Chapter 3 Money, Gold and the Age of Consent

Key Takeaways

The Bank of England holds $180 billion worth of gold bullion which has been pulled out of the earth from the Canadian arctic or South Africa brought to London and put in a vault…back…into the earth. At one point, as will be illustrated, gold was money and then we had gold backed money and the central banks engaged in the selling of gold to each other and now under FIAT, it no longer has the value that it once did. The gold is held at the Bank of England because it was the promissory basis of banknotes such that a person would walk into the Bank of England with a banknote and receive a clip of gold in exchange.

Money is subjective value. We can all agree that money is better than bartering. But money is a social convention, it is an IOU. But what is money for Carney:

- One, banknotes now only account for ¼ of all transactions. In the 1950s, people were mostly paid in cash so it was more like ⅘ of all transactions.

- Two, electronic reserves and to settle transaction, every transaction is finished with the central bank as the commercial banks settle daily. At the central bank they complete the settlements with commercial banks at the end of each business day and we have come to trust it.

- Three, fractional reserve banking and Medici style technique of money management have been crucial to making money so versatile. Sweden’s Riksbank was the first central bank. They only keep a fraction of the currency. A run on the bank is what created institutions of private money, and safety nets and depositors insurance.

Public Institutions Underwrite Money:

Central banks have unlimited currency resources. Being well run is hard but necessary for a central bank. The private financial sector has high expectations. The commercial banks make money making a loan and new money enters circulation. Credit = trust.

The Debasement of Money, A Classic Paranoia:

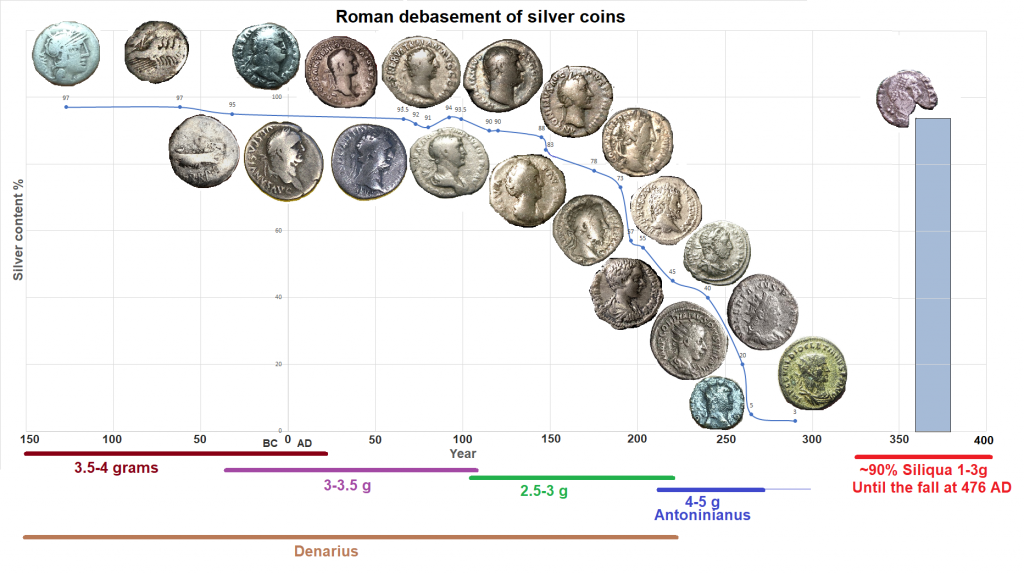

The debasement of money in the Roman Empire etc was a major problem in currency devaluation as the banknotes are typically very cheap to make and the temptation to print more than the economy requires is always strong. And ultimately, the temptation to over print or over create is followed by the reminder that such a decision causes inflation and debasement.

Private money collapses happen gradually and then very suddenly…in a pattern of promise, trust and then disillusionment, according to Carney.

The Bank of Amsterdam:

The Bank of Amsterdam started a revolution in banking created a bank of money, confidence was maintained. Its ability to be the central bank, the lenders of last resort was secure. Then the Bank of Amsterdam became heavily invested in the Dutch East India company (VOC) and there was a run (where depositors all demand their money at the same time) and the bank collapsed. Transparency was critical. You need purpose, transparency and accountability to get people to believe in your bank and there is always a risk you will destroy that trust.

Free Banking Era in the US (1837 – 1863):

Free banks were rogue US banks before the central reserve banks were established in 1915. These free banks would reduce the gold held to back their commercial bank money that they issued, thus debasing their own rogue currencies that were issuing notes. And their value varied in the market like an unstable asset. Guarding against debasement was too difficult. The solution was to develop FIAT currencies and a central bank that would act as a lender of last resort should liquidity dry up. The central bank concept pioneered by the Bank of Amsterdam would be implemented in England (1694 to present) and backed by institutions led by institutional independence with the ability to set out monetary policy.

What Backs Money?

Metal-backed money was problematic since there was an unsteady supply of precious metals. Silver and gold coins were the medium of exchange in the Roman empire and the shortage explains why the Roman coinage outlived the Roman empire. Roman coins were used into the Charlemagne era (768 – 814). The Spanish learned the hard way that getting gold money did not make you rich: if the supply increases at a greater rate then the consumer price index then purchasing power decreases ie. inflation.

England’s Financial Revolution:

The Glorious Revolution 1688 in England and the success of the Dutch as a global power triggered a financial revolution.

- First, the founding of the Bank of England in 1694 as a joint-stock company plus its focus on monetary management and the creation of banknotes enabled it to flourish.

- Second, gold became the standard by accident. Britain moved completely off the silver and gold standard to just the gold standard in 1717. The silver and gold were paired together at ratios based on their relative availability which needed to be rebalanced. Sir Isaac Newton accidently priced gold too low driving silver into private hands. So the guy who developed calculus created the gold standard by accident in 1717. The gold standard was officially adopted in the British empire, Europe and the United States by the mid-19th century.

- Third, the Bank of England got rid of the convertibility of banknotes into gold. In 1797, there was a financial crisis and Prime Minister William Pitt the Younger suspended the traditional right of banknotes to be converted into gold by an Order in Council. Many economists, later referred to as Bullionists (David Ricardo for example), were aghast arguing that “if the banks were not required to convert into gold, they would issue too many notes, causing inflation and the debasement of money.” pg 68, Value(s) The Real Bill Doctrine argues that you can have banknotes that are credible as long as the assets that backed them could be deemed creditworthy. As long as there isn’t excessive notes issuance and any excesses were realized quickly and cleaned up, such a FIAT system could work. And in fact, it was much better since gold supplies could not keep up with the demand for new currency…BUT then the Bullionists prevailed in 1821, the gold standard of convertibility of banknotes into gold was reinstated up into the First World War. Since gold was limited, the only way to support commercial expansion at the required rate was the allowance of new (joint-stock taking banks) that permitted and provided loans for investment.

- Then in 1844 the Bank of England was granted a monopoly on note issuance and became the bank of last resort for commercial banks that failed. There were conflicts however as there were balance of payments forces which required higher interest rates while domestic banking problems required lower interest rates.

- The de-politicization of the Bank of England occurred in the modern era in 1998. Setting a target of 2% inflation and then handing the operational controls to technocrats that are independent of political short-term interests. That has been a significant change for BoE which Carney himself led.

International Gold Standard:

The Franco Prussian war of 1870 was a turning point for the gold standard. The France, Russia and Austro Hungary all halted convertibility of banknotes into gold. Thus, Britain became the superpower that continued to support the gold standard. Path dependence leads to the most powerful nation imposing its standard on the rest of the world within 150 years. A standard that was accidental. Today, the US and China are deciding the future of currency globally in this same way.

Workings of the Gold Standard:

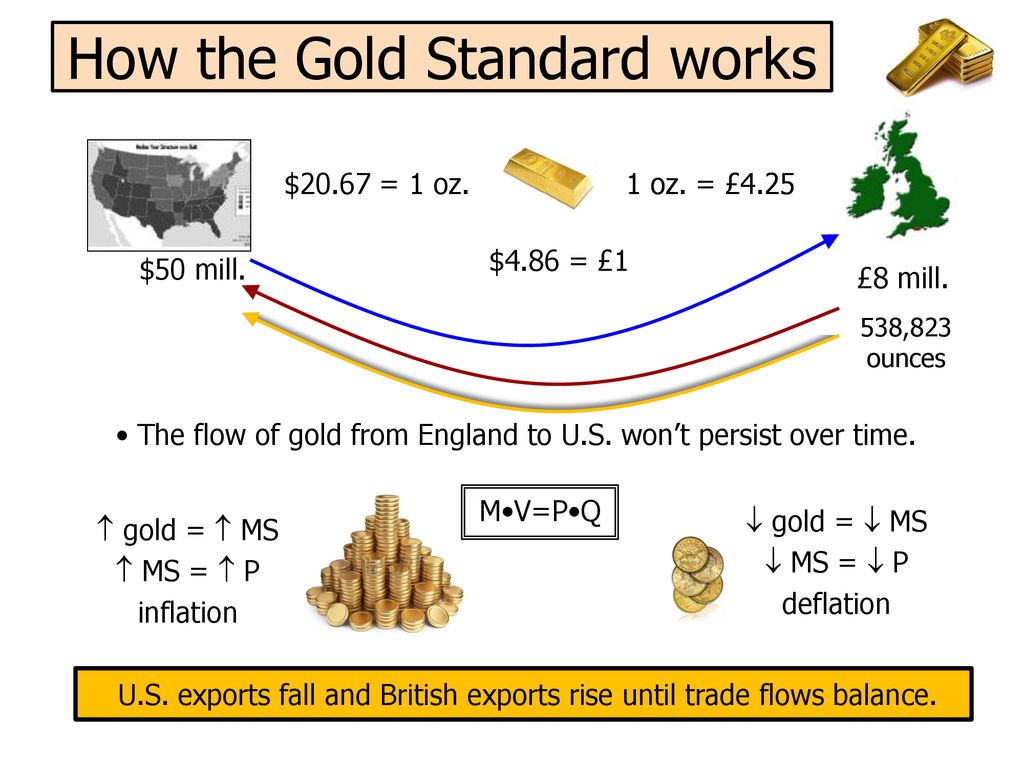

David Hume (1711 – 1776) described the gold standard in international trade:

1) The goods are exported,

2) the exporter of those goods receives payment in gold and then,

3) that gold was minted into a coin locally,

4) The importer buys that good and pays with gold…..

In the trade deficit (importers) country, gold flows out in net. That sets in train a mechanism of self correcting prices downward because less gold was chasing the same amount of goods.

In the foreign country, more gold was chasing the same amount of goods so prices rose. With imports more expensive, people would consume less of them and more of the now cheaper domestic produce. The trade deficit would shrink and the balance would be restored.

The problem is: in a complex financial society, gold was not how this above process was done but rather in currency. So:

- the money supply contracts in the deficit trade as more currency flows out then

- interest rates would rise,

- Dometic prices/wages falls,

- then export competitiveness would reach a new equilibrium since prices would be attractive again to foreign investors.

The gold exchange standard works because the Bank of England, Bank of France and Bank of Reichstag all were credible. Trust was essential. This trust wasn’t a product of the system’s design. There is no magic to keeping money valuable, the pressures to print wildly are always present. Trust in the gold standard was the means of managing the printing of paper banknotes for convertibility. And such a system was contingent on stability.

There are three factors in re-enforcing the Gold Standard System:

- The UK economy created large re-enforcing synergies that recycled gold into the economy for productive investment through the selling of machinery technology and manufacturing in exchange for raw resources from the empire like Canada and Argentina.

- There weren’t any serious internal or external risks to the system.

- The system was backed by the politicians. They would try to keep the system stable at any cost which includes raising interest rates to increase gold inflows that would also apply downward pressure on prices/wages and thus restore competitiveness.

By the end of the 19th century, the flaw in the gold standard become more evident: the amount of gold mined was not keeping pace with economic demands leading to deflation ie. prices and wages fell. Since the economic power was not singularly in London anymore, the gold standard was harder to manage. As more countries joined the gold standard in 1870s, the amount of gold available was not able to chase the same amount of economic activity, this was causing deflation in general prices. When they found new gold deposits in Alaska, South Africa and Australia the downward pressure subsided but the increased again as the new supply faded. The system turned to unbacked foreign reserves thus weakening the creditworthiness within banking.

Central banks were conflicted with being lenders of last resorts (internal balance) versus convertibility (external balance). There were more frequent bank runs and more provisions for liquidity. There were self-fulling behaviours in which the Bank of England was being called the coordinator of international cooperation. The Bank of England tried to manage the 1890 bearings crisis in Argentina. The Bank of England loaned from France and Russia to help Argentina. The political movements became more working class parties, it was harder to manage the system because the gold standard model was built before fractional reserve banking and paper banknotes. It seemed fraudulent to laymen voters. Governments prior to democracy could manage their currency above all else. But now citizens were asking about the gold standard, just as many crypto-currency enthusiasts are asking about FIAT in the early 21st century.

Carney’s Diagnosis of the End of the Gold Standard:

The gold standard was not aligned with ‘solidarity’ of domestic requirements. It was a product of international exchange in a multi-polar central banking world. The First World War triggered the end of the gold standard. The centre of economic power shifted to the US but the US wasn’t willing to follow the gold standard. The rise of trade unions prevented wages from adjusting in response to deflationary equilibrium….

For Carney, the gold standard’s values were not consistent with values. It was about international cooperation between central banks rather than the internal cooperation of citizens in a domestic polity.

The gold standard was not immediately resurrected after World War I in part because Britain wasn’t the central power that it once was prior to World War I. For example the United States was twice the economy of the United Kingdom and Britain was under performing relative to France and Russia. So the gold standard no longer makes sense. The US was also emergent in its influence and the protocols of the gold standard wouldn’t have worked for the US.

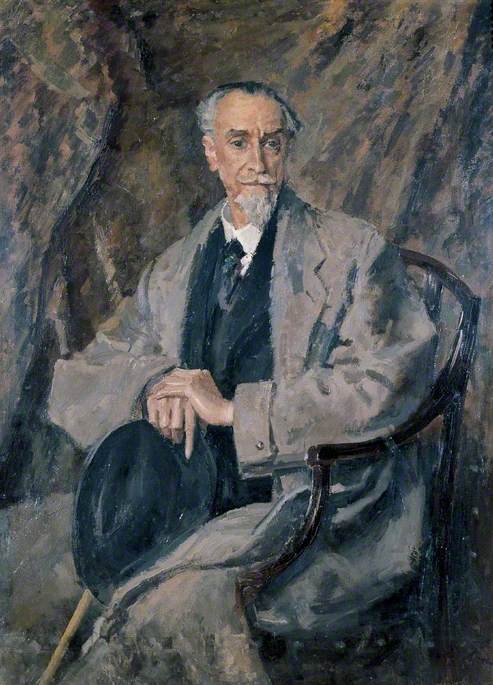

There was a 1920 Mansion House bankers dinner where Montagu Norman assumed the gold standard was coming back. He arrogantly pushed his case. But as Carney points out, the people who are often least aware of changes in the financial world are the bankers themselves who have vested interest in retaining its existing structure. This was the era of “never elaborate and never explain” according to Carney. The UK reinstated the gold standard in 1926 with disastrous results. And then had to abandon the gold standard again in 1931. UK had screwed-up their economy as a result.

The Montagu Norman Painting:

Carney recounts his first day as the Governor of the Bank of England and his decision to remove a painting of Montagu Norman. George Osborne (the Chancellor of the Exchequer/ Minister of Finance / Secretary of the Treasury) called and said he wanted the painting to remind him not to listen to the Governor of the Bank of England. Montagu Norman had convinced (finance minister in the UK) at the time was Winston Churchill to back the gold standard at pre-WWI levels. The painting would remind Osborne to never listen to the Governor of the Bank of England.

Lessons from Gold Standard for the Values:

- Trust is critical, you need to have convertibility, and self equilibrium, but trust can’t be maintained without transparency. You need consent and a fair sharing of the burdens of adjustments. The world becomes multi-polar.

- Domestic financial systems are complex. This brings financial prudence. Labour power would increase such that the equilibrium required for a gold standard adjustment no longer worked.

- The values of the “value of money” is about trust, integrity solidarity and accountability.

- Most countries use fiat money, but those institutional foundations are just as fragile if they aren’t tied to the right values.

Analysis Part 1 Chapter 3

- Free Banking in the US seems to be precursor to the Social Credit movement in Alberta, Canada. I wonder if there is a connection to this alternative to a central bank movement to explore further?

- The fact that central banks are better now then in the past does not re-assure the crypto-currency enthusiasts who say central bankers are crooks.

- Which society are we talking about? The focus is squarely on countries in which Carney has resided….there is more to England than London and there is more to Earth then England.

- Gold is no longer the gold standard but rather the promise to manage the supply of new bills, new bond issuance and the levers of monetary policy. The Bank of England conducts monetary policy to ensure that the amount of cash circulation supports low and stable inflation. The point is that Bitcoin and Zeitgeist folks simply don’t trust the civil servants operating such machinery AND the processes of central banking as sufficiently complex such that their functioning can be misconstrued. There is a vested interest in not trusting central banks.

- Super-ironic that Mark Carney makes fun of the elitism of a Bankers Dinner in 1920 where the Governor of the Bank of England, Montagu Norman gave a speech in which he was certain the gold standard “would return of normal” after after the conclusion of the 1919 Paris peace conference….meanwhile people aren’t going to be reading Value(s) closely and Carney is also advocating for things that are disconnected from the values of the ‘majority’….

- Montagu Norman’s arrogance mirrors Mark Carney’s own arrogance in thinking that people will follow him just because he has the right credentials. Value(s) is a good effort but the parallels are interesting.

- The Bank of England is look at the top of the greasy pole of monetary and accounting prudence and thinking….naw, its nice let’s keep climbing, there is always someone smarter, better.

- Carney mentions the donut shaped Yap’s of Micronesian island of Yap. The Rai stone is viewed as not actually being a money system at all according to some economists…..

- Mobile phone payments in Kenya involve selling airtime minutes but also there are direct money transfers as well, Carney makes it sound like M-Pesa is merely about selling airtime minutes.

Citations Worth Noting for Part 1: Chapter 3:

- Michael McLeay, Amar Radia and Ryland, ‘Money Creation in the Modern Economy’, Bank of England Quarterly Bulletin (2014) Q1.

- Niall Ferguson, The Ascent of Money: A Financial History of the World (London: Allen Lane, 2008).

- P.G.M Dickson, The Financial Revolution in England: A Study in the Development of Public Credit, 1688 – 1756 (London: Macmillan; New York: St Martin’s Press, 1967).

- David Omrod, The Rise of Commercial Empires: England and the Netherlands in the Age of Mercantilism, 1650 – 1770 (Cambridge: Cambridge University Press, 2003).

- John David Angle, ‘Glorious Revolution as Financial Revolution’, History Faculty Publications 6 (2013), https://scholar.snu.edu/hum_sci_history_research/6

- B.R. Mtchel, International Historical Statistics, Europe 1750 – 1988 (New York: Stockton press, 1992)

- Angus Maddison, Contour of the World Economy, 1 – 2030 AD: Essays in Macro-economic History (Oxford: Oxford University Press, 2007).