1962 – Synopsis | Travel the World to Get Insights & Chase Dreams

Phil Knight, aged 24, traveled across the world to chase his Stanford MBA dream of creating a shoe importing business. Now a days, air travel is accepted as part of pop culture, with bucket lists, gap years and travel vlogging becoming the norm. But back in the 1960s, ninety per cent of Americans had never boarded a plane. Most Americans had not travelled more than 100 miles from their home.

Phil Knight, aged 24, traveled across the world to chase his Stanford MBA dream of creating a shoe importing business. Now a days, air travel is accepted as part of pop culture, with bucket lists, gap years and travel vlogging becoming the norm. But back in the 1960s, ninety per cent of Americans had never boarded a plane. Most Americans had not travelled more than 100 miles from their home.

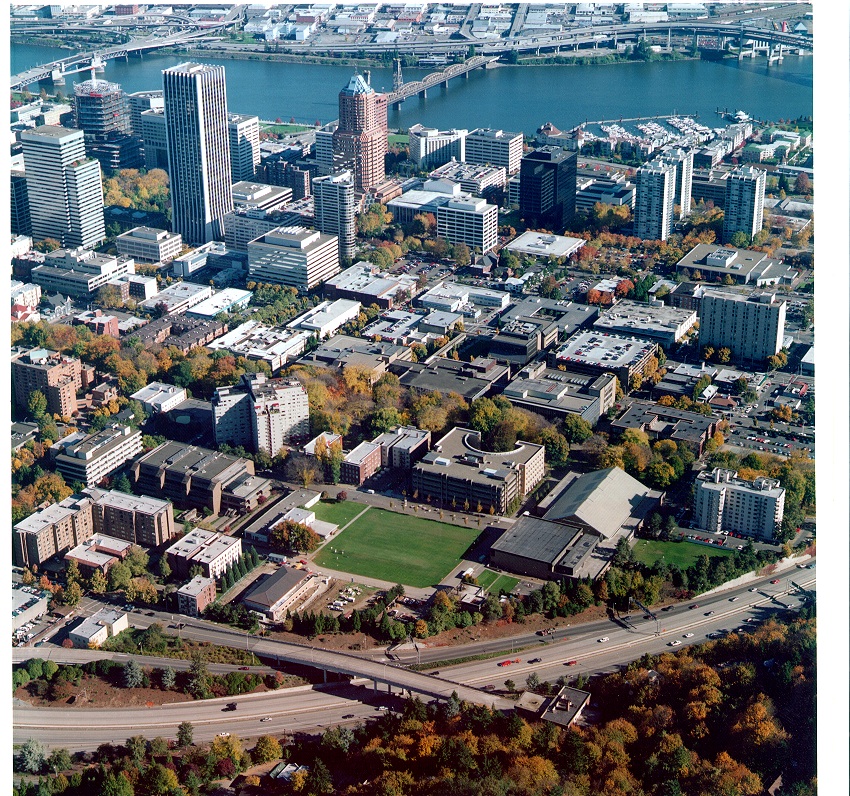

Phil or Bucky, as his dad used to call him, felt hesitant to ask his father for money to support a plan to travel the world from Hawaii, Berlin, London, Paris to Tokyo, Cairo, Athens while also exploring his business venture idea in Japan. Phil knew before going into the chat exactly why his father would reject the travel plan. Phil Knight’s dad ran a local Portland-based publisher and was a former lawyer with a poverty stricken upbringing. He was someone whose aim in life was to achieve respectability, and more importantly, to be seen as respectable by the society around him. Respectability demands a stable career, a beautiful wife and obedient children – children who don’t randomly have the urge to travel around the world. However, Phil’s request plays on his father’s youthful regret of not travelling much, and he gets his way immediately.

Knight decides to enlist a friend for the journey, his Stanford buddy Carter was excitedly on board with the global adventure. They had an amazing ‘beach-drenched’ time in Honolulu, where the itinerary goes out of whack because they fall in love with the place so much that they decide to rent a place and find jobs. From selling encyclopedias to securities, Phil finds he is uncomfortable being a salesman, and even more uncomfortable with rejection. Eventually, he moves on in his travels alone, as Carter chooses to stay behind for a girl he found. The journey Knight is on is one of self-discovery, to find out what interests him – and perhaps denotes something we all can relate to at one point of time or the other.

Knight decides to enlist a friend for the journey, his Stanford buddy Carter was excitedly on board with the global adventure. They had an amazing ‘beach-drenched’ time in Honolulu, where the itinerary goes out of whack because they fall in love with the place so much that they decide to rent a place and find jobs. From selling encyclopedias to securities, Phil finds he is uncomfortable being a salesman, and even more uncomfortable with rejection. Eventually, he moves on in his travels alone, as Carter chooses to stay behind for a girl he found. The journey Knight is on is one of self-discovery, to find out what interests him – and perhaps denotes something we all can relate to at one point of time or the other.

He describes his travels through various countries, elaborating on the ones he enjoyed the most while the rest are clipped to a couple of sentences. Knight searches for spiritualism everywhere he goes – as if he is seeking out a power higher than himself to give him directions. He does find the teachings of various cultures, but nothing moves him as he expected it to. Greece and its architecture, however, leaves a lasting mark on him. Athena the goddess of victory “Nike” is of particular interest. It might be historical revisionism but that name might come up later…..

He describes his travels through various countries, elaborating on the ones he enjoyed the most while the rest are clipped to a couple of sentences. Knight searches for spiritualism everywhere he goes – as if he is seeking out a power higher than himself to give him directions. He does find the teachings of various cultures, but nothing moves him as he expected it to. Greece and its architecture, however, leaves a lasting mark on him. Athena the goddess of victory “Nike” is of particular interest. It might be historical revisionism but that name might come up later…..

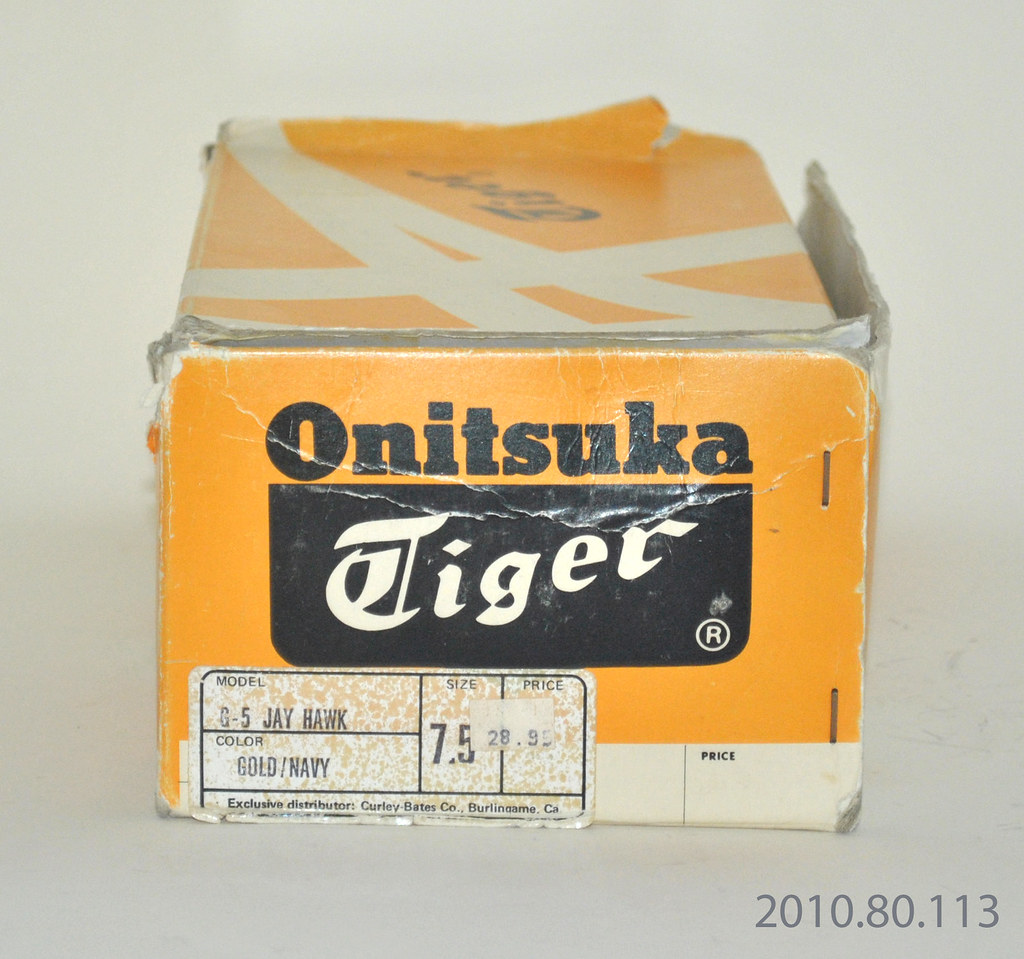

Phil Knight creates his first business pitch in Kobe. Japan at the HQ of Tiger Shoes, Onitsuka Co. He was warned by two American ex-occupation military guys about how Japanese negotiating is completely different than the typical aggressive American manner. So Phil practices what he will say and how he will deal with his proposed pitch of the “Crazy Shoe Idea.” In the meeting, which featured top Tiger Shoe brass, Knight ends up speaking from a safe space – channeling the speech he gave at his entrepreneurship presentation at Stanford, something he had studied really hard for (‘58-’62) and which had been then the basis of his “Crazy Shoe Idea.” The basic pitch can be captured in the title of his small business class paper: “Can Japanese Sports Shoes Do to German Sports Shoes What Japanese Cameras Did to German Cameras?”

Phil Knight creates his first business pitch in Kobe. Japan at the HQ of Tiger Shoes, Onitsuka Co. He was warned by two American ex-occupation military guys about how Japanese negotiating is completely different than the typical aggressive American manner. So Phil practices what he will say and how he will deal with his proposed pitch of the “Crazy Shoe Idea.” In the meeting, which featured top Tiger Shoe brass, Knight ends up speaking from a safe space – channeling the speech he gave at his entrepreneurship presentation at Stanford, something he had studied really hard for (‘58-’62) and which had been then the basis of his “Crazy Shoe Idea.” The basic pitch can be captured in the title of his small business class paper: “Can Japanese Sports Shoes Do to German Sports Shoes What Japanese Cameras Did to German Cameras?”

Knight was pleased with how the meeting went. The Onitsuka team seemed intrigued with his US distribution strategy which was peppered with quantitative insights, market sizing and a vision for getting Tiger ensconced into the US mainstream. When they asked what the name of his company was, Knight replied with “Blue Ribbon”. His pitch also hit a nerve as the Japanese management were seeing Yen ($) signs via the US track. Without knowing the outcome of the meeting (as Japanese are stereotypically hard to read), Phil had his father wire fifty bucks to Onitsuka so that they could send over shoe samples they talked about in the meeting.

Knight was pleased with how the meeting went. The Onitsuka team seemed intrigued with his US distribution strategy which was peppered with quantitative insights, market sizing and a vision for getting Tiger ensconced into the US mainstream. When they asked what the name of his company was, Knight replied with “Blue Ribbon”. His pitch also hit a nerve as the Japanese management were seeing Yen ($) signs via the US track. Without knowing the outcome of the meeting (as Japanese are stereotypically hard to read), Phil had his father wire fifty bucks to Onitsuka so that they could send over shoe samples they talked about in the meeting.

When Phil arrives home, looking bohemian and travel worn, the first thing he asks his dad is if the shoes have arrived. This part of the ShoeDog story is interesting not just because there is a very beautiful description of every country he visited, but because the reader can see the author’s passion for shoes developing in successive stages – from nothing in Honolulu to noticing the shoes of even beggars and statues. Great minds connect desperate events to create innovation; Knight was already on his way to greatness.

When Phil arrives home, looking bohemian and travel worn, the first thing he asks his dad is if the shoes have arrived. This part of the ShoeDog story is interesting not just because there is a very beautiful description of every country he visited, but because the reader can see the author’s passion for shoes developing in successive stages – from nothing in Honolulu to noticing the shoes of even beggars and statues. Great minds connect desperate events to create innovation; Knight was already on his way to greatness.

![]() The above synopsis is based on notes from ShoeDog by Phil Knight.

The above synopsis is based on notes from ShoeDog by Phil Knight.![]()

1963 – Synopsis | Accounting is a very useful skill

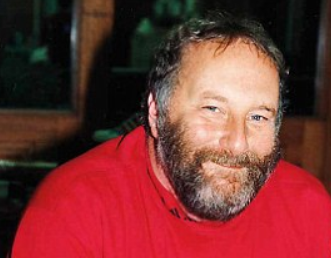

Phil Knight’s family dynamic has changed upon his return; he finds that something has changed in him – it is not just his scruffy beard and castaway attire that causes his mother to thoughtfully call him ‘worldly’; there is a fundamental change in his spirit. Buddhism had captured him; be one with the path.

Phil Knight’s family dynamic has changed upon his return; he finds that something has changed in him – it is not just his scruffy beard and castaway attire that causes his mother to thoughtfully call him ‘worldly’; there is a fundamental change in his spirit. Buddhism had captured him; be one with the path.

Having been betrayed by someone he thought was a business associate and having lost fifty dollars borrowed from his father for the purpose of getting a specific pair of shoes shipped, he comes to the realization that he is actually drifting in life without a sense of purpose. He brings this up with his father, who encourages him to talk to a friend of his, Mr. Frisbee.

Having been betrayed by someone he thought was a business associate and having lost fifty dollars borrowed from his father for the purpose of getting a specific pair of shoes shipped, he comes to the realization that he is actually drifting in life without a sense of purpose. He brings this up with his father, who encourages him to talk to a friend of his, Mr. Frisbee.

Mr. Frisbee had officially ‘made it’ in life – he was an alumnus of Harvard Business School and had quickly risen to become the CEO of a New York State Exchange Company. This makes quite an impression on Phil. In a meeting with Frisbee, Knight hears a useful philosophy of working, saying that everyone typically changes three jobs before they hit upon the right one. Now, if you are not adequately educated, your career and earning scale might go down as you progress from job to job instead of going up. Therefore to secure a solid financial return, it is necessary to do two things – get a CPA to strengthen the MBA Phil already had.

Now, if you are not adequately educated, your career and earning scale might go down as you progress from job to job instead of going up. Therefore to secure a solid financial return, it is necessary to do two things – get a CPA to strengthen the MBA Phil already had.

This though poses a problem for Phil because he hadn’t studied accounting as a major and didn’t have the necessary hours to qualify. He therefore enrolled at Portland State for three accounting classes. Portland State is a far cry from something like Harvard (something that both Phil and his father realize), but Knight finishes his nine hours and starts working at the accounting firm Lybrand, Ross Bros. and Montgomery. It is one of the Big Eight National firms, but the offices in Portland are quite small. Knight takes this positively, reflecting that this would give him a chance to learn the language of business.

This though poses a problem for Phil because he hadn’t studied accounting as a major and didn’t have the necessary hours to qualify. He therefore enrolled at Portland State for three accounting classes. Portland State is a far cry from something like Harvard (something that both Phil and his father realize), but Knight finishes his nine hours and starts working at the accounting firm Lybrand, Ross Bros. and Montgomery. It is one of the Big Eight National firms, but the offices in Portland are quite small. Knight takes this positively, reflecting that this would give him a chance to learn the language of business.

Phil quickly discovers the downside of a small branch at L.R.Bros & M. There is no one to take up the slack when the workload increases, which means that everyone is logging in long hours, not leaving much opportunity for the learning process. However Knight admires the CEO, Al Reser, who happens to be a mere three years older than Phil.

The best example of how important work is at this firm is reflected when Phil is refused a holiday on the day after President Kennedy’s assassination. Of course, the upside to all this is that Phil is earning well. So he buys a car for himself. His life has finally taken a definite direction, and he seems set in his profession too. However, the chapter closes with him often wondering if his travels around the world in ’62 were the peak of his life, and there is nothing better to look forward to…..

The best example of how important work is at this firm is reflected when Phil is refused a holiday on the day after President Kennedy’s assassination. Of course, the upside to all this is that Phil is earning well. So he buys a car for himself. His life has finally taken a definite direction, and he seems set in his profession too. However, the chapter closes with him often wondering if his travels around the world in ’62 were the peak of his life, and there is nothing better to look forward to…..

![]() The above synopsis is based on notes from ShoeDog by Phil Knight – Founder of NIKE INC.

The above synopsis is based on notes from ShoeDog by Phil Knight – Founder of NIKE INC.![]()

1964 – Synopsis | Finding Bill Bowerman & the Importance of Rejection

Growing up equipped Knight to deal with rejection, both in professional and personal life, something that was severely lacking in him before. His mother (Lota Hatfield Knight) is an interesting character, who may, as per first impressions, seem meek, but had many layers to her. She was a confident woman who did not hesitate to support her son in front of anyone, whether it was her husband or the outside world. She did not speak much, but proved herself through her actions.

Growing up equipped Knight to deal with rejection, both in professional and personal life, something that was severely lacking in him before. His mother (Lota Hatfield Knight) is an interesting character, who may, as per first impressions, seem meek, but had many layers to her. She was a confident woman who did not hesitate to support her son in front of anyone, whether it was her husband or the outside world. She did not speak much, but proved herself through her actions.

Another important figure in Phil’s life is Bill Bowerman. He was a taskmaster during Phil’s University of Oregon stint. Bowerman was frugal with praise and known for churning out successful athletes. Phil yearned for his approval, but knew that it was not something that he’d get much of. Having finally received his shipment of shoes from Japan, Phil Knight sent over two of the pairs to Bowerman, expecting him to praise the shoes. Bowerman asked to meet Phil over a deal to buy more shoes and it goes even better than expected – Bowerman wants to be a partner in this business. He calls Phil over to meet his lawyer, which causes him some trepidation, but the discussion is brief and settles any fears Phil had.

Another important figure in Phil’s life is Bill Bowerman. He was a taskmaster during Phil’s University of Oregon stint. Bowerman was frugal with praise and known for churning out successful athletes. Phil yearned for his approval, but knew that it was not something that he’d get much of. Having finally received his shipment of shoes from Japan, Phil Knight sent over two of the pairs to Bowerman, expecting him to praise the shoes. Bowerman asked to meet Phil over a deal to buy more shoes and it goes even better than expected – Bowerman wants to be a partner in this business. He calls Phil over to meet his lawyer, which causes him some trepidation, but the discussion is brief and settles any fears Phil had.

The Tiger shoe import business booms, and Phil feels immensely content and happy with his success. However a wrinkle pops up when a competing US distributor on the East Coast sends a letter to Blue Ribbon demanding they stop selling Tiger shoes. Unable to take rejection, Knights falls back into old habits, but eventually decides to fight back and makes a visit to Japan. Phil’s character essentially changes – instead of allowing rejection to simply make him miserable, he lets it propel him into success. He flies to Japan and successfully gets rights to sell the shoes for another area in his thirteen states.

The Tiger shoe import business booms, and Phil feels immensely content and happy with his success. However a wrinkle pops up when a competing US distributor on the East Coast sends a letter to Blue Ribbon demanding they stop selling Tiger shoes. Unable to take rejection, Knights falls back into old habits, but eventually decides to fight back and makes a visit to Japan. Phil’s character essentially changes – instead of allowing rejection to simply make him miserable, he lets it propel him into success. He flies to Japan and successfully gets rights to sell the shoes for another area in his thirteen states.

In 1964, Knight also falls in love after meeting a girl while climbing Mount Fuji. It is a whirlwind romance, and they part without any plans of meeting up. One day, however, Sarah lands up at his doorstep and it is here that the love affair actually begins. The family is charmed by Sarah, and the author falls head over heels for her. Eventually, Sarah cools off and this causes heartache to the author, but brings up a very essential relationship to the forefront – Phil’s relationship with his sister Jeanne which till now has not been talked about. She supports him and speaks the first words of comfort that actually reach him, and goes on to become the first employee of his company since she had read all of Phil and Sarah loveletters to eachother, she would manage the mail room at Blue Ribbon.

In 1964, Knight also falls in love after meeting a girl while climbing Mount Fuji. It is a whirlwind romance, and they part without any plans of meeting up. One day, however, Sarah lands up at his doorstep and it is here that the love affair actually begins. The family is charmed by Sarah, and the author falls head over heels for her. Eventually, Sarah cools off and this causes heartache to the author, but brings up a very essential relationship to the forefront – Phil’s relationship with his sister Jeanne which till now has not been talked about. She supports him and speaks the first words of comfort that actually reach him, and goes on to become the first employee of his company since she had read all of Phil and Sarah loveletters to eachother, she would manage the mail room at Blue Ribbon.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

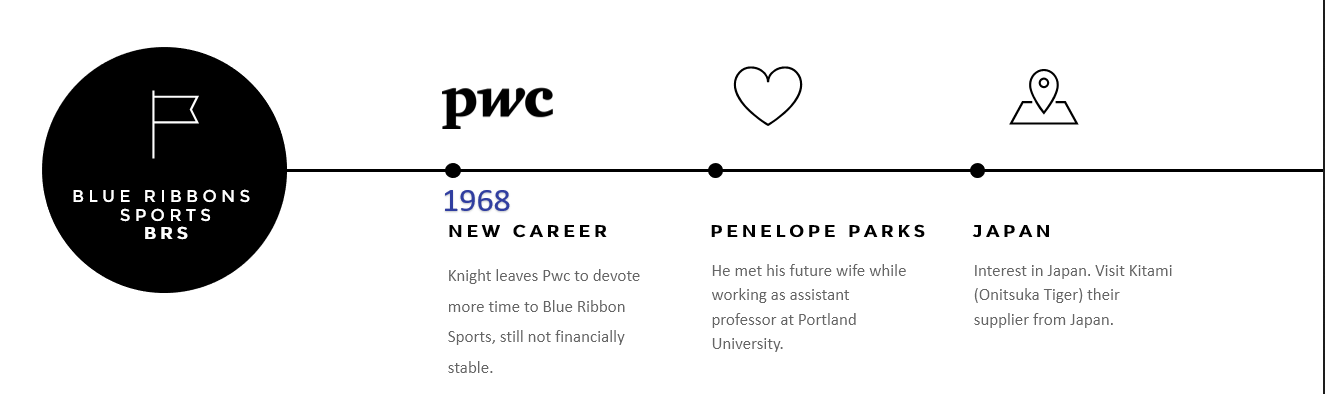

1965 – Synopsis | Banks are Risk Averse & The PwC Experience

All along, Phil Knight believed that growth was possible for Blue Ribbon, his company importing Tiger shoes from Japan. His bank, however, had a different idea. A conservative banking institution, they did not believe in risk and were only concerned with maintaining equity in case of failure. This is key commentary on the difficulties faced by entrepreneurs back in the day. Entrepreneurs have various funding options, but back then even inter-state financing from banks wasn’t possible. Venture capitalists were a far cry, and investment in startups wasn’t an established subculture. There wasn’t much encouragement given to a new idea.

All along, Phil Knight believed that growth was possible for Blue Ribbon, his company importing Tiger shoes from Japan. His bank, however, had a different idea. A conservative banking institution, they did not believe in risk and were only concerned with maintaining equity in case of failure. This is key commentary on the difficulties faced by entrepreneurs back in the day. Entrepreneurs have various funding options, but back then even inter-state financing from banks wasn’t possible. Venture capitalists were a far cry, and investment in startups wasn’t an established subculture. There wasn’t much encouragement given to a new idea.

Phil Knight renews acquaintances with an old classmate he had met on the tracks one day, Jeff Johnson. Johnson reveres the sport of running like no other, and looks upon it as something almost divine. Although enthusiastic and energetic, Johnson is perhaps too much so. Beginning with working part time for Knight, Johnson ends up becoming the first full time employee of the company through sheer doggedness, quitting his day job for it. Johnson is relentless in his communication – Phil starts getting overwhelmed with Johnson writing two to three letters everyday.

Phil Knight renews acquaintances with an old classmate he had met on the tracks one day, Jeff Johnson. Johnson reveres the sport of running like no other, and looks upon it as something almost divine. Although enthusiastic and energetic, Johnson is perhaps too much so. Beginning with working part time for Knight, Johnson ends up becoming the first full time employee of the company through sheer doggedness, quitting his day job for it. Johnson is relentless in his communication – Phil starts getting overwhelmed with Johnson writing two to three letters everyday.

With the bank continuously bearing down on him for maintaining equity and having to wheedle for a loan everytime he needs to order a shipment, Knight applies for the position of an accountant and gets recruited by Price Waterhouse. This becomes a stepping stone for him as he meets the next big influence in his life – Delbert J. Heyes, the leader of his team. Heyes makes Phil look at numbers in a way that makes him feel like an artist. Moreover, this job allows Knight to intricately study how and why different kinds of companies go under, and how the ones that survive flourish. Cash is king in all cases; accounting and cash. Phil starts taking notes for the purpose of his own company.

With the bank continuously bearing down on him for maintaining equity and having to wheedle for a loan everytime he needs to order a shipment, Knight applies for the position of an accountant and gets recruited by Price Waterhouse. This becomes a stepping stone for him as he meets the next big influence in his life – Delbert J. Heyes, the leader of his team. Heyes makes Phil look at numbers in a way that makes him feel like an artist. Moreover, this job allows Knight to intricately study how and why different kinds of companies go under, and how the ones that survive flourish. Cash is king in all cases; accounting and cash. Phil starts taking notes for the purpose of his own company.

Phil also begins drinking a lot, courtesy the company of Mr. Hayes and the Reserves. With a full day ahead of him, he begins to handle his job, the Reserves training as well as his company all at once. With so much alcohol in his system, it becomes difficult to handle but Knight rallies on. Bowerman, on the other hand, rises up to help the company while Knight is so engaged. Having received a grand reception in Japan upon visiting the shoe factory offices, Bowerman gets excited about new possibilities and works on endless new shoe modifications for adapting Tiger’s Japanese products specifically for the American feet. Knight also picks up life lessons from Bowerman in ’65 about making the most of twenty four hours in a day. Apart from shoe design and his coaching, at a time Bowerman had multiple projects going on; for instance, trying to make the perfect energy drink for track racers. Bowerman was effectively inventing Gatorade. On top of that, Bowerman managed a family life as well as reveals that he is writing a book.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1966 – Synopsis | Bluff When You Have to & Failure is Okay

Phil Knight was anxious about the ending of the one-year contract with Tiger and waiting for an alert to either renew the contract or end it. By the end of 1966, Phil had sealed a three-year contract over the head of a better placed, richer East coast operation. The journey between how this is made possible is a lesson not only for entrepreneurship, but in life itself.

Phil Knight was anxious about the ending of the one-year contract with Tiger and waiting for an alert to either renew the contract or end it. By the end of 1966, Phil had sealed a three-year contract over the head of a better placed, richer East coast operation. The journey between how this is made possible is a lesson not only for entrepreneurship, but in life itself.

1966 was the point in time when Knight actually starts realizing the importance of Johnson. Divorced, broke and car hurting from an accident, Johnson managed to reach levels of sales that Knight himself believed to be impossible. Having made a deal with Johnson that after reaching a certain number of sales Knight would allow him to open up the first retail store, Johnson is ecstatic and puts in all efforts to make it the place for runners to be.

1966 was the point in time when Knight actually starts realizing the importance of Johnson. Divorced, broke and car hurting from an accident, Johnson managed to reach levels of sales that Knight himself believed to be impossible. Having made a deal with Johnson that after reaching a certain number of sales Knight would allow him to open up the first retail store, Johnson is ecstatic and puts in all efforts to make it the place for runners to be.

1966 was an important landmark not just in Phil’s journey but perhaps also the history of running. Running for fun or just to keep fit wasn’t common back then, and runners were often made fun of. In the middle of all this, Johnson opens up a place that looked great, but also has essential books on running, some from Johnson’s own personal library and souvenirs for the more dedicated customers. It becomes a place for runners to find solace, to find more of their own.

1966 was an important landmark not just in Phil’s journey but perhaps also the history of running. Running for fun or just to keep fit wasn’t common back then, and runners were often made fun of. In the middle of all this, Johnson opens up a place that looked great, but also has essential books on running, some from Johnson’s own personal library and souvenirs for the more dedicated customers. It becomes a place for runners to find solace, to find more of their own.

Although Knight does not like to offer encouragement or reply to Johnson’s letters too often, preferring to leave him to his own devices, he is faced with no choice when he learns that a major competitor is angling for exclusive rights for selling Tiger shoes in America. Plotting overnight with Jackson at his apartment, Knight visits Japan to find that everything has changed – from the man in charge to the conference room furniture.

Although Knight does not like to offer encouragement or reply to Johnson’s letters too often, preferring to leave him to his own devices, he is faced with no choice when he learns that a major competitor is angling for exclusive rights for selling Tiger shoes in America. Plotting overnight with Jackson at his apartment, Knight visits Japan to find that everything has changed – from the man in charge to the conference room furniture.

The difference between the last time and this time is evident to Phil – there is more confidence, more poise and much more ease in handling the negotiations. He successfully bluffs his way into making sure he is awarded the contract, but Knight does this by lying that he had an East Coast office where Tiger could ship their shoes. Phil faces the problem of actually having to erect an East Coast office and paying for a large shipment by biding his time.

Though always a risk taker, Phil is firmly in the territory of risks. There is no going back from this point. Aware of the possibility of failure, Knight has grown way past his days of fear of rejection and only hopes that if he has to fail, he fails at the earliest point so that he may use his lessons from this failed venture in the next. The change from a sheltered, rejection averse boy to a man who can find positivity in the face of complete failure is stunning. Phil does not fear failure anymore, but welcomes it with open arms, and this attitude ends up winning him a great deal against a competitor who won’t even be aware what hit them.

Though always a risk taker, Phil is firmly in the territory of risks. There is no going back from this point. Aware of the possibility of failure, Knight has grown way past his days of fear of rejection and only hopes that if he has to fail, he fails at the earliest point so that he may use his lessons from this failed venture in the next. The change from a sheltered, rejection averse boy to a man who can find positivity in the face of complete failure is stunning. Phil does not fear failure anymore, but welcomes it with open arms, and this attitude ends up winning him a great deal against a competitor who won’t even be aware what hit them.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1967 – Synopsis | Appreciate Dedicated Staff

Returning back from Japan with a 3 year contract of Onitsuka, Knight procrastinated in his communicating to Johnson that Blue Ribbon needed an East Coast store because Phil wanted someone else to do that job. Sometimes procrastination is difficult to avoid, Phil kept procrastinating giving Johnson the news that Johnson had to move to the East Coast. So much so that Knight hired a new store manager in Santa Monica to replace Johnson without telling him. When Johnson phoned Knight, however, Johnson accepted because of his lack of confidence. The next day however, he asked for a stake in the company or a profit participation and a raise. Via letter; Johnson threatened to quit with a two part ultimatum, one was to make Johnson a full partner in Blue Ribbon and two was to raise his salary to $600 per month + 1/3rd of all profits beyond the first 6000 pairs of shoes sold or he walks.

Just when Knight has begun to appreciate Johnson’s loyalty as a team player, he is forced into a meeting with his salesman father Owen’s office who was bent on getting his son a stake in the company. The negotiations end with a fifty dollar raise for Johnson. Despite all this, this is where Knight has begun to appreciate Johnson truly, having recognized the fact that it is near impossible to find someone ready to uproot their life and open up a new office in a new location in such a short time.

Just when Knight has begun to appreciate Johnson’s loyalty as a team player, he is forced into a meeting with his salesman father Owen’s office who was bent on getting his son a stake in the company. The negotiations end with a fifty dollar raise for Johnson. Despite all this, this is where Knight has begun to appreciate Johnson truly, having recognized the fact that it is near impossible to find someone ready to uproot their life and open up a new office in a new location in such a short time.

This is also the turning point where Blue Ribbon actually begins to expand into a company. Hires are made one after the other on the recommendations of Bowerman, new offices are moved into both by Knight and Johnson. It is plain that the failure that Knight had always seen forthcoming and prayed for to come early is held at bay for now. The growth of the company seems positive and inevitable. Woodel is a special hire out of Oregon, whom Knight hired under the recommendation of Bowerman. Woodel was a track athlete but was wheelchair bound after he was injured when a float fell on top of him while moving it with a team of 20 guys.

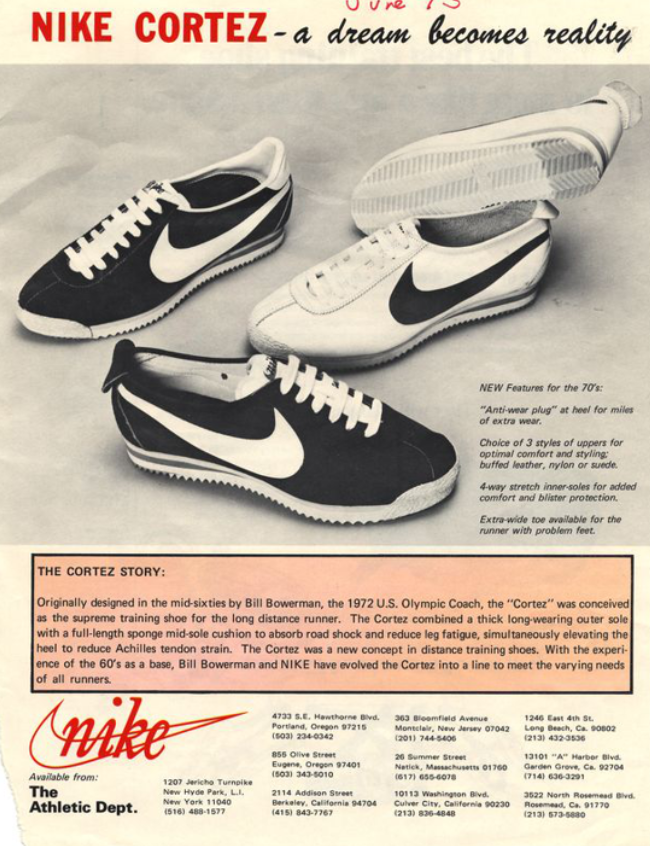

There is a legal face-off with Adidas over the name of a new shoe, which only serves to highlight that Blue Ribbon is now beginning to affect the big leagues. Although it is early days, the competitive mindset of Blue Ribbon is evident when they name their new shoe Cortez after Adidas made them back off the name Aztec because Adidas was going to use it (Cortez defeated the Aztecs).

There is a legal face-off with Adidas over the name of a new shoe, which only serves to highlight that Blue Ribbon is now beginning to affect the big leagues. Although it is early days, the competitive mindset of Blue Ribbon is evident when they name their new shoe Cortez after Adidas made them back off the name Aztec because Adidas was going to use it (Cortez defeated the Aztecs).

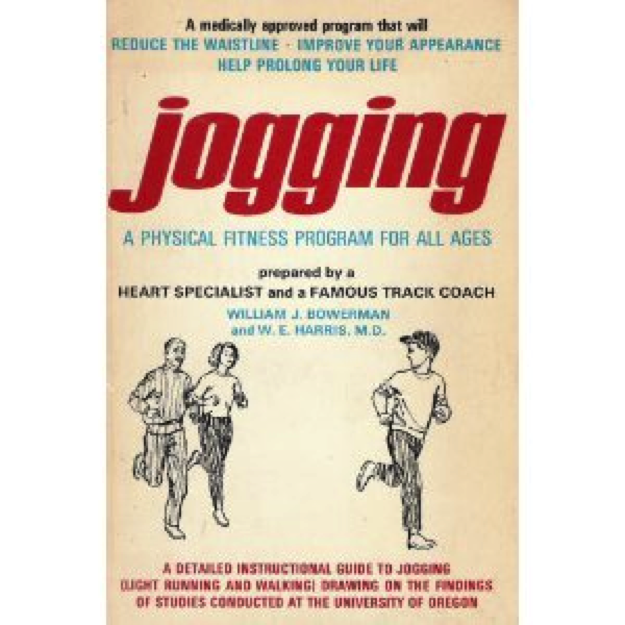

Knight’s relationship with Bowerman is also further developed in 1967. Bowerman’s book, a thin volume on jogging, goes viral and changes people’s outlook on running, almost making it seem ‘cool’. Knight is pleased at first, hoping it would add to the company’s success, but when he actually gets down to read it, he finds that Bowerman has clearly stated that running is not about shoes or branded apparel – one can use any kind for running.

This hits Knight badly for the purpose of his business, of course, but also on a personal level as even now Knight is looking for approval from Bowerman. That urge hasn’t gone away, and is the same since his school days. It also reflects on Bowerman’s character that running is something that is above business or profit for him.

Even with the company making-do with less than best facilities – like cracked windows that let in the cold or the noises of the pub that start from four everyday – beyond all of that, the beginnings of big success are evident. From a single basement in Knight’s parents’ home to multiple employees and offices, the company is growing fast and quickly. Even though Blue Ribbon was successfully doubling revenue year on year, it still could not support it’s co-founder Phil Knight after 5 years of operation. But Phil did not enjoy PWC enough and that work was too time consuming so he found a low key job as an assistant professor at Portland State. Phil decided he would focus on his shoe business which was as far as Phil’s father was concerned “still jackass-ing around.” Even the equity problem at the bank is staved off by meeting revenue expectations.

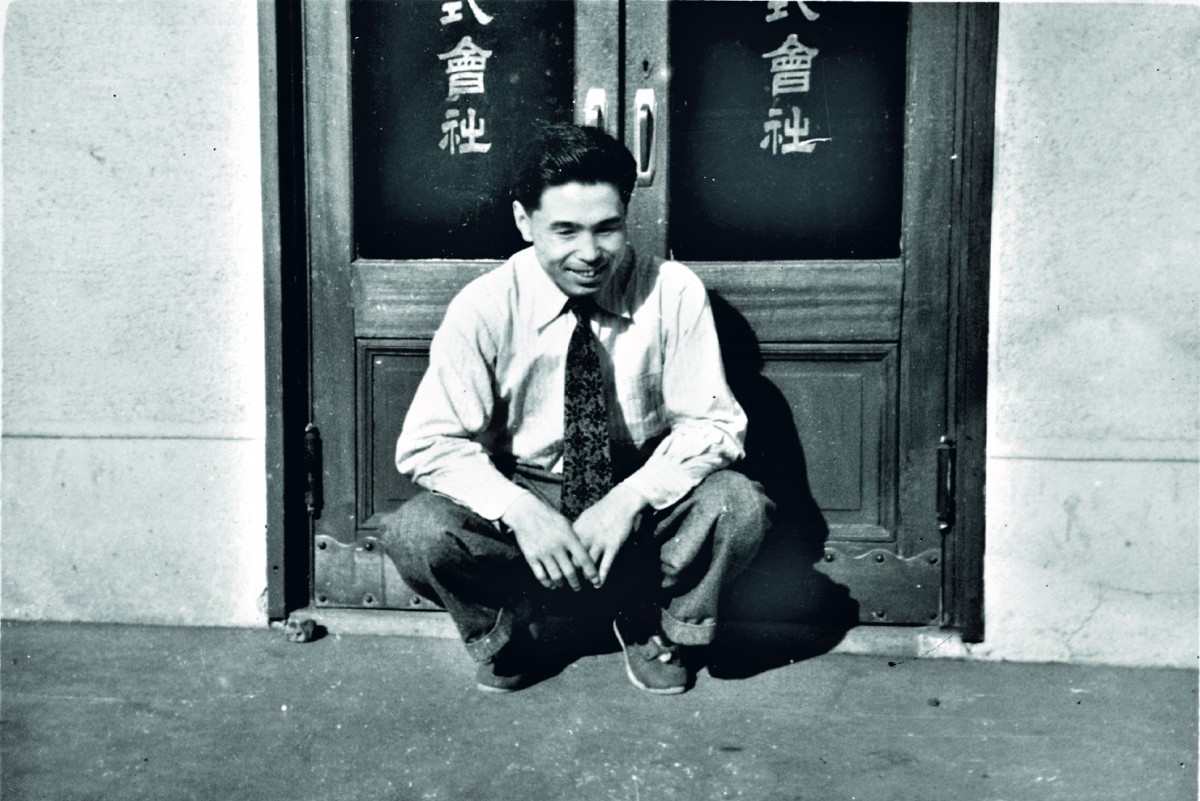

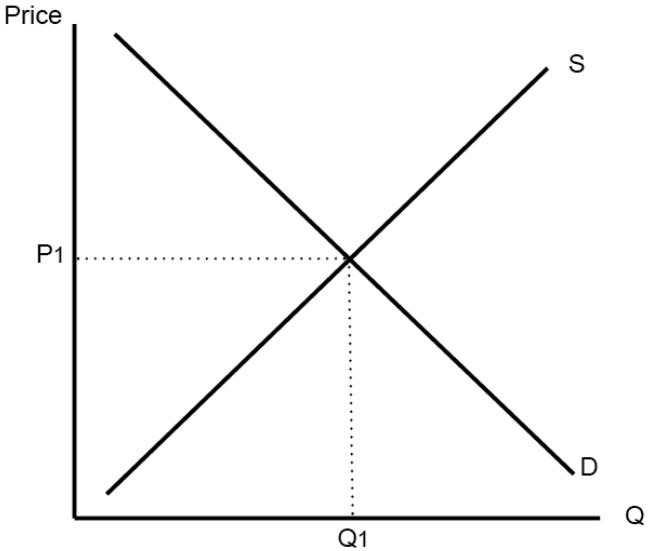

As an assistant professor, Phil knew that accounting is about balancing these equations. He met Penny Parks in his accounting class. In fact she turned out to be the best student so Phil hired Penny as a bookkeeper. Knight asked her out on a date and they hit it off and were married within a year.

As an assistant professor, Phil knew that accounting is about balancing these equations. He met Penny Parks in his accounting class. In fact she turned out to be the best student so Phil hired Penny as a bookkeeper. Knight asked her out on a date and they hit it off and were married within a year.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1968 – A synopsis

1968 – A synopsis

This chapter begins with Phil Knight deliberating about leaving his long-hours job at Price Waterhouse to be able to devote more time to Blue Ribbon. However, financially, it wasn’t possible to just work at Blue Ribbon. So he accepted the assistant professor at Portland State University, which allows him to earn income as well as have more time for his company. His senior at Price Waterhouse and his father both are baffled at his decision to quit his job.

This is where the story of how he meets his future wife begins. She is a student who looks different than everyone else and diverts his attention by sitting in the first row. A Julie Christie look-a-like, Penelope Parks never participates in class discussions (which the author makes lively by using the Socratic method), but ends up surprising the author by getting the topmost grades in her assignments.

This is where the story of how he meets his future wife begins. She is a student who looks different than everyone else and diverts his attention by sitting in the first row. A Julie Christie look-a-like, Penelope Parks never participates in class discussions (which the author makes lively by using the Socratic method), but ends up surprising the author by getting the topmost grades in her assignments.

He eventually asks her if she would be interested in doing accounting work for his company, and she acquiesces. She soon becomes indispensable, both from a professional as well as a friend perpective. Phil one day finds that she has kept all her salary cheques uncashed in her drawer, and this is what perhaps gives him the courage to ask her out on a date. They go to the zoo where he tells her more about himself, his travels around the world and his dream for his company. She is suitably impressed as she has only dated ‘boys’ who are interested in sports and cars.

They go on a couple more dates, and become more comfortable with each other. They end up meeting each other’s parents, and discover that their homes are as different as possible. Phil’s parents are polite but insist on knowing more about her. Parks’ home, in contrast, is rowdy and in disorder. Phil eventually connects with Penelope’s mother, who begins to like him.

With things going smoothly at the office and at home and Penelope spending increasingly more time with him, he asks her mother permission to take her away for a weekend with him. She refuses the first time, but Phil uses his negotiation skills to get her to agree the second time round.

The trip is successful, he proposes since having a relationship with a student wouldn’t bode well long-term, and ends with the couple very matter-of-factly deciding about their upcoming marriage.

This chapter also deals with Knight’s observations on Japan and its culture. He openly admires their way of doing things, their shyness and his growing camaraderie with Kitami, who invites him to his department’s annual picnic.

An important incident here that highlights the author’s character is his sending fifty dollars to a man in Japan named Fugimoto who lost his home and bicycle in a typhoon. Phil has just met and conversed with this man once, yet considered it important enough to help him out. The man replies saying he can’t accept the money as per the instructions of his superiors, but cleverly adds a postscript saying that if Phil instead sends the money to his home address, he will be able to take it. So that’s what Phil does so. Fugimoto would later become Knight’s spy against Onitsuka.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1969 – A Synopsis

1969 – A Synopsis

Now that the company is running in a stable manner with regards to steady sales, attention is drawn to other important factors like advertising, athletic endorsements etc. Knight recruits a broke art student for painting advertisements when he realizes how behind they are in that field.

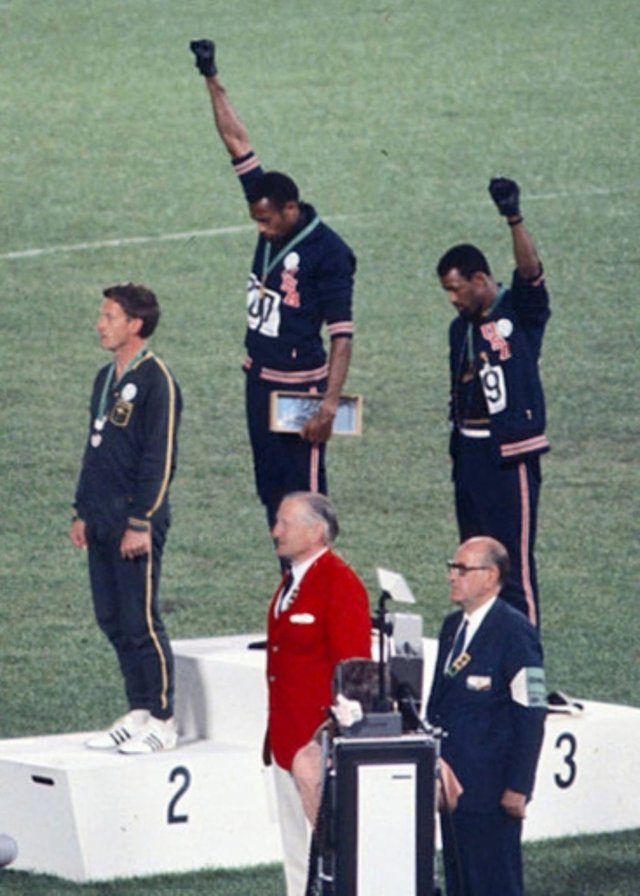

Mention is also made to the historic moment when two athletes, John Carlos and Tommy Smith, raised a protest at the Olympics as a protest. Knight mentions that Bowerman naturally supported them, because he would support all runners. This adds to the facet of Bowerman’s personality revealed before – of putting running before everything. Not only is it above business (he never mentions his company in the bestselling jogging book), but it is also above his beliefs, whether racial or otherwise, at the time. He supports his runners simply because they are that.

Mention is also made to the historic moment when two athletes, John Carlos and Tommy Smith, raised a protest at the Olympics as a protest. Knight mentions that Bowerman naturally supported them, because he would support all runners. This adds to the facet of Bowerman’s personality revealed before – of putting running before everything. Not only is it above business (he never mentions his company in the bestselling jogging book), but it is also above his beliefs, whether racial or otherwise, at the time. He supports his runners simply because they are that.

Knight’s naiveté is also shown in this chapter when he openly puts in the mail to all his employees saying he has his own spy working on Kitami. He is also revealed to be a difficult person to live with, absentminded, a bad driver, not neat and spoiled in the sense that he is unable to take care of himself. His wife lovingly puts up with all of it. However, when she gets pregnant and they buy a house and Knight makes it clear that the house will be taken away if the company goes under, a major development in her character is reflected.

Knight also mistakenly takes a harder than necessary stance with an employee who is overburdened with work and wants a raise and is starting to detest Knight’s offhand management style. Woodell helps patch this trouble over by staying with the employee for a few days and effectively bonding with him.

Penny has always been shown as a diligent person who becomes indispensable to the office, but now, she works harder than ever before even when she is pregnant. Her fear of not having stability drives her more than anything else. She fills out uncertain and badly drawn orders, keeping up sales numbers through her days of morning sickness and weight gain. She is a stellar character who rises up to the challenges of Knight’s life.

The relationship between Woodell and Knight also develops. This is the first time that Knight speaks of someone with such fond remembrance that one can detect a yearning of nostalgia for times spent with Woodell. Woodell is an inspiration and much more self-reliant than most able-bodied men. He abhors pity and is dedicated to his work. He quickly becomes a very important part of the Knights’ lives, both professionally and personally.

The relationship between Woodell and Knight also develops. This is the first time that Knight speaks of someone with such fond remembrance that one can detect a yearning of nostalgia for times spent with Woodell. Woodell is an inspiration and much more self-reliant than most able-bodied men. He abhors pity and is dedicated to his work. He quickly becomes a very important part of the Knights’ lives, both professionally and personally.

Knight also reaches another key point in his life – he becomes a father. He is both scared but mostly wondrous at the feeling of having created his own child with his wife when he first holds his son Matthew. He is ecstatic, and the first thought that comes into his mind is to find his father and tell him the news.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1970 – A Synopsis

1970 – A Synopsis

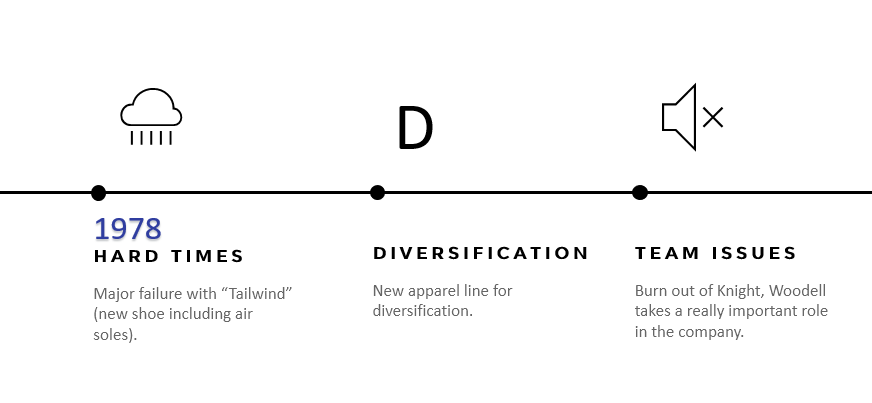

This is the point when Knight faces many challenges, including one in his personal life. The gamut of challenges starts with a meeting for contract renewal in Japan that goes well but leaves him in doubt nevertheless. He secures 3 more years of Tiger shoes with distribution rights but simultaneously, orders start coming in with even worse delays – earlier, they used to be merely late, now they are the wrong models as well the wrong sizes. Customers start getting frustrated in large numbers. Of course, the Blue Ribbon staff understands that Onitsuka Tiger are likely first fulfilling their demand in Japan and then sending the leftovers to America.

Next, Knight gets told by his banker that there will be no money given to him any longer, and to return the money he already owes, he must fulfill strict sales quotas set by the bank. Here, for the first time, Japan offers to send the shipment on time – just when the bank has backed out. Knight comes up with the idea of a small public offering to capture the tide of companies that put the work tech or electronic in their name in order to rid the stock craze of the Nifty Fifty era.

Next, Knight gets told by his banker that there will be no money given to him any longer, and to return the money he already owes, he must fulfill strict sales quotas set by the bank. Here, for the first time, Japan offers to send the shipment on time – just when the bank has backed out. Knight comes up with the idea of a small public offering to capture the tide of companies that put the work tech or electronic in their name in order to rid the stock craze of the Nifty Fifty era.

He names the offering the “Sport Tech Company” but when this public offering disastrously fails, however, it leaves Knight’s confidence in his life’s work shattered. He is left questioning himself. Although he blames various things for it (Vietnam, the depression) he is ultimately racked with humiliation at having thought too much of something that clearly was not. Still struggling, Knight struggles to find money so badly that he accepts the last life savings of Woodell’s parents.

He names the offering the “Sport Tech Company” but when this public offering disastrously fails, however, it leaves Knight’s confidence in his life’s work shattered. He is left questioning himself. Although he blames various things for it (Vietnam, the depression) he is ultimately racked with humiliation at having thought too much of something that clearly was not. Still struggling, Knight struggles to find money so badly that he accepts the last life savings of Woodell’s parents.

To continue the downward spiral, Knight also loses the physical agility which he was so proud of. Having gained weight, he could no longer run the way he used to. It all comes down to one humiliating moment when Knight cannot keep up with Grelle in a private run. But this serves as a springboard, and Knight begins to shed the extra kilos.

To continue the downward spiral, Knight also loses the physical agility which he was so proud of. Having gained weight, he could no longer run the way he used to. It all comes down to one humiliating moment when Knight cannot keep up with Grelle in a private run. But this serves as a springboard, and Knight begins to shed the extra kilos.

He trains hard, comes back and beats Grelle in a running bet. This is perhaps the beginning of better days, because Knight finds out about Japanese trading companies, who like to extend lines of credit to fledgling companies. This provides Knight an option after the bank debacle. But he is careful, and takes time to decide.

He discovers some disturbing news – his doubts in the meeting in Japan were correct, it is evident that Kitami is shopping for another US dealer to distribute the Tiger shoes products. This is when he makes the strategic decision of inviting Kitami to his country and his home.

He discovers some disturbing news – his doubts in the meeting in Japan were correct, it is evident that Kitami is shopping for another US dealer to distribute the Tiger shoes products. This is when he makes the strategic decision of inviting Kitami to his country and his home.

There is a subtle link between the physical fitness of Knight and his ability to keep his company running. This is perhaps because in the past chapters he has always used running as something to soothe him, or calm him down, or even blow off steam – he has gone on a run before big deals or before big decisions, often feeling better afterwards. His lack of physical fitness came as a realization to him at a particularly low point professionally. But once he overcomes that and goes back to his previous weight and is able to proudly run again, even bigger problems than before seem easier to resolve.

There is a subtle link between the physical fitness of Knight and his ability to keep his company running. This is perhaps because in the past chapters he has always used running as something to soothe him, or calm him down, or even blow off steam – he has gone on a run before big deals or before big decisions, often feeling better afterwards. His lack of physical fitness came as a realization to him at a particularly low point professionally. But once he overcomes that and goes back to his previous weight and is able to proudly run again, even bigger problems than before seem easier to resolve.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1971 – A Synopsis

This chapter is whirlwind of ups and down, and reveals the character of the mysterious Mr. Kitami at length. While the Knights make his and his assistant’s American visit as hospitable as possible in order to help re-centre their relationship since Knight was told that Tiger was looking for alternative suppliers in the US, Kitami appears to be intentionally over react during a meeting at the bank by outright demanding that the bank “give Blue Ribbon more money to support its operations” and then storms out of the meeting. Knight is shocked, but catches the smug expression on Kitami’s face as they exit the bank, understanding that Kitami is trying to sabotage this deal in more ways than one.

Phil’s position was clear: Blue Ribbon could increase sales if they had more shoes and would have more shoes if the bank could lend more money, and the bank would lend more money if Onitsuka’s contract with Blue Ribbon was greater than 3 years and if the terms of service for delivering the shoes were tightened up. Blue Ribbon could seek funding from a trading company such as Nissho but Kitami said that they would send money first then take over second.

- Onitsuka was only manufacturing 1/4 of their own shoes and subcontracting the other 3/4st to cheaper suppliers;

- Kitami was worried that Nissho would find out which cheap suppliers were involved and then go around Onitsuka to produce the product and put Onitsuka out of business;

Kitami continues this irritable behaviour at the new offices, refusing to acknowledge the steady double growth as a good thing, demanding more. Here is where a side of Knight previously unseen is revealed. On continuously hearing that their growth should be triple through reference to a folder, Knight becomes curious and pilfers through a folder from Kitani’s briefcase while he is in the toilet. Shocked at himself, he confides in Woodell, who is shocked as well, but wants to analyze the contents nevertheless. The folder showed 18 US manufacturers and Kitami was interviewing half of them on this trip to replace Blue Ribbon. This was the ultimate betrayal. The next day, Woodell and Knight slid the folder back into Kitami’s briefcase when he wasn’t looking.

Here it is evident that although both men have a good conscience, when it comes to their business, there are some lines that they wouldn’t mind crossing.

Kitami’s unforgivable behaviour continues when he leaves Penny alone to fix a flat tyre on the highway, himself just sitting in the car. Things continue to go downhill at a get-together at the Bowermans’, where Mrs. Bowerman has allowed alcohol when she generally doesn’t. Tensions are already high due to the war, and Mr. Bowerman gets really tipsy and makes his anti-Japanese sentiment known. The weird night ends with Kitami playing songs on a guitar, making everyone fall into silence.

Kitami’s unforgivable behaviour continues when he leaves Penny alone to fix a flat tyre on the highway, himself just sitting in the car. Things continue to go downhill at a get-together at the Bowermans’, where Mrs. Bowerman has allowed alcohol when she generally doesn’t. Tensions are already high due to the war, and Mr. Bowerman gets really tipsy and makes his anti-Japanese sentiment known. The weird night ends with Kitami playing songs on a guitar, making everyone fall into silence.

For the first time, Bowerman’s goofy side is shown. He is always the quiet, resilient and diligent person in the background, but at this get-together, he does not mind being the verbose centre of attention. Perhaps it was this effect of alcohol that made Mrs. Bowerman forbid any alcohol in the house.

Kitami goes off on a two week trip and then returns to Portland where he proposes that Onitsuka would like to buying out Blue Ribbon (51% ownership stake) or otherwise Onitsuka would have to seek out superior distributors. Knight is forced to come up with a strategy to save his company. He stalls his decision and Kitami leaves without a problem.

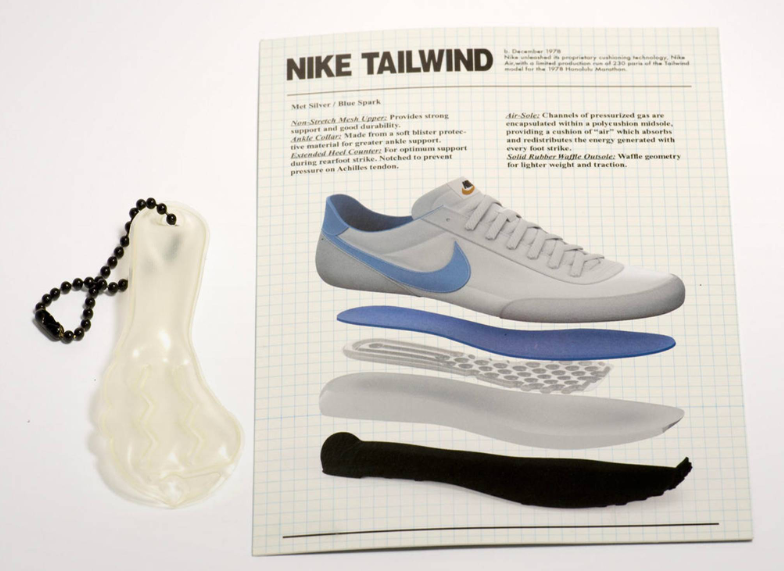

Then First National decided to stop supporting Blue Ribbon just around this time. The perfect storm was brewing. So Knight got a deal with a small bank in California. But he turned back to the Japanese trading company (Nissho) which was looking for huge upside ventures like Blue Ribbon. Nissho was willing to take a second position to Blue Ribbon on their existing loans which would have quelled their bank needs. And to top it off, Nissho had been rejected by Onitsuka and so Nissho was embarrassed and wanted to work with Blue Ribbon. They were offering them access to a whole host of Japanese manufacturers to work with. The only problem being that Blue Ribbon’s contract with Onitsuka forbade importing any other track and field shoes…but the wheels were turning and Phil Knight was introduced to a shoe factory producer in Mexico that was called Canada and he was impressed to the point where he made an order of 3,000 pairs of soccer shoes which were not track shoes. This didn’t violate the terms but it broke the spirit of the contract with Onitsuka. The factory owner wanted to know the name of Knight’s brand, he said he’d get back to them on an answer soon.

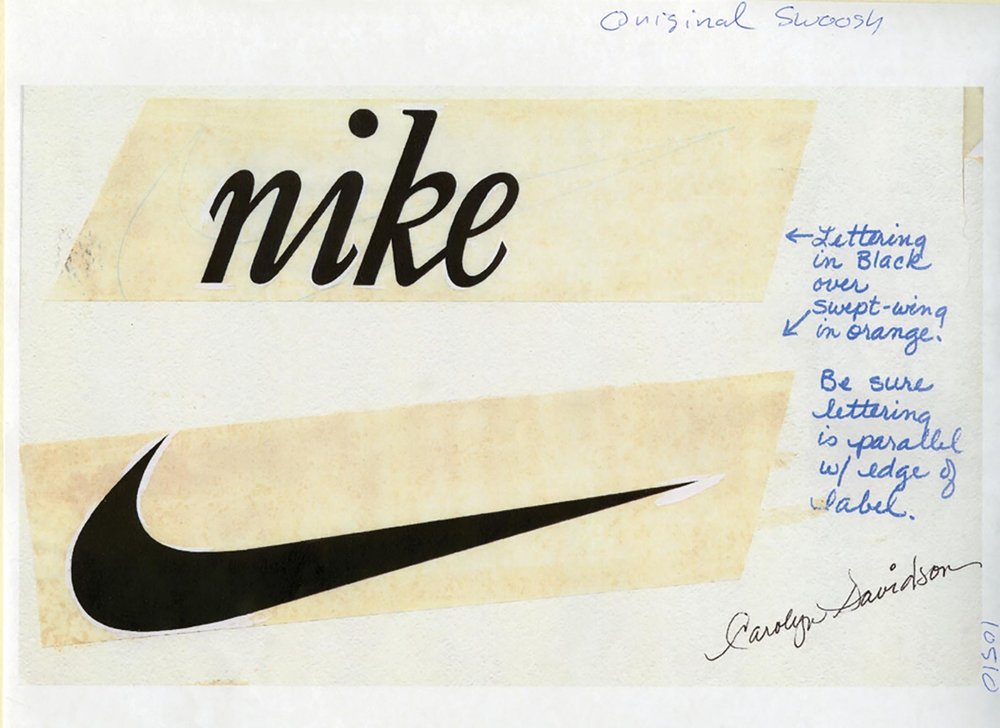

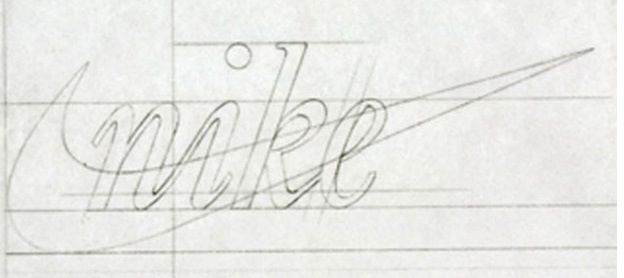

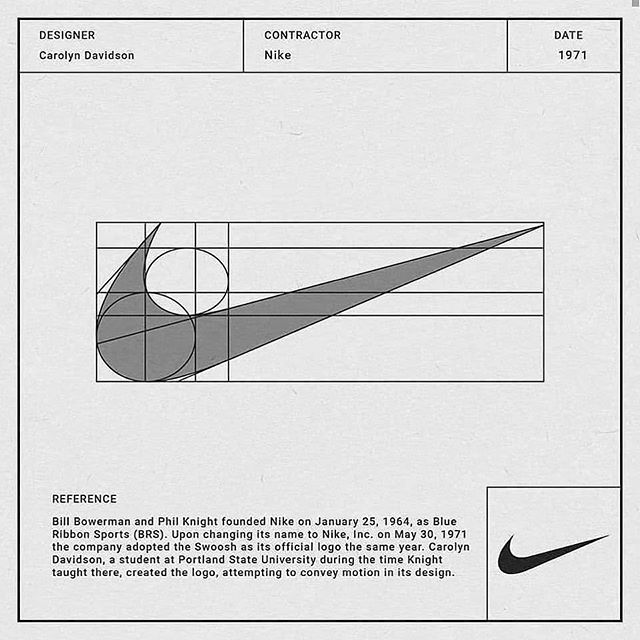

Phil calls up Carolyn Davidson who had done some ad work and asks her to create a new logo that would set King’s company apart from Onitsuka and Adidas. She came back 2 weeks later with various lightning bolts and other motion like icons. Knight singled out 5 and gave her a few more days to refine. It looked like a wing and invoiced Knight $35 USD. Knight picked the one that looked the best although he wasn’t happy with it.

Phil calls up Carolyn Davidson who had done some ad work and asks her to create a new logo that would set King’s company apart from Onitsuka and Adidas. She came back 2 weeks later with various lightning bolts and other motion like icons. Knight singled out 5 and gave her a few more days to refine. It looked like a wing and invoiced Knight $35 USD. Knight picked the one that looked the best although he wasn’t happy with it.

One of the most historic moments of the story also falls within this chapter – the naming of the brand as Nike. Woodell wanted Falcon, on of the other staff wanted Bangle and Knight wanted Dimension 6. All terrible. After thinking of various names that the employees could not agree on, Jeff Johnson phoned Woodell to explain that he had a dream, the Greek goddess “Nike”. The name Nike was decided on in desperation. Nike was like Xerox, Kodak. He thought about the victory in World War 2. and so is a symbol resembling a swoosh of air. Knight sent the message that the product is called Nike.

After trying out various factories, including the factory Canada which sucked, Knight finds a dream factory that manufactures shoes to his satisfaction; a Nippon factor that build Firestone tires. Although he finds a few faults, overall, the quality control and the manufacturing speed are above reproach. He ends up naming the rest of the models in a fit of exuberance, and feels victorious afterwards. That feeling of victory is similar to how he felt when his son was born – the words ‘we made this’ are common in both situations.

After trying out various factories, including the factory Canada which sucked, Knight finds a dream factory that manufactures shoes to his satisfaction; a Nippon factor that build Firestone tires. Although he finds a few faults, overall, the quality control and the manufacturing speed are above reproach. He ends up naming the rest of the models in a fit of exuberance, and feels victorious afterwards. That feeling of victory is similar to how he felt when his son was born – the words ‘we made this’ are common in both situations.

Knight had spent 3 weeks in Japan finding manufacturers. And knew that Onitsuka would hear about his visit so he invited Penny over for the last week to make a visit to Kobe. Onituka and Kitami all got together. Fugimoto the spy was also invited.

Knight also recalls that Bowerman was interested in innovation in the soles of these shoes in preparation for the 1972 Olympics. He was looking at waffle irons in a new way and believed that they could be the basis of a new rubber sole. Turns out he was inventing the future.

Knight also recalls that Bowerman was interested in innovation in the soles of these shoes in preparation for the 1972 Olympics. He was looking at waffle irons in a new way and believed that they could be the basis of a new rubber sole. Turns out he was inventing the future.

This chapter is important not only because of the beginning of the evolving of the company as it is popularly known, but also delving into aspects of personality of the characters previously unexplored.

This chapter is important not only because of the beginning of the evolving of the company as it is popularly known, but also delving into aspects of personality of the characters previously unexplored.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1972 – A Synopsis

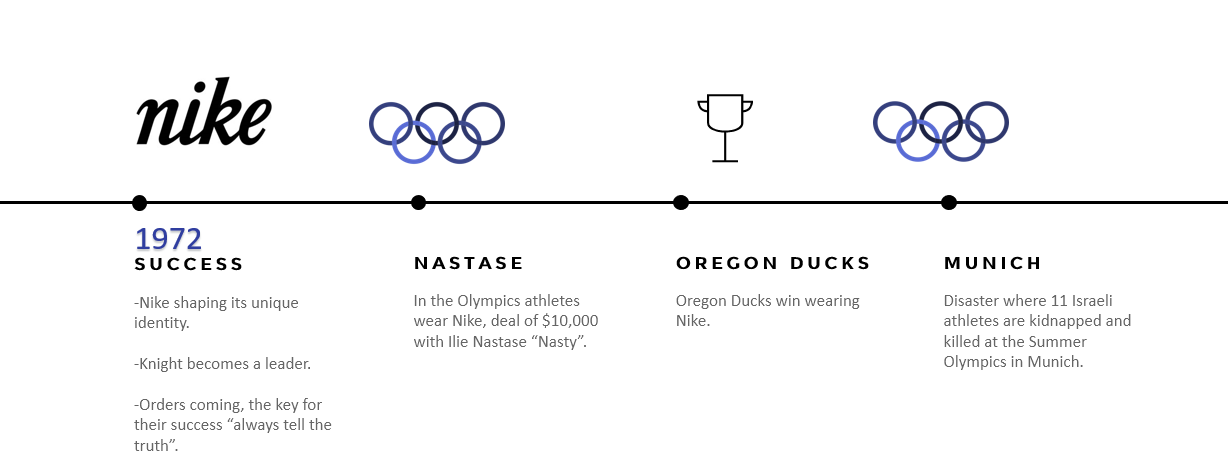

This chapter focuses on how the company starts shaping its own unique identity. Till now, Knight and his people have been working hard, yes, but they have always been controlled by someone else; by Onitsuka Tigers and by Kitami the vendor contact that effectively bossed Knight and Blue Ribbon around. The key was that they would need at least a few months of Onitsuka inventory to keep the cashflow coming in order to support the Nike venture, so Knight needed to be super quiet and hope that Kitami didn’t read local papers. Although Japan’s support was important in the initial stages, this chapter shows how the company has grown strong enough to throw away the shackles and follow their own path, somewhat deviously. After all, the Onitsuka contract stipulated that Blue Ribbon could only import track shoes from Onitsuka factories and with the Tiger brand.

This chapter focuses on how the company starts shaping its own unique identity. Till now, Knight and his people have been working hard, yes, but they have always been controlled by someone else; by Onitsuka Tigers and by Kitami the vendor contact that effectively bossed Knight and Blue Ribbon around. The key was that they would need at least a few months of Onitsuka inventory to keep the cashflow coming in order to support the Nike venture, so Knight needed to be super quiet and hope that Kitami didn’t read local papers. Although Japan’s support was important in the initial stages, this chapter shows how the company has grown strong enough to throw away the shackles and follow their own path, somewhat deviously. After all, the Onitsuka contract stipulated that Blue Ribbon could only import track shoes from Onitsuka factories and with the Tiger brand.

At a trade show early in the year, shoes salesmen showed some interest even though the dream manufacturer’s shoes were flawed, some of the paint was too shiny. The orange Nike’s stacked up beside the Onitsuka Tigers perplexed Knight’s team as well: Johnson, Woodell in particular. One of the customers was asking “what the hell is a Nike?” Knight explained, “it’s the Greek goddess of victory”. And what is this logo?” Knight – “it’s a Swoosh.” Customer – “What’s a swoosh?” Knight – “It’s the sound of someone running past you!” They loved it and bought pairs. Johnson couldn’t believe the excitement and asked one sales rep why he was buying inventory, he said “because Blue Ribbon has never bullshitted us in the past, and we’ve been doing business for years.”

At a trade show early in the year, shoes salesmen showed some interest even though the dream manufacturer’s shoes were flawed, some of the paint was too shiny. The orange Nike’s stacked up beside the Onitsuka Tigers perplexed Knight’s team as well: Johnson, Woodell in particular. One of the customers was asking “what the hell is a Nike?” Knight explained, “it’s the Greek goddess of victory”. And what is this logo?” Knight – “it’s a Swoosh.” Customer – “What’s a swoosh?” Knight – “It’s the sound of someone running past you!” They loved it and bought pairs. Johnson couldn’t believe the excitement and asked one sales rep why he was buying inventory, he said “because Blue Ribbon has never bullshitted us in the past, and we’ve been doing business for years.”

Kitami flew over to Portland in a rush and demanded to understand what had gone on at the trade show. He confronted Knight asking what was the deal with the orange boxes and the “Nik-e” pronouncing Nee-kay. Knight explained that it was a sideline he had developed in case Onitsuka did as threatened and yanked the rug from under Blue Ribbon. Kitami was on his heels, how many Nike’s did you order? Who manufactured them? Knight answered. Knight fibbed that the Nike’s were not in stores….Kitami finally wanted to know when Phil would sign his papers and sell Blue Ribbon to Onitsuka…clueless.

Kitami stormed off to one of the Blue Ribbon shoe stores and found boxes upon boxes of Nike shoes stacked in the back. Thus follows a meeting where both sides threaten each other with lawsuits, and their business connection is terminated. Knight, in this chapter, shows the true qualities of a leader. Till now, although effective, there hasn’t been much evidence of Knight encouraging people, as he prefers not to be the hands-on type of leader. In the meeting after this incident, however, Knight single-handedly converts the defeat and pessimism in everyone’s body language to hope and an eagerness for success. The story after this almost feels destined for success.

Kitami stormed off to one of the Blue Ribbon shoe stores and found boxes upon boxes of Nike shoes stacked in the back. Thus follows a meeting where both sides threaten each other with lawsuits, and their business connection is terminated. Knight, in this chapter, shows the true qualities of a leader. Till now, although effective, there hasn’t been much evidence of Knight encouraging people, as he prefers not to be the hands-on type of leader. In the meeting after this incident, however, Knight single-handedly converts the defeat and pessimism in everyone’s body language to hope and an eagerness for success. The story after this almost feels destined for success.

The rest of the chapter deals with Nike and how it gets itself into the endorsement business. It begins with the National Sporting Goods Association Show, where despite having mediocre product the company manages to exceed all of their collective order expectations. In disbelief, when asked why they were ordering the product at all, the salesmen confess that they know that this company always tells the truth. Although bewildered that such a simple thing could be behind this success, the answer sticks with Knight.

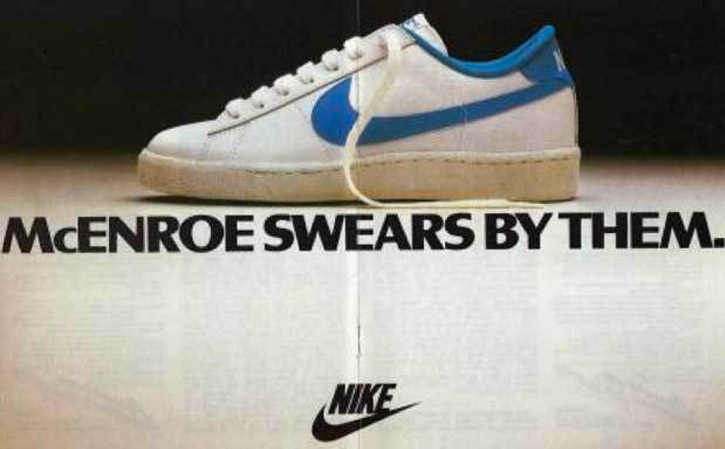

The company also meets with good success at the Olympic field and track trials, where they get athletes to wear their apparel and their shoes. They eventually end up signing a deal for ten thousand dollars with Ilie ‘Nasty’ Nastase the tennis pro for $10,000.

The company also meets with good success at the Olympic field and track trials, where they get athletes to wear their apparel and their shoes. They eventually end up signing a deal for ten thousand dollars with Ilie ‘Nasty’ Nastase the tennis pro for $10,000.

To top it all off, the University of Oregon Ducks unexpectedly win, and they do so wearing Nike waffles. Knight is ecstatic because it is a double whammy – his team is winning while wearing his product.

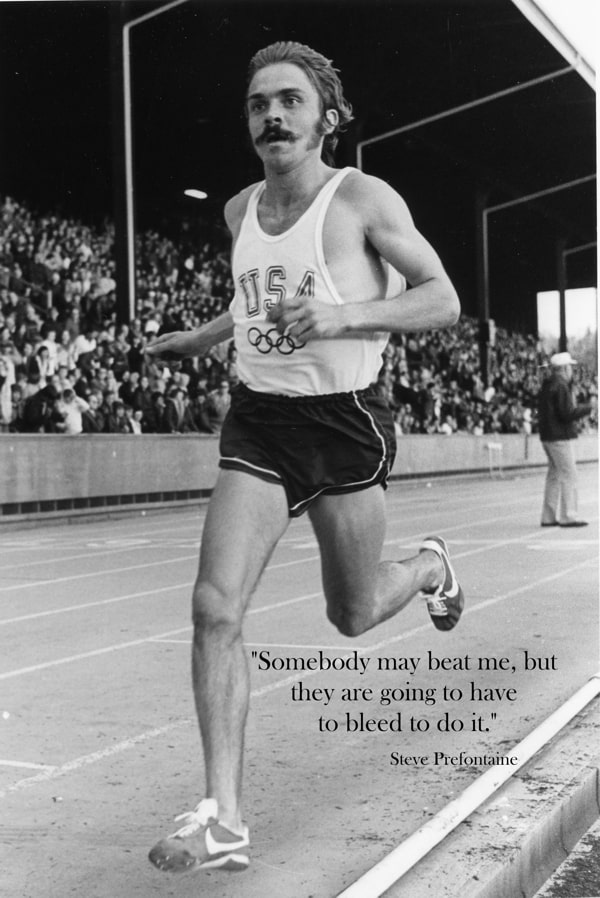

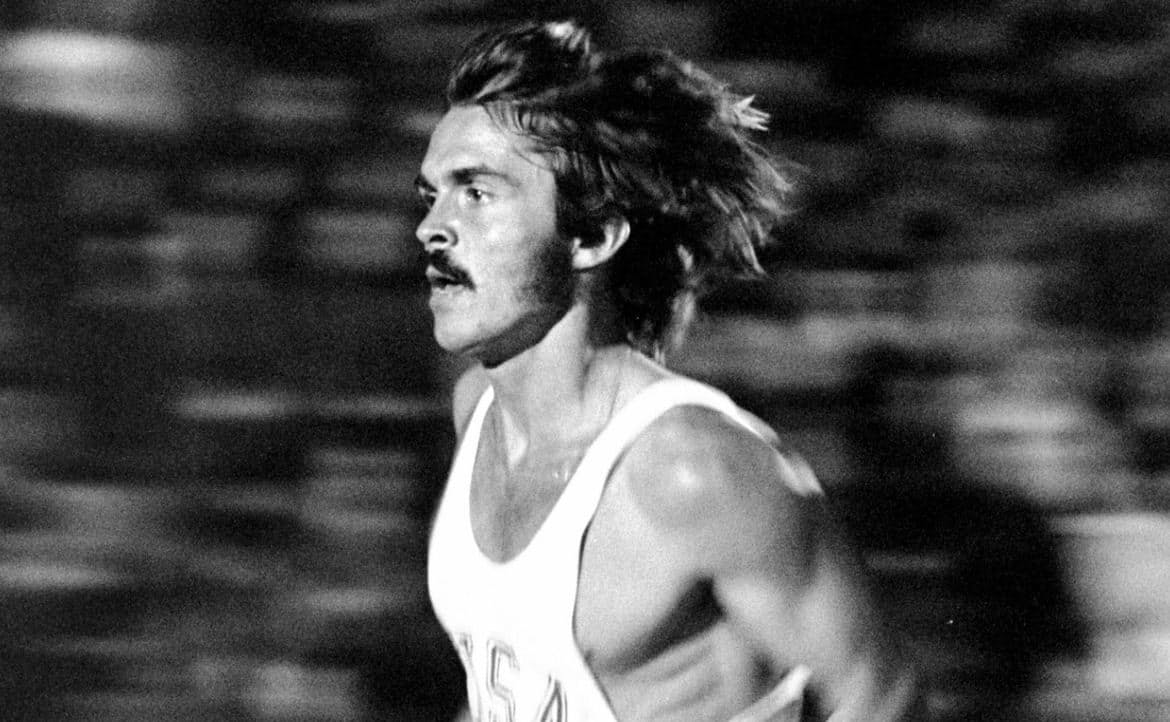

In this chapter, Knight also consciously or subconsciously reveals that this is the turning point from which there is no return. Till before this, Knight’s mindset has always been that if the business fails, it had better fail fast, because then he can get out young. But here, after witnessing the legendary win of Prefontaine and the emerging of the Ducks as winner, it is clear that Knight loves sports so much they are a part of who he is as a person, and he will never be truly able to turn back.

In this chapter, Knight also consciously or subconsciously reveals that this is the turning point from which there is no return. Till before this, Knight’s mindset has always been that if the business fails, it had better fail fast, because then he can get out young. But here, after witnessing the legendary win of Prefontaine and the emerging of the Ducks as winner, it is clear that Knight loves sports so much they are a part of who he is as a person, and he will never be truly able to turn back.

Knight gives Prefontaine a job as a promoter for Nike. Prefontaine was the identity of Nike and vice versa. Phil loved Prefontaine and had Hollister support Pre’s.

Knight gives Prefontaine a job as a promoter for Nike. Prefontaine was the identity of Nike and vice versa. Phil loved Prefontaine and had Hollister support Pre’s.

Finally, Bowerman reveals another facet of this character, which comes as a big surprise. After a shocking disaster where eleven Israeli athletes are kidnapped and killed, Bowerman is irrevocably shaken, and resigns from coaching a few days after. This is the first time Bowerman is shown in a defeatist stance. But he continued to develop the waffle shoe design. Johnson also worked on the Pre-Montreal.

Overall, the tone of the chapter is promising, and everything is going good for Knight. It seems there is nowhere to go but up.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

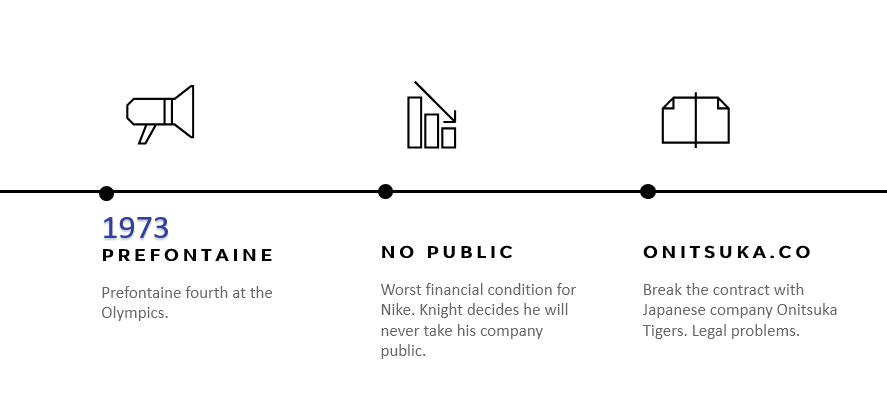

1973 – A Synopsis

Problems have started cropping up – and not just for Knight. Pre, the star of the last chapter, finishes fourth in the Olympic finals. His financial condition also takes a turn for the worse because Olympic athletes weren’t allowed to collect endorsement money. Knight eventually decides to hire him and use him to spread the word about Nike.

Problems have started cropping up – and not just for Knight. Pre, the star of the last chapter, finishes fourth in the Olympic finals. His financial condition also takes a turn for the worse because Olympic athletes weren’t allowed to collect endorsement money. Knight eventually decides to hire him and use him to spread the word about Nike.

Pre’s personality takes up a lot of the chapter. He is the sort of person people automatically become intimidated by when he walks into a room. The ice eventually breaks over a meal when everyone realizes how Pre is just like them.

Pre’s personality takes up a lot of the chapter. He is the sort of person people automatically become intimidated by when he walks into a room. The ice eventually breaks over a meal when everyone realizes how Pre is just like them.

Knight takes another important managerial decision – he gets Woodell and Johnson to switch cities. This is difficult because both of them have settled well in the cities they already are in, but Knight convinces them to do it. And he calls them butt heads in the process.

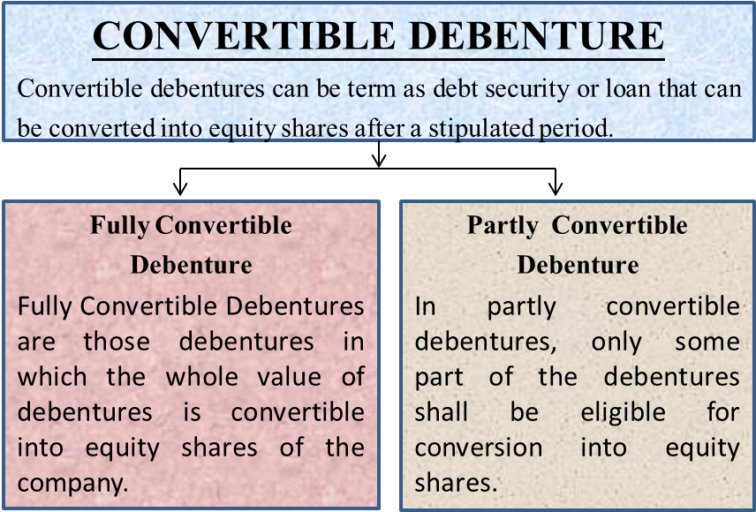

One of the most painful moments yet are chronicled in this chapter. The shoe market was changing, there was massive demand now for running shoes from Adidas to Puma etc but insufficient supply and Blue Ribbon was now less financially stable. Knight meets with his debenture holders after posting a loss of ($50K), and trying to answer their questions is very difficult for him. Staring up at him are working class faces who put their faith in him, and then and there, Knight decides that he will never take his company public – if facing a few debenture holders could make him feel so bad, what would thousand of shareholders do for him? He placates the debenture holders by telling them that he would keep the conversion rate the same for all the five years (when originally it was supposed to increase each year).

One of the most painful moments yet are chronicled in this chapter. The shoe market was changing, there was massive demand now for running shoes from Adidas to Puma etc but insufficient supply and Blue Ribbon was now less financially stable. Knight meets with his debenture holders after posting a loss of ($50K), and trying to answer their questions is very difficult for him. Staring up at him are working class faces who put their faith in him, and then and there, Knight decides that he will never take his company public – if facing a few debenture holders could make him feel so bad, what would thousand of shareholders do for him? He placates the debenture holders by telling them that he would keep the conversion rate the same for all the five years (when originally it was supposed to increase each year).

A suit is filed against the company in Japan, and they sue back with the help of Knight’s cousin, Houser. Houser is tenacious and competitive, and plays well in front of a judge or a jury. Knight feels drained because of the depositions he has to go through, where various questions are asked of him just to somehow get him to accept breaking the contract. His father provides him valuable support during this time, both familial and legal. Having such a focused thing to concentrate on gives his father a mission too.

A new law graduate, Rob Strasser, is added to the legal team, and he and Knight hit it off. They bond over work, over sports and over having similar fathers. Strasser also fully believes in the company’s cause.

A new law graduate, Rob Strasser, is added to the legal team, and he and Knight hit it off. They bond over work, over sports and over having similar fathers. Strasser also fully believes in the company’s cause.

Meanwhile, Penny is about to have another child. Knight is worried about supporting two children financially. However, after the child is safely delivered, Knight’s mind returns to his business, and Penny can feel it. Although Knight realizes that what he did wasn’t something he should have done, he doesn’t stop himself. Neither does Penny. It is amply clear that she understands him and his state of mind completely.

Knight starts a completely new system where distributors commit to support the Blue Ribbon supply with advance commitments which would give strength to Nike’s capital raising ability. This picks up pace with the shoe suppliers for solving the problem of demand and supply. Specifically, he asks for bulk non refundable orders six months in advance. Although he faces resistance in the beginning, by the end of it, the stores who aren’t included beg to be let in.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1974 – A Synopsis

This chapter is a finger-biting account of the entire trial. It is described so well that the tension is palpable. Everything that could have gone splendidly right goes wrong in one way or another. Knight’s nerves are on edge after the countless question in the deposition, and he makes the mistake of not being well rested or well fed before coming to court. He breaks under pressure, often becoming incoherent.

This chapter is a finger-biting account of the entire trial. It is described so well that the tension is palpable. Everything that could have gone splendidly right goes wrong in one way or another. Knight’s nerves are on edge after the countless question in the deposition, and he makes the mistake of not being well rested or well fed before coming to court. He breaks under pressure, often becoming incoherent.

Other witnesses don’t do too well either. Bowerman refuses to prepare for his testimony because of his deep disdain for the Japanese business and ends up getting intimidated on the stand, and Woodell gets so nervous he starts giggling while spelling his name for the judge. After the judge passes a gag order forbidding both sides to talk about the trial, the very next day, Johnson speaks to a salesperson who turns up in the court with the defense team. Overall, the case looks like a wreck. But amidst all of this chaos, Knight manages to convey the unstoppable belief that he has in his cousin – and it seems the cousin is the only one who does not in some way contribute to the worsening of the case.

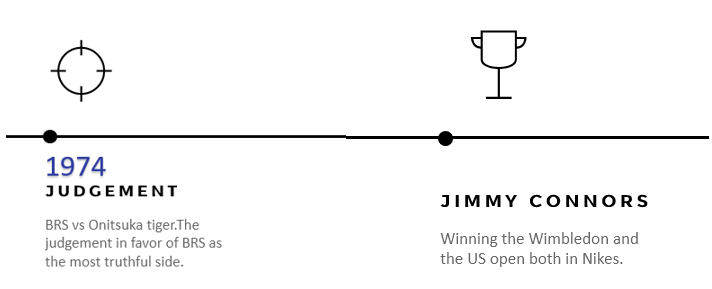

The judge himself is a character whose different sides are revealed throughout the chapter. Increasingly dramatic and at first appearing very stern, it is later revealed that under all the dramatic announcements, he is a logical person who is simply making the most of a case that he doesn’t particularly like. His judgment finds in favor of Blue Ribbon simply because he finds that side most truthful – and it is shown how the judge is a very astute observer because he notices things like Kitami getting a translator but that Kitami would correct his translator in perfect English whenever he made a mistake in translation: an obvious ploy to pretend to not speak English well that went wrong.

The judge himself is a character whose different sides are revealed throughout the chapter. Increasingly dramatic and at first appearing very stern, it is later revealed that under all the dramatic announcements, he is a logical person who is simply making the most of a case that he doesn’t particularly like. His judgment finds in favor of Blue Ribbon simply because he finds that side most truthful – and it is shown how the judge is a very astute observer because he notices things like Kitami getting a translator but that Kitami would correct his translator in perfect English whenever he made a mistake in translation: an obvious ploy to pretend to not speak English well that went wrong.

This chapter is extremely well worded – throughout the proceedings, it seems that Knight and his company will lose, but when the point of ruling actually comes about, there isn’t incredulous surprise at them winning. The feeling of joy afterwards is very well captured, and Knight especially gets carried away with the feeling of victory.

They also needed money for a new factory since there was a weak supply line for the Nike brands. Hiding the fact that they took a large portion of the Nissho financing to pay for a new factory was a risky move. At any rate, Johnson helped Phil out and took on the role of running the factory on the East coasts in Exeter, New Hampshire.

They also needed money for a new factory since there was a weak supply line for the Nike brands. Hiding the fact that they took a large portion of the Nissho financing to pay for a new factory was a risky move. At any rate, Johnson helped Phil out and took on the role of running the factory on the East coasts in Exeter, New Hampshire.

The other side however does not render the cheque immediately as per their settlement agreement. Another great victory is Jimmy Connors surprisingly winning the Wimbeldon and the US Open, both in Nikes.

Another important part of the chapter is Knight trying to recruit Strasser. Till now, Knight has never actually prepared a speech or arguments to try to hire someone. But he knows how valuable Strasser can be – and knows that Strasser too would love to work with Blue Ribbon. Eventually, Strasser’s only problem turns out to be getting his father’s permission – something Knight hasn’t prepared for. But that works out for the best and Strasser becomes the company’s first in-house counsel. It is clear that this is the bedrock of a relationship that is going to last for a long time..or is it? The number of similarities in their personal lives is already quite great, and now they are beginning a professional relationship too. As we see Bowerman becoming less and less focused, Strasser’s involvement simultaneously grows along side them.

![]() The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

The above notes are based on ShoeDog by Phil Knight – Founder of NIKE INC.

1975 – A Synopsis

This is where all the financial problems come to a head – there comes a point when the company is unable to pay Nissho, the salary cheques of the employees bounce, the bank refuses to associate with them anymore, an FBI investigation is prompted by the bank, angry creditors fly down to demand their money, all the while when the person from Nissho who was dealing with Blue Ribbon – the friendly Sumeragi – is replaced by a higher-up, Ito. He is so cold that Knight starts referring to him as the Ice Man.

This is where all the financial problems come to a head – there comes a point when the company is unable to pay Nissho, the salary cheques of the employees bounce, the bank refuses to associate with them anymore, an FBI investigation is prompted by the bank, angry creditors fly down to demand their money, all the while when the person from Nissho who was dealing with Blue Ribbon – the friendly Sumeragi – is replaced by a higher-up, Ito. He is so cold that Knight starts referring to him as the Ice Man.

Through all the troubles that emerge, the characters of three people come out through and through – Ito, Knight and Giampietro, the man Knight had hired for managing the shoe factory.

Giampietro gets the company out of a huge fix in a very unconventional manner. When the cheques bounce and the angry employees swarm around Johnson, Giampietro drives around to the owner of a local box company, demanding a loan of five thousand dollars. It is a mark of Giampietro’s personality that he actually gets the loan. He then hands out crisp notes to the employees, staving off one disaster.

The entire bank situation gets out of hand with the FBI potentially getting involved because of the missed pay cheques. Knight informs Nissho of the situation, preferring to be truthful. He also asks for a further loan of a million dollars to hold everybody else off. Ito demands to see the books before he makes a decision. This is a warning sign because Knight used the money from Nissho to build the Exeter factory – and Nissho had no idea about it. Knight spends a sleepless night, only to see that Ito handles it way better than Knight could ever have imagined.