Chapter 5 The Future of Money

Key Takeaway

Carney opens this chapter by admitting that predicting the future is extremely hard. And so he will be looking at the past as a proxy for how money might evolve. But who knows. The mistake is to think you were right on a prediction because your modelled assumptions reflected reality well. Just considering the changing variables between the point of prediction and the point of evaluating the prediction, if you predict something correctly, then you should admit to yourself that you were to some varying degree “thoughtfully lucky.” Admitting that is easier said than done, especially if your career (portfolio managers, pollsters, policy makers) depends on your claim of superior judgement.

Revolutions become conventional wisdom in retrospect. Democratization of financial technology is happening all around us, well sort of. Carney admits the institutions typically do not identify innovation positively, and by definition are slow or disincentivized to respond to it.

Externalities Drive Change:

Digital changes are coming, of course. Mobile telephony could change the future of money. This is why Carney is on the board of Stripe, effective March 2021. Enabling technologies, as the term suggests, allow financial innovation in every era. The telegraph to the stock ticker to the personal computer to the Bloomberg Terminal to the tablet. Cables on the Atlantic Ocean bed enabled messages to travel from North America to Europe…..the Internet ‘s instant information slowly replaced the Pits on the Stock Exchange floors, you don’t need the market makers. There are a bunch of other tools that have played a role in the evolution of finance, often in unexpected ways such as BitCoin.

History of Financial Technology:

Most prominent innovations start in the private sector then they get nationalized. The private sector is less equipped to manage currencies and the likelihood of debasement is very real as discussed in Chapter 1:

- Chinese banknotes were developed in 7th century China to avoid heavy copper coins;

- Marco Polo brought banknotes to Europe and of course debasement was a side-effect. Paper money in the 13th century was a unique innovation.

- Medici’s 14th and 15th dynasties of Florence introduced bills of exchange as a way to manage medieval trade between nations and city-states. These IOUs could be used for convertibility of banknotes into other assets.

- The Bank of Amsterdam’s 17th century innovation of fractional reserve banking also expanded the risk of debasement once again

In 1694, the Bank of England as the central bank served as supervisors of the private banks.

- The most powerful innovation is the ledger which enables record transactions, comparing balances and assessing risks.

- Deposit protection is also a nice innovation provided by central banks.

Money is changing in response to “AI”, cryptography and social media information leakage. Likes could become a ‘social currency’…they already are for advertising revenue. However, the financial system is centred on dealers hubs and payment spokes. Most of the innovation in the West is around:

- Payments such as contactless credit cards;

- Banking apps to replace branches;

- Mobile wallets….in other words, making digital what was analogue.

For Carney, Bitcoin is not the answer but the universal ledger is interesting. The blockchain subcomponent might have legs. But the incentive of contributing to the ledger in exchange for BitCoin may not be the right structure. Smart contracts could be useful. For Carney, however, the more things change the more they stay the same.

The Evolution of Money:

The underlying payment system is the same. The commercial banks are regulated by the central bank. All transactions in sovereign currencies are cleared by the central bank since commercial banks settle there. This is expensive. Payments can be slow. WeChat in China and PayTM is India cover most of the mobile transactions globally (about 90%) since most of the mobile payment customers are in China and India. Meanwhile, Robinhood may be selling trading data to large asset managers in order to front-run those trades.

So, for Carney however, trust takes years to be build, seconds to break and years to rebuild. For Value(s), maintaining and protecting public money is critical and so Carney won’t be very bullish on cryptocurrencies by definition. His warnings are on point however.

The Grounding of Private Monetary Innovations:

These private monetary systems are worse than tulips as an asset whose subjective value was out of whack with its price. Pay attention to debasement even with crypto currencies since they aren’t even scarce in the case of Dogecoin which was intended as a joke originally.

Mark Carney’s test for a new system of Money:

- It must be trustworthy and resilient: new money should hold its value (monetary stability), and the institutions that use it should also be reliable (financial stability) and should not have outages;

- It must be accountable and transparent: protecting privacy must be sustained; ensuring finality of payments and define the rules for anonymous versus access to customer information;

- It must be democratic and not private: that forms of electronic private currencies wherein the creator of the currency controls a large block of the currency independent of a sovereign actor is not tenable…not that this precisely what BitCoin is a big F.U. to central banks and the PMC (Professional Managerial Class).

Further unresolved questions from Mark Carney about cryptocurrencies:

- Does the currency have tacit consent of the society?

- Is the currency run by a bunch of non-responsive computers or a private sector actor with narrow self-interests?

- Does the currency have the ‘unconditional backing of the state’?

- Does the currency mimic the physical transaction such that the final decision is irrevocable?

- Is the debt cleared as soon as the transaction is complete?

- Is there a public backstop if this new money fails?

- Who will back the crypto users if there is a fundamental collapse?

- Will the tulips still have some value or will the collapse be complete?

- What institutions will provide liquidity to an anonymous system?

As this line of question implies, central banks are here to stay in Carney’s opinion.

Evaluating the Three Current Options based on Carney’s Test for a new system of Money:

Two types of money according to Carney:

account based and token based money.

- Token based: have many examples for example the Yap stones to banknotes. The intrinsic value of the token is worthless but the power is institutions that back that token.

- Account based: settlement at the central banks where the payer is debited and payee is credited. This hasn’t changed since Amsterdam. 95% of all transactions are account-based.

There are two tiers here: private/commercial banks create private money by making new loans.

These loans are supported by capital and funded by deposits. And the commercial banks settle with the central bank.

Argument for decentralized cryptocurrencies being more trustworthy than centralized FIAT money is four fold:

- Debasement is not as easily achieved since the total number of coins to be mined is fixed (for most coins);

- Private banks aren’t using crypto-currencies and that’s a good thing. Banks charge a commission for most of the global transactions using sovereign money, therefore anything that prevents banks for generating a profit is going to be seen as a powerful consequence/punishment for the financial crisis that spurred these crypto-currencies in the first place;

- Those who hold it are anonymous and therefore free from the ravenous eyes of tax authorities etc.

- There are fewer intermediaries with a ledger that is publicly available for all to see rather than a ledger managed by a central bank.

Cryptocurrencies and the Role of Money:

cryptocurrencies don’t meet the requirement of the role of actual money:

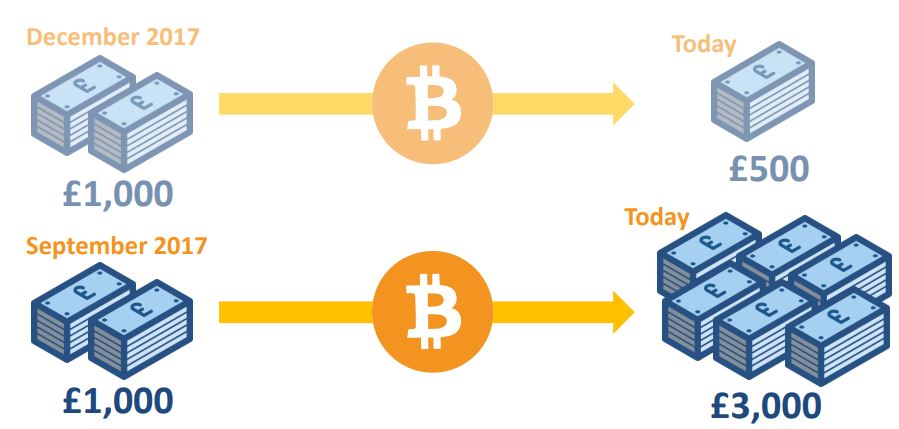

- Massive fluctuations in the value of the currency is a bad sign. BitCoin has a standard deviation of 10 times that of the British pound, therefore it is not a stable currency at all and highly susceptible to manipulation;

- These currencies do not have intrinsic value or backing from a central bank, obviously;

- Debasement happens when a crypto-currencies fluctuate in a debasement-like manner (i.e. the lowering of the value of a currency) even though their intention is to prevent ‘arbitrary printing’ of currency;

- If all global money was BitCoin, then the ability for society to overcome a depression would be severely hindered based on its non-responsive design;

- New issuance of crypto-currency is not in response to a reflection of an underlying asset or even an approximation of the economic reality that currencies ought to reflect;

- Few retailers use these currencies. There is no demand to use the currency as a medium of exchange based on these unstable prices;

- Transactions are slow, Bitcoin is 7 per second, Etherium 25 and mining (which is the proof of work) is carbon intensive;

- Cryptocurrency is attractive as a castle in the sky where new investors support earliest adherents and where early adherents churn the value upwards further through advocacy;

- Concentration of ownership and or holding is a problem (debasement but also manipulation on an unregulated exchange: thievery), such that you can build a currency to market your particular product through and then that crypto-currency can potentially become a tulip bubble where on the way up, some investors put their net worth and then the market snaps that up at a point that is not correlated with broader NPVs but by some dude’s tweet or a major movement (caveat emptor);

- Carney believes that nations will ultimately regulate on crypto exchanges and that there would not be a coordinated effort by the FSB or other international entity;

- BitCoin is an “algorithm” and LiteCoin is a currency that many new versions split from; including Dogecoin;

- Blockchain is not proprietary for the creator therefore unlike owning a stock in an underlying company, you do not own any portion of the system that makes the currency possible.

- Still mostly about appreciation of a pseudo-currency and then converting it at the top of the peak back into USD or your local currency…There are the risks of using the currency as a digital cash which is great for international money laundering etc as long as the value continues to increase relative to USD or your local FIAT;

Mark Carney drops the A-bomb here which can be expected to be met with hostility: “Cryptocurrencies are not the future of money” page 114, Value(s). Adding to this in the Notes…”in the words of General Manager of the BIS (Bank of International Settlements), Agustin Carstens (2018), ‘Novel technology is not the same as better technology or better economics. That is clearly the case with Bitcoin: while perhaps intended as an alternative payment system with no government involvement, it has become a combination of a bubble, a Ponzi scheme and an environmental disaster. The volatility of bitcoin renders it a poor means of payment and a crazy way to store value. Very few people use it for payments or as a unit of account. In fact, as a major cryptocurrency conference the registration fee could not be paid with bitcoins because it was too costly and slow: only convention money was accepted.” (Page 546, Value(s)).

But Carney adds that they are useful for the low correlation with other assets in a portfolio and also as mentioned above this blockchain concept may have legs if the incentives and decentralization utilized properly.

Stablecoins:

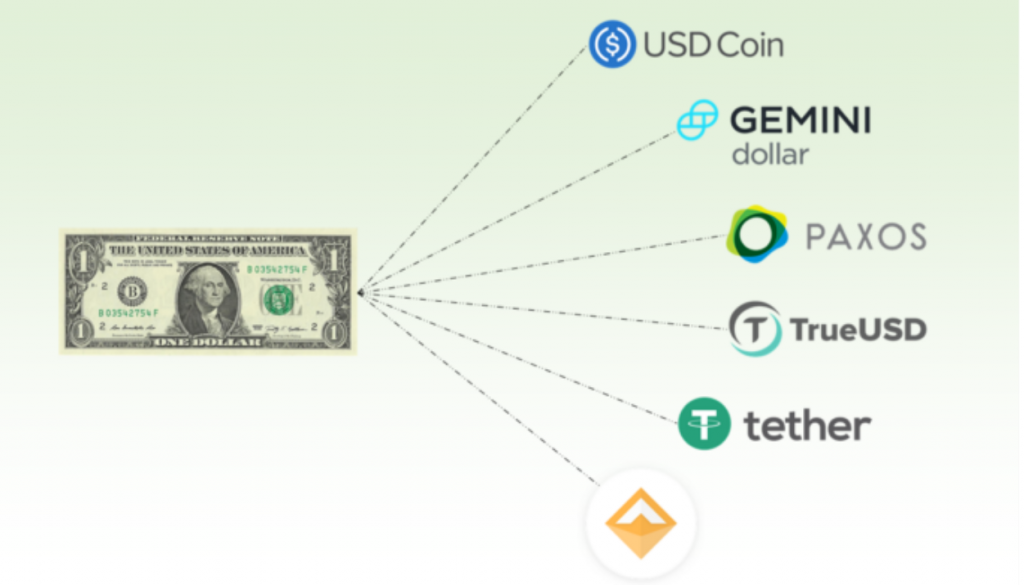

Mark Carney says stablecoins are more interesting…because:

- Retail payment across borders are expensive and that is reducing global commerce which is a shame and is due also in part to protectionism;

- There is a lack of universal access to financial services around the world both currency but other asset classes potentially;

- These stablecoins are tied to underlying assets which are typically sovereign currencies (public money) therefore it’s the best of both worlds or the worst depending on how crypto-centric your investment strategy is…;

- Basically, these crypto-currencies don’t really make much sense as new currencies themselves based on a long history of private bank currency issuance and debasements but if stabilized by being another way to pay GBP to USD with no or fewer intermediaries, then there is an ecosystem there…and he’s not talking about TransferWise or new remittance companies that capture this new efficiency, he’s talking about an end consumer decentralized coin here….of course, the paradox is always (what is the business model for someone to build and market such a stablecoin?)…Enter Facebook CEO Mark Zuckerberg….

- Tether (tied to USD) and Libra (rebranded to Diem) which is a payments system rather than a money since it derives value of sovereign currencies are what Carney is entertaining as a possible future of money IF those mediums of exchange are tied, tethered to public money….the key with Diem is that since it has a base of 2.5Billion Facebook users and about 1Billion active users (because Facebook is no longer cool), Diem could circumvent fiat money.

- M-Pesa is another example of ‘financial inclusion’;

- Note that the ledger does not necessarily have to be decentralized, ie. It could be a closed pool of miners that are protecting the ledgers integrity….

- Carney points out that Stablecoins should heed the warnings from the Bank of Amsterdam where “Debasement happens.” Binding rules matter.

The problem with stablecoins is that it still falls prey to cash on steroids (money laundering! terrorism financing! Other illicit financing!) Those things are bad for society.

Central Bank Digital Currencies:

Central Bank Digital Currencies (CBDC) are an electronic form of central bank money. CBDC bridges the divide between legal digital currencies and crypto-currencies that in time, Carney argues will be subject to being made illegal (at the exchange level principally and the anonymity is pseudo according to Carney). Currently, if we transact via accounts then we are using private bank ledgers that are fueled by the central bank. The only ‘risk-free asset’ of a central bank is the banknotes/cash in hand. CBDC is the best of both worlds: a) 24/7 payments, b) provide a stablecoin model that is backed by a publicly accountable/liquid/operationally sound solution of which work is slowly being developed.

Carney recommends a two-tiered system where consumers have an ‘indirect claim’ to the CBDC through a private bank or digital wallet (Apple Pay or Facebook’s Calibra). Central banks would supervise these wallets with integrations into smart contracts, and if the customer agrees, to better data pooling for improved digital services. Carney figures this is the efficiency gain such that paper money can be phased out (seigniorage: the value of that currency versus the cost to produce that currency). Carney believes there is true value here, consumers would be able to access the risk-free asset digitally….

The questions for CBDC are:

- if consumers can’t convert their holdings would the government back them? Oh yes! Like current deposit insurance.

- Would there be a risk of a CBDC Sterling being worth more or less than actual banknotes?

- Would you try to create a token currency or an accounts based currency? Central banks would want an accounts based solution.

- Why not allow every citizen to have an account with the central bank? Because then there would be massive shifts of capital from commercial banks into the central bank during a crisis. It would also undermine the commercial banks as intermediaries.

- If interest is paid to the CBDCs then it would be attractive to be paid in CBDC however, it would weaken the dealers in the banking system…a bit of a problem there…But it would also allow the central bank to neatly charge “negative interest rates” which is currently mitigated because cash yields zero or slightly negative interest when taking storage costs into account. So is CBDC solving the right problem here?

- Famously negative interest rates would make holdings in accounts less attractive and make putting money under a mattress a better move for consumers…

- There is also the Know Your Customer implications of CBDC, prevents money laundering, terrorism could be tracked etc…

- Under what circumstances could customer data be accessed?

- Would it be to the benefit of better targeting customer services for consent?

- The big elephant in the room with CBDC is that the central bank would be crowding out investment dollars from private investment projects…

Carney then shifts his attention to musing about the social credit system in China. Just mentioning it really. Instagram and YouTube stars who are creating value that is underpinned by advertising revenue/marketing.

Trust is Key:

Money must be “resilient, responsible, transparent, dynamic and trusted” (122, Value(s)). Trust in independent institutions is paramount. The default situation is much like democracy, the public will cede control in exchange for the economic and financial stability that central banks facilitate. For Carney, the key is to spot the difference between good innovation and mediocre snake oil. The 2008 crisis triggered a revolution in crypto-currencies but the real value of money is in the public trust with central banks.

Analysis of Part 1 and Chapter 5

- Carney suggests that cryptocurrency could be made illegal. What would that legal mandate look like? What would be the justification? As long as there are some decentralized bit-torrents working away then its had to close that down.

- If something doesn’t make sense, then it doesn’t….the alignment of greed with altruism (replacing central banks who ‘arbitrarily dispense currency’)

- Mark Carney misses an opportunity in this chapter to illustrate the concept of objective value in the digital age because blockchain ensure, through computational “proof of work”, that a transactions on the ledger is the true transaction, making blockchain highly trust-independent / decentralized. This act of mining ie. proof of work is an example of objective value as it is autonomous labour that is engaged in the proof of work! Adam Smith would be proud for a micro-second but then realize the value is ledger itself. Review this industry standard explanation of cryptocurrency here for more details.

- The playroom to fiat is not to have computers decide the supply of money but rather independent data points that cannot be games that are connected to real economic demand.

- To look under the hood of Bitcoin and other crypto-currency might highlight that the market is subject to massive manipulation by Elon Musk for example as well as investors who got in early who then reinvest with their massive winnings are much the higher prices in order to further churn-up the currencies value.

- It appears correct that monetary institutions aren’t just powerful arbitrarily, they are powerful because they facilitate the financial system, stupid! The evolution in money is a product of a back and forth between private innovation and political and economic responses to those innovations.

- The criticism of the Professional Managerial Class who may or may not be “rich” off the back of their central banker or commercial banker role is an important concept in BitCoin. Those who are not in the PMC, didn’t complete the Charter Financial Analyst exam or didn’t get a PhD in economics and instead mined BitCoin frequently point out that the PMC-types are the croaks and that the miner of BitCoin who are trying to replace FIAT currencies are the ones who driving the Ferrari (too bad there are some suckers buying at the wrong time building castles in the sky….).

- Carney seems to overlook the fact that there’s a venn diagram between the actions of central bankers and the commercial bankers whose butts needed to be saved during the financial crisis. The lender of last resorts is imbedded into an infrastructure that does not directly assist individual citizens but rather realizes on intermediaries (commercial banks) which have their own self-interest at heart as well as their customers to varying degrees. The ire of the general public was that these experts had screwed up and walked away while the public had to pay in various formats: a) declining economy, b) houses underwater, c) quantitative easing that served to debase salary in real terms etc. Who made Carney the master of the universe turned public sector enabler? Are his motives subject to unconscious bias about who deserves to be bailed out? In times of crisis, central banks typically operate with a friend and social network of adjacent private sector allies looking to keep the arteries of the financial flowing with liquidity with means to distributing financial relief to small business owners, employees etc…There is no helicopter of money or universal basic income but rather the academic central banks biases at hand. With Bitcoin, ostensibly the trust is in the ledger itself. It’s flaw being it is complete untethered to economic activity.

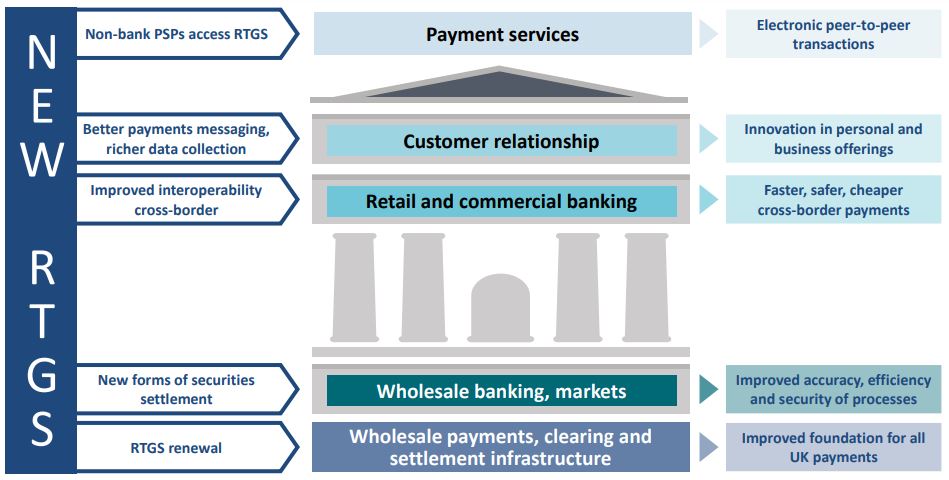

- RTGS and the APIs to the PSPs (alternative payment providers) have started to take off via Carney’s leadership as the Governor of the Bank of England. I would say he is open to such progress, and able to mitigate the detractors within the monopoly to effect incremental change.

- The emergence of crypto-currencies which currently operates as assets (despite having no net present value of future cashflows) or tulips rather than actual currencies is due to an alignment with greed and altruism. Greed in the sense that the value of the currency enables a tulip bulb increase in valuation that can be sold to the next fool in a highly liquid market. Altruism in the sense that the currency proposes an alternative to public money which is not trusted. Of course, the flaws in a bit-torrent type decentralized ‘central bank’ are myriad: slow transaction speeds, security risk at the doorway between the blockchain and the transaction interfaces, environmental costs to mine these coins but I know a few people have really gotten rich just be doing something that seems ‘stupid’ and not fit for the purpose it was intended for. Ultimately, crypto-currencies most ardent defenders have the value to prove it worked for them, unless they lost on those transactions…

- One gets the impression of castles in the sky, but there are a lot of people who made great wealth by selling castles in the sky and got out before it collapsed.

- Mark Carney’s interest in protecting public money seems self-interested but it is also system-interested. If you consider the last 4 chapters, this one is well placed to be an “oh, yeah” moment. Money is about reflecting scarcity of measurable goods and services whether via the classists (objective value) or neoclassicist (subjective value. Competing cryptocurrencies are less obviously about values but the narrative that central banks are evil is a nice marketing strategy here.

- At first, I wonder why would Carney bother with a crypto-currency at all if all you are doing is further enriching and empowering the existing interests. He has identified the real problems in finance, intermediary costs, lack of global transactions without onerous fees. Some of this is about avoiding government tax however, Carney wants to take the fun out of this crypto-revolution and keep the practical benefits. Makes sense from his standpoint.

- If the private sector drives innovation and then public/government sector nationalizes that private sector innovation then is there a risk that the private sector will be dis-incentivized to create in the first instance? Probably not, because risk reward is not that simple and also there are select nationalizations that occur where either the profit margins are too small to deliver the service such as rural telecoms or there is the risk of not nationalizing being greater than the risk of allowing private interests to exploit the innovation to the determinant of society. With crypto-currency, such nationalization is hard to implement however so Carney is more an advocate of steal the good ideas and let these crypto-currencies die on the vine.

Citations Worth Noting for Part 1: Chapter 5:

- John Maynard Keynes, The Economic Consequences of the Peace (London: Macmillan, 1920).

- Hyman P. Minsky, Stabilising an Unstable Economy (New York: McGraw Hill, 1986).

- The Future of Money speech by March Carney, March 2, 2018: PDF slides: https://www.bankofengland.co.uk/speech/2018/mark-carney-speech-to-the-inaugural-scottish-economics-conference

- Ben Broadbent, ‘Central Banks and Digital Currencies,’ speech at the LSE, 2 March 2016, https://www.bankofengland.co.uk/speech/2016/central-bank-and-digital-currencies

- Curzio Gianna, The Age of Central Banks (Cheltenham: Endwatd Elgar, 2011).