Chapter 2 Perspectives of Value – Subjective Value

Key Takeaways

The last chapter was about objective value and this chapter is about subjective value which Carney shows is how the world operates today.

The central question in this chapter is: if beauty is in the eye of the beholder, is the same true for value? Subjectivity is the demand and supply way of deriving a price which is a biased perspective of any individual actor as it pertains to any commodity.

Damian Hirst created an art piece that showed that the act of valuing is art itself. The value of money and the value of art collides. Morris, the director of the Tate Modern, made a plea against blockbuster art installations and instead emphasized the British art that Tate holds in ‘trust for the nation.’ Morris’ view was that you can’t really value art but you still have to pay for it. Tate Modern is a social space not a marketplace…..

The emergence of the Neoclassicists is critical to our understanding of value. In short, the value of a good is in the demand and supply of that good itself and not in the labour as the classists (Smith, Ricardo, Marx) argued.

The utility of goods; they are good for something equals their value. Carney discusses a group of early neoclassical thinkers:

John Law (1671 -1729)

- Demand and supply defines the price of a good or service was the concept developed by Law.

- Set the standard for a price being the measure of the goods utility.

- John Law has a pretty fascinating rise and fall.

- He famously developed the concept that water and diamonds show that price is based also on the subjective utility of the item. Water versus diamonds in a desert for example.

- Utility is reflected in the buyer’s willingness to bid at a given price.

John Stuart Mill (1806 – 1873)

- JS Mill demonstrated that the value of a commodity is the price just sufficient to carry off the existing supply.

Marginalism was the major breakthrough that ushered in the neoclassical view for Carney. Marginalism asks: What’s the particular availability of the good in a given time and place? That’s what matters! It’s the marginal value, stupid. Not total supply but available supply. For example, you are willing to pay for a pair of shoes at $100 instead of the $60 retail prices because it’s convenient. And so you are then also willing to pay another $80 for a second pair for the weekend. The consumer surplus is $180 – $120 which is the retail price x 2 pairs = $60 is considered the consumer surplus. A third pair of shoes would be valued at $60 which totals $240 – $180 which is the retail price x 3 pairs = $60 consumer surplus. The value of each subsequent pair of shoes changes in a judgement. The more ice cream you have the less each additional scoop is valued and in computer coding, the best coding is not developed by more and more developers in the Mythical-Man-Month i.e. the law of diminishing returns.

Carl Menger (1840 – 1921), William Jevon (1835 – 1882) and Leon Walras (1834 – 1910) capture this view best. They argue that value does not exist outside the consciousness of human beings and thus is subjective. If this is so then, an environmentalists value of a tree and a lumber jacks value of that same tree can be wildly different. And that reflects the reality we live in. Human beings live in the moment and do not price based at the system level. So Walras tried to include a system level view but no one really cared.

Carney however goes on to explain equilibrium of markets of exchange where all marginal benefits and costs are equalized. Utilitarianism is developed to maximize the greatest good for the greatest number of people, popularized by Jeremy Bentham (1747 – 1832). John Stuart Mills saw that life is more than happiness but the pursuit of meaning and the ability to get things done.

Carl Sunstein

He believes that cost-benefit analysis is more complex, especially for goods and services that aren’t generally priced. Totally obvious and true. Except that “animal welfare” and “access to public buildings” are examples of subjective values that Sunstein is biased towards and as a member of the Obama administration would be advocating for without capturing actual preferences beyond representative democratic processes which are highly flawed. Carney shows that there is a knowledge problem with knowing what people value beyond simple price discovery and transaction price. Much of the most valuable things in life aren’t measured in capital terms. “Money is a proxy for value.” – Professor Nerdster. There are efforts to measure what people value: randomized control trials, retrospective analysis and other strategies to measure what money can’t buy but it is rather wanting with current data science technology and the lack of control groups….in real world settings.

The value of life is not easily measured either. It’s priceless, obviously. We can’t really measure the value of the person. So Carney shows that we aren’t really going solve this problem of how to value things….

So Carney pivots here. He explained objective value and subjective value. Now he will explain how the fact that today, there is no underlying, fundamental or intrinsic value that isn’t already reflected in the price of a commodity, and that markets define value and demand and supply expresses that value but that this is very flawed. Carney will argue we are mispricing at a societal level the things that are most valuable.

Mariana Mazzucato (1968 – present)

Describes the dangers of performativity “how we talk effects behaviour” she would like you to believe what she believes. She wonders are shareholders as the biggest risk takers or is it actually the employees? Anyone can call themselves a value creator and so this is limited term for value creation.

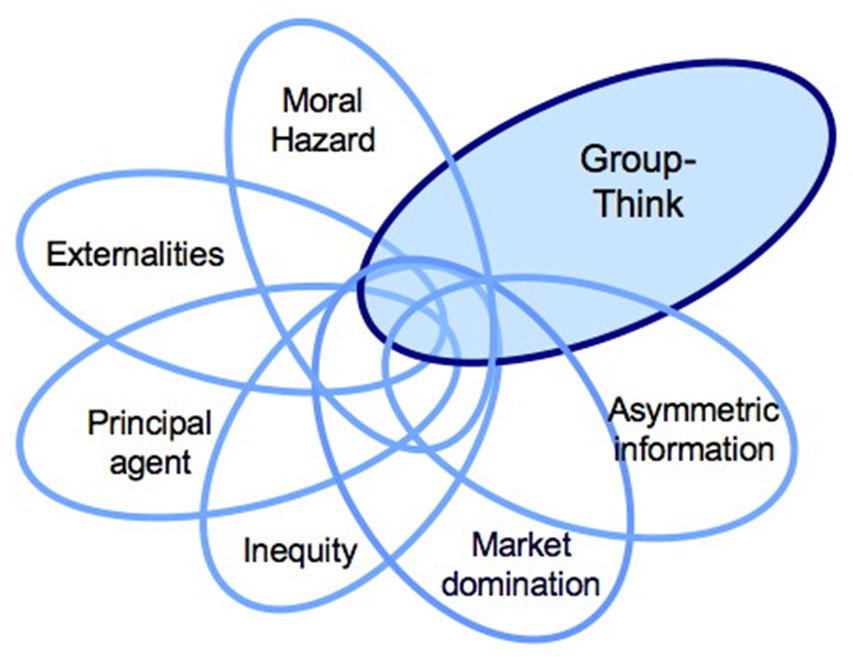

There are four consequences of the victory of the subjective values system:

- Market Failures;

- Human Frailties;

- Welfare of Nations;

- The Theory of Market Sentiments.

On Market Failures

Economist are bad are creating generalizable theories because humans will defy expectations, reality is more complex, hence Keynes’ famous claim that there are madmen in authority who are typically trying to distill academic writings into practical decision-making. Reality of unpredictable human behaviour will screw up academic theory in the following ways:

- Oligopolies or Monopolies: which are operated by self-interested people and this distort reality, surprise economists since monopolists are like most people, semi-rational. Monopolists are rent seekers in a world where the free market is not realized according to Adam Smith…

- Externalities: failure is socialized and profits are individualized / privatized. Environmental externalities aren’t calculated. Externalities show the limits of property rights. Trust (of the system of valuation) is critical for market functioning. Social capital needs to be nurtured for human capital to grow.

- Incomplete Markets: when financial firms are hedging risk, they assume they have access to the complete market. That error can lead to major financial crises and have impacts that are not directly connected to the financial system.

On Human Frailty

Humans are only rational when they are dispassionate about the outcome. We tend to support past decisions believing them to still be good. Subjective values are more important. We value the present much more than the future. We tend to value distant issues at a lower rate. We didn’t invest in pandemic preparedness or care homes. Banks didn’t build up enough buffer to avoid the financial crisis; moral hazard. Carney refers to these human frailties as the tragedy of the horizon. The environmental catastrophe that Carney believes is coming could and should be avoided through actions now.

- The value of a human being during Covid was ‘priced’ higher level then generally accepted by actuaries. Seniors with x years left to live were priced much higher then a subjective value approach would suggest.

The Welfare of Nations

- As has been described in chapter 1, Carney is trying to hit home that subjective value does not distinguish between productive and unproductive value creation and rent-seeking or value capture. Everything priced is in the GDP calculation but there is a lot missing there. And what has value today is not valuable in the future necessarily. Diane Coyle saw that finance was revalued as important in the economy due to statistical changes in how GDP is calculated which has now included finance in economic production. Standard GDP of the government was just the salary of government employees for the longest time.

- It is painfully obvious that healthcare workers are paid a salary which can be measured but Carney recommends measuring the workers ability to save lives.

- Well-being or happiness is not being priced and therefore not being valued. If markets were perfectly efficient and people were rational and there were no transaction costs then the sum would not maximize welfare because again “capital is a proxy for total value.”

- Distribution matters for welfare, when there are large benefits that aren’t captured by monetary figures. Even if losers lose and gainers gain in welfare terms. An extra 1000 matters not for Zuckerberg. Small gains or losses for the wealthy but for the least well off, it is material.

The Theory of Market Sentiments

In a society that rewards value capture, our social psychology will adjust accordingly, as per Adam Smith’s view of the desire to be well-regarded and well-liked. The problem is much more about what is not measured. Carney asks:

- If it is not priced is it not valued?

- Or is it possible that market value will increasingly become the measure of all things?

- By changing how we value, can we change our own values?

- Or will subjectivism destroy intrinsic or objective value? It does that now!

Analysis Part 1 and Chapter 2

- Theory (7/10) and Reality (8/10). Basically, utility or labour that defines the value of things doesn’t really matter. Both objective and subjective value are a factor in my view and varies per person. But subjective value is central in the financial sphere that Carney has succeeded in.

- Carney considers social media a monopoly…which is highly suspect. Facebook is not really a monopoly…I can pick up the phone and talk to friends…we should all try that more often.

- Carney’s view that healthcare workers should be paid by how many lives they save shows a lack of understanding of healthcare and clinicians. How do you show the causal connection between clinician inputs and better outcomes is very complex. Sometimes a clinician’s action results in a patient’s death and other times a patient is really going to die even with herculean efforts. To try to explicitly connect cause effect and provide a reward to clinicians on the basis of lives saved is not well thought through…

- Carney is preaching to a very small group of possible readers, there is the Liberal Party hopefuls that would like to see him as finance minister and then Prime Minister just based on his competence and then there are finance specialists or Bank of Canada, England types who will enjoy his approach. But Carney’s Value(s) is challenged by the fact that his bullhorn is a lot smaller than he seems to realize, he’s not going to be changing the way society values things without stepping into leadership in the Liberal Party….or making a documentary like Niall Ferguson. Politics is fraught with difficulties, sacrifice and mixed results.

- Mark Carney references British sterling and not Canadian dollars, I think if you read between he lines, his examples are very British, perhaps he is not serious about the Liberal Party of Canada.

- Carney doesn’t have a serious view on healthcare workers instead he’s making an abstract point over and over again, that what we value more and what we price are disjointed: ie “money is a poor proxy for value.” But put Carney in the role of a hospital administrator managing a budget and suddenly…nurses are paid reasonably.

- Carney mentions Carl Sunstein, whose work in the Obama White House included an effort to measure whether a law makes people’s lives better…um, cost-benefit analysis is important, I wonder if Sunstein is Carney’s friend here? Again, we could summarize this entire section as money is a poor proxy for value.

- If the neo-classists are correct, then the value of the inland areas above 20 feet should be more valuable if the climate crisis leads to water level increases suddenly.

- Another example of Mark Carney insider thinking.

- Did Carney know “that money is but a proxy for value” all along and did he play in ignorance until recently? Was he talking about this while at the Bank of Canada…is this a death bed confession or a political pivot? And perhaps like Bill Gates philanthropic second-career, as Carney climbed the greasy pole to the top of the organizations he operated, only then does he look down to say “hey, now that I have the market values working well for me, I should mention that perhaps market values aren’t aligned with what matters more!” Obvious but Carney is just coming around because now that he’s been at the peak of the mountain (Goldman Sachs, Bank of Canada, Bank of England) he can see it’s somewhat an illusion. How he created value was working a system that valued things in a way that needs to change…but in fairness, I’d rather have someone who knows how markets work then someone who doesn’t at all….

- Did Harvard and Oxford indoctrinate him to not realize the money is a proxy for value and a poor proxy at that? In other words, is Carney a faux capitalist or did he have latent realizations that money is a proxy for value just recently? This point is really just an echo of the above. Again, to be honest, it’s great that Carney has written this book but it also shows he has deep knowledge that can be channeled for good.

Citations Worth Noting for Part 1: Chapter 2:

- William Stanley Jevons, Theory of Political Economy (London Macmillan, 1871), p.2

- John Stuart Mill, The Principles of Political Economy (Batoche Books, 1848/2000), p.517.

- Diane Coyle, GDP: A Brief but Affectionate History, revised and expanded edn (Princeton: Princeton University Press, 2015), p. 108.