Chapter 6 The Market Society and the Value of Nothing

Key Takeaways

The way we value the market has bled into how we value everything in society and that is harmful to public policy, society and quality of life.

Gift giving is an emotional value that cash cannot measure. Economic value is commodification these days. The reality is market value is taken to mean intrinsic value (the net present value of all future cashflows). And so in the market society, they know the price of everything and (try) to calculate the value of everything.

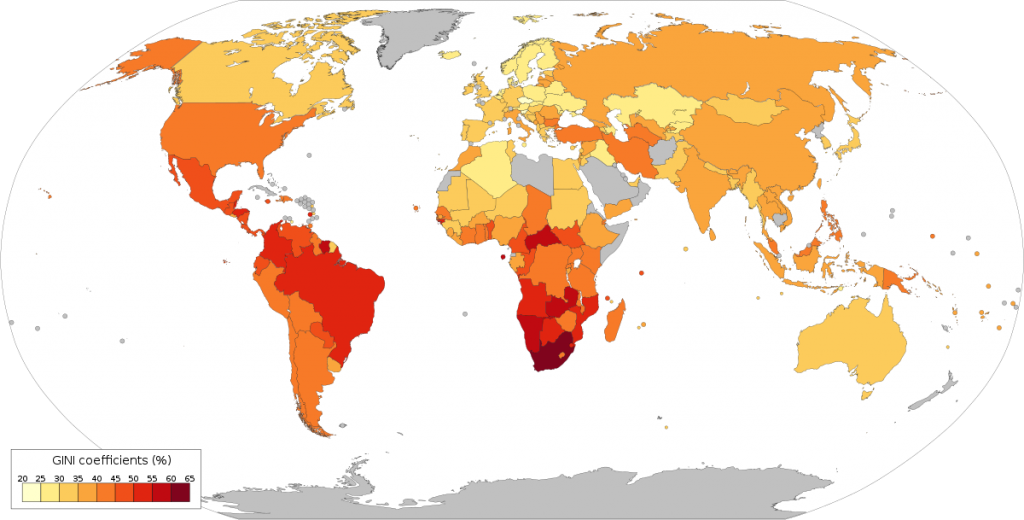

There is another way to view reality. Relative equality is better for society, more opportunity distributed to as many people as possible is better for GDP and for happiness within society. Inequality has a negative impact on economic growth. 1% Gini-point increase in inequality leads to a 6% increased chance that economic growth will fall in the coming year. Carney pulls out some social science research (warning: difficult to base conclusions on data science that involves human subjects as we aren’t always rational and will defy expectation because we are awesome creatures!). Carney shows that inequality is bad based on the IMF research etc…over the long term. In the short-term, inequality is shown to be positively correlated to GDP growth.

Carney believes that happiness is the key to life, not just money. He lists the keys to happiness:

- Mental and physical health;

- Quality of relationships;

- Sense of community;

- Job satisfaction;

- Income/money;

- Society status (freedom, government performance, peace)

A little bit of money to the less well off can truly boost GDP. For example, after about $75K USD a person’s happiness is not necessarily improved with that much more money according to Milanovic’s Capitalism Alone. Happiness does not equal just prosperity. John Rawls veil of ignorance as in, if you were born again but didn’t know under what circumstances you were to be born, what kind of societal arrangement would you want….is the marker that Carney supports.

Carney argues that Freakeonomics is incorrect when their authors argued that economics is morally neutral. Carney believes that economics is moral. He’s in good company. Adam Smith and Socrates also believed that economics is a moral science. Whether economists realize it or not, they typically are trading in a utilitarian approach of some variation: “to maximize the greatest benefit to the most people”. Utilitarianism is about the happiness of the most number of people according to Bentham. Carney’s point here is that economic growth maximization is not necessarily going to lead to the best welfare outcomes in society. There is a risk as Milanovic argues that the endpoint might be “utopia of wealth and a dystopia of personal relations.” page 137, Value(s).

Carney asks, what about:

- Distribution of the gains and losses or

- Unpriced benefits and costs related to the dignity of life…..

Carney believes the social capital (altruism, supporting each other, sharing) has been crowded out by economic capital, selfishness. John Kay’s approach is useful here. That the pluralism of capitalism enables a) creative trial and error testing of ideas where the bad ones disappear, b) entrepreneurial energy is focused on wealth creation rather than value capture/rent-seeking.

Capitalism is the best way to organize society. China and Russia are have capitalism without democracy. A political capitalist society has 1) an efficient technocratic bureaucracy, 2) rule of law, 3) autonomy of the state.

What was needed to build on the capitalist foundation is:

- A competitive nation state in the form of Thomas Hobbes’ Leviathan. A state could ease these fears;

- The rise of the liberal state with a professional class of bureaucrats/civil servants;

- The welfare state from Bismarck to LBJ’s Great Society;

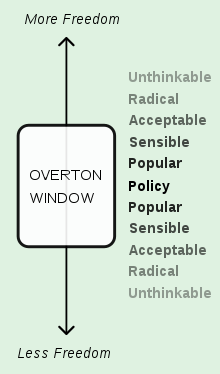

- Thatcher and Reagan’s revolution unlocked dynamism at the time. For Carney, red-tape, state ownership of commercial businesses, extensive regulations and the states interference in the markets needed to be shaken up. Pro-market ideas shifted the overton window such that the market society became conventional wisdom for Carney as he started out his career. Inequality rose and economic dynamism did as well. The right thinks the state gives too much where teacher unions are prioritized over students and the left thinks the state gives too little with small state arguments to push special interest groups. It’s a false framework.

The Tommaso Padoa-Schioppa Doctrine:

Carney worked with Tommaso Pado-Schioppa as the Italian Minister of Finance at the IMG/World Bank Annual Meeting in Dubai in 2003. His argument was that if the market is deep and liquid it will move towards equilibrium or that the market is ‘always correct”. Tommaso said that this ideal had gone too far. He argues that ”when we grant an entity infinite wisdom, we enter the realm of faith.” page 135, Value(s). In short, policymakers should not simply take their orders from the masters of the universe, the market is not infinitely wise. His major contribution is that:

- Separation of linked spheres is healthy: The church and state should be separated because these two aspects of life ought not to contaminate one another because when they do it is depravity.

- Political and economic activity is also linked but also separated. They may determine the fate of the other power and wealth and…..

The Social Contract is Breaking Down:

As Michael Lewis explains to the Princeton graduating class “Success is always rationalized. People don’t like to hear success explained away as luck – especially successful people. But you are lucky to live in the richest society the world has ever seen, in a time when no one actually expects you to sacrifice your interest to anything.” (page 138,Value(s))

Equality of opportunity has fallen as well. Social mobility:

Gatsby curve. People who get rich generation by generation versus nouveau rich.

Why It Matters:

Carney argues for creating a foundation of inclusive capitalism:

- Dynamism: The dynamism is essential;

- Sustainable: To align incentives between generations, there needs to be sustainability;

- Trusted: Markets need to be fair in order to be effective and trusted;

- Accountable: Individuals must be responsible or accountable for their choices.

- Solidarity: Citizens must recognize their obligation to each other, there is a need for solidarity.

The Financial Crisis revealed:

- Major banks were treated as too big to fail with a “heads I win, tails you lose” mentality;

- Market benchmarks were manipulated for personal gains;

- Equity markets support the technologically empowered over the retail investor.

Commodification or Hyper-Capitalist Society that Carney would like to Fix:

- Erosion of the trust.

- Money is not that glorious.

- Cheating in sports.

- Companies typically create shell companies.

- There are forced sellers.

- Traders only care about money, a crisis of culture.

- Voluntary system: payments take away the moral system. Money doesn’t solve all problems:Israeli day-care fines story: the lateness fee actually gave parents the license to be lade.

- Paying a child to read makes the act of reading work..

The thesis of the book remains: “How do we learn to be moral again?” – Rabbi Jonathan Sacks with a sprinkling of:

- We need to grow our civic virtue: Civic virtues are grown, not drawn down. Nicomachean Ethics by Aristotle talks about cultivating virtue with practice…like a muscle that needs to be exercised regularly.

- We need a scorecard of value: Cass Sunstein’s scorecard competition for all the values that are beyond capital but aren’t calculated in economics or aren’t valued.

- We’re measuring value incorrectly: The idea that value is measured by the sum of all market prices it’s just wrong.

- Pragmatic centrism: Joe Biden says “don’t tell me your values show me your budget” Carney’s solutions are readily presented in this section but you have to expect that involves money being redistributed while presenting his investment banker credibility as amenable to incremental rather then radical and ineffective revolutionary change.

Analysis of Part 1 and Chapter 6

- The citations are extensive because the claims are more normative (what ought to be the case). We have to wonder, finishing off this section, we should appreciate the analysis but where are the solutions; Woodrow Wilson might have stayed vague about the League of Nations but the hope is that Carney will delineate how you get a trader to “be more moral….”

- Just as Carney takes us on a winding and fascinating journey to show that ‘money is a proxy for value’ so too does he inch by inch explain that ‘more money tends to lead to more problems after a certain individual threshold’ in this chapter.

- While the claim that inequality in Ireland went down and the economic growth went up is obviously a data science play. There is no way to know for certain with statistically expressions which cannot reflect the complexity of reality, that inequality declines lead to increased GDP. The thesis is political which by definition means that because it was applied across the entire sample (a country) we cannot validate that inequality is the independent variable (decline in inequality) that drove the dependent variable (rise in GDP). So it is in the realm of “I don’t know if for a fact but I know it’s true.”

- He has not read the Subtle Art of Not Giving A @$ck and others who view happiness as highly overrated. There is a strong conservative (perhaps) streak that says that the kind of thinking that focuses on making life easier, happier truly ignores the importance of cruelty, fear and unhappiness which can also serve to drive GDP or meaning in one’s life…in the proper dosage per person.

- How fair is a financial system that allows for people to put cash that they have saved up or inherited or otherwise to put that cash into the market and then get more money in exchange for risking that capital?

- “Greed, for a lack of a better word, is good.” Michael Douglas in Wall Street

- Cue Matthew McConaughey in The Wolf of Wall Street.

- Carney worked at Goldman Sachs…where is the long list of transgression of that firm?

Citations Worth Noting for Part 1: Chapter 6:

- John Maynard Keynes, The Economic Consequences of the Peace (London: Macmillan, 1920).

- Joel Waldfogel, Scroogenomics: Why You Shouldn’t Buy Presents for the Holidays (Princeton: Princeton’s University Press, 2009) and the “The Deadweight Loss of Christmas”, American Economic Review 83(5) (1993).

- Michael Sandel, What Money Can’t Buy: The Moral Limits of Markets (London: Penguin, 2012).

- Johnathan D. Ostry, Andrew Berg and Charalambos G. Tsangaride, “Redistribution, Inequality and Growth” IMF Staff Discussion Note (April 2014).

- Abhijit Banerjee ad Esther Duflo, “Inequality and Growth: What Can the Data Say?”, Journal of Economic Growth 8(3) 2003. Growth and inequality are non-linear.

- Shekhar Aiya and Chistian Ebeke, “Inequality of Opportunity, Inequality of Income, and Economic Growth’ IMF Working Paper No 19/34 (15 February 2019)

- Albrto Alesian, Rafael DiTella and Robert MacCulloch, “Inequality and Happiness: Are Europeans and Americans Different?” Journal of PUblic Economics 88 (2004).

- Richard Layard, Can We Be Happier? Evidence and Ethic (London: Pelican Books, 2020).

- Brank Milanovic, Capitalism Alone: The Future of the System that Rules the World (Cambridge, Mass.: Belknap Press, 2019).

- Steven Levitt and Stephen J. Dubnet, Freakonomics (William Morrow and Company, 2005).

- A. B. Atkinson, “Economics as a Moral Science”, Economica 76 (2009) (issue Supplement S1).

- Cass R. Sunstein, The Cost-Benefit Revolution (Cambridge, Mass.: MIT Press, 2018).

- Tommaso Padoa-Schioppa, Markets and Government Before, During and After the 2007-20XX Crissi, Per Jakobson Foundation lecture, Basel, 27 June 2010.