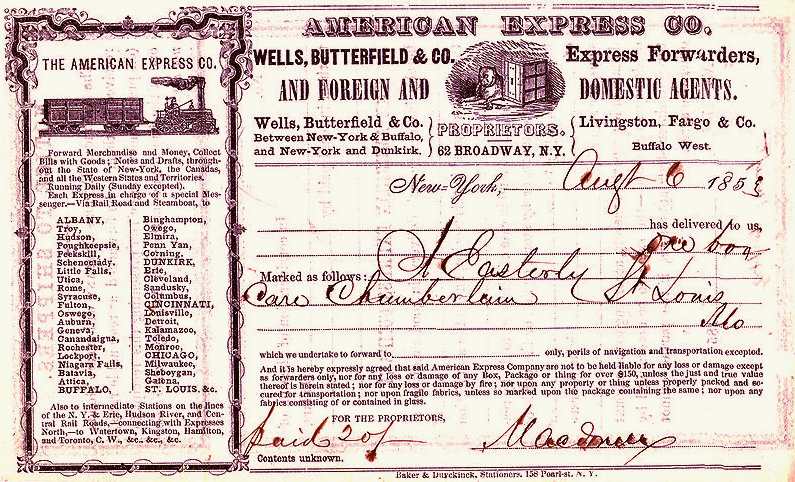

1850 – Founded as express courier service

1891 – Launched travellers cheques

Early 1900’s – opened offices in Europe

1957 to 1978- green, gold, platinum card

1987 – launched Optima Card

1991 – Boston Fee Party

1999 – Exclusive arrangement with Costco

1999 – Launch of Centurion “Black Card”

Travellers Cheques Advertisements

1981 – acquired Shearson Rhodes

1984 – acquired Lehman Brothers Kuhn Loeb

1984 – acquired IDS

1988 – acquired EF Hutton

1991 – wrote off $300 million on Optima credit card launch

1992 – spun off First Data

1993 – spun off retail brokerage arm

1994 – spun off Lehman Brothers

2005 – spun off Ameriprise

Push to capitalize on brand / expand co branded cards beyond Costco – Starwood, Jet Blue, Delta

2008: GFC affected all credit card issuers, forced to tighten up credit – less impact on AMEX

2010: Paid $300 M for internet payments processor for consumers without bank accounts (Revolution Money became Serve)

2012: Launched BlueBird with Walmart – prepaid credit card as option as lower option to chequing accounts and debit cards

Cost pressures: Airline mergers forced Amex to open airport Amex lounges versus giving cardholder access to airline lounges

Attack on high end customers from Barclays and JP Morgan Chase – Chase now leads card penetration among $125K plus households

2015: Costco switched credit cards to VISA, 10% of Amex’s 112 million cards were Costco

Question about value of Amex brand – 23% of $1 trillion in spending from co branded cards

– “Partner” vs “Vendor”

- 19 card options

- Card Type: Personal vs Small Business

- Card Benefits: Rewards, Concierge, Cash Back

- Loyalty Programs: AeroplanPlus, Air Miles, SPG, Membership Rewards

- Card Attractions: No Fee, First Year Waived, Welcome Bonus

- Blue Sky Credit Cards

- Response Time When Apply?

Card options

Drop in new customers in 2014 from 150K to 80K – half via referrals, others via traditional methods

Tested pop-up in a shipping container in shopping mall parking lots / in malls (take up eight parking spots) – local area marketing to drive traffic

Signed up more customers in two months than best Scotia branch in a year

Key is credibility of Scotia and single minded focus on customer acquisition – salespeople only in the pop up branch, videoconference customer to an advisor if needed

Now have nine pop up branches that shift location every 60 to 90 days

Now back to 150K; if 8K per popup = 160 weekly / 25 daily