Chapter 9 The Covid Crisis: How We Got Here

Key Takeaway

This chapter discusses the discovering of COVID and all the other asks of this pandemic that we are all very familiar with. Carney was the governor of the Bank of England until February 2020. Economic and family priorities.

The Covid crisis emphasized:

- Solidarity: companies, bank, society

- Responsibility: for each other, employees, supplies, customers.

- Sustainability: where the health consequences skew towards seniors while the economics consequences skew towards millennials and Gen Z.

- Fairness: sharing the burden, providing access to care.

- Dynamism: restoring the economy with massive government intervention and private sector resurgences…..

Duty of the State:

Carney goes through a review of political philosophy from Thomas Hobbes (1588 – 1679) to John Locke (1632 – 1704) to Rousseau (1712 – 1778) to suggest that in exchange for giving up certain freedoms, the state promises to deliver protection to its citizens. Much the same with central banks; that the public gives up the detailed nuanced control of the money supply in exchange the financial system delivers prosperity.

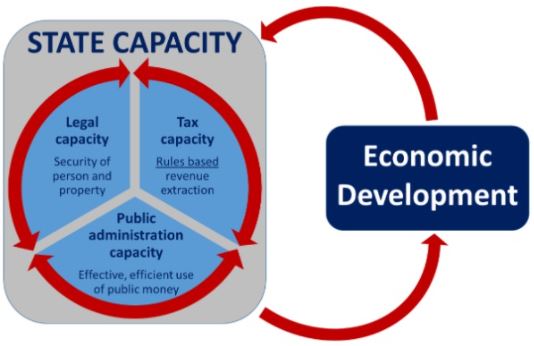

Capacity of the State must have:

1) legal capacity: ability to create regulations, enforce contracts and protect property rights: these include social distancing regulations that aimed to reduce transmission of COVID 19;

2) collective capacity delivering services;

3) fiscal capacity: power to tax and spend: state capacity has moved from 10% of GDP to 25% to 50% of GDP with corresponding services to protect citizens from COVID 19.

Other Points:

- Poor compliance in democratic societies;

- Stock piles were not restocked;

- Bill Gates Ted Talk from 2015 was not actioned by any one actor;

- Many countries didn’t have PPE and depended on China’s production initially;

- No country is really prepared for this particular kind of pandemic;

- South Korea had a pandemic in 2015 and Carney repeats the often mentioned success of South Korea through contact tracing and geo-targeting of users;

- Governments need to be better at coordinating: there were departmental territoriality;

- In simulations for pandemics this was very evident.

Cost-Benefit Analysis for Hard Choices:

- There was a weighting of variables to decide whether to lockdown or otherwise.

- The effects of lockdown: domestic abuse were hard to do that.

Calculating the value of a human life: is hard to do. But there is actuaries to put the intrinsic versus investment value of a life or the net present value of all future cashflows that person is predicted to generate. Life is priceless. Sometimes the calculation is about the productivity of the person in life…..

Schelling’s “The Life You Save May Be Your Own” points out that the value of a life principally the concern of the person living it. Value of a Statistical Life (VSL) became the industry standard. The example Carney provides is the a risk of death in a high-risk job might be 1 in 10,000 and employees receive $300 of danger pay, therefore the VSL is $3,000,000. There are several other methods: 1) stated-preference, 2)hedonic-wage, 3) contingent etc. And different countries use different metrics in similar circumstances. In Canada, the estimated range of a human life is $3.4M to $9.9M CAD meanwhile in the US, the estimated range of a human life is $1M to $10M USD. Healthcare looks at quality-adjusted life year (QALY) and cost-utility versus cost-benefit analysis. Schelling’s assumption about how a person can evaluate the value of their life. VSL usage is a moral choice. Wealthcare many not be measured properly according to Carney. Another model is the VSLY Value of a Statistical Life Year. The question remains: do all lives have an equal value or is it the number of life years should be treated as equal?

Analysis of Value(s) Part 2 Chapter 9

- While it is complicated, I would have liked Carney to have explained the system of money creation in simple terms as it pertains to the pandemic. The level of government issuance of support has been massive. It is imperative folks understand how stimulus money is created.

- The perception that money is created out of thin air, subject to political pressures is not true. Zeitgeist and other explanations of the money system are warped thinking. There friends and family going around saying that central banks ‘just print money’ whenever it suits them…

- Here is a good explanation of how the central bank enables money creation: To support small businesses and citizens out of work: Is the government increasing tax or are they printing money during the pandemic? The stimulus money was not coming from new taxes so here the government raises through borrowing. The government issues treasury bills to three groups of savers:

(1) public sector (other parts of the government,

(2) the private sector (people and companies),

(3) foreign entities.

The government agrees to pay those savers back with interest at a future date. In the short-term the government uses that cash sucked out of the economy in exchange for the treasury bills to issue stimulus cheques back into the economy. Keynesian economics says that the more stimulus there is, the more economic activity which enables more private savings which then fuels more transactions for bonds. The government can borrow, unlike an individual, through this system as long as the economy is growing at the same or greater rate then that of the debt. The economy is growing at the same rate as debt then the debt to GDP ratio will be stable. If the debt to GDP ratio is stable, then the government can argue for continued investment in its debt securities (ie. bonds).

An additional layer of complexity is that: (4) the source which is the Mint in Canada and the Federal Reserve in the US does not print actual paper money much any more but does indeed ‘print out of thin air’: electronic money, that is credited in the treasury department’s account. In exchange, the Fed then holds treasury bills. The key consequence of issuing too much money with this source (4) is inflation whereby more money in circulation is chasing the same limited number of goods available thus driving the price upward of the individual goods. The 10 year Treasury Note then starts to go up and inflation creeps in. In this case, the Fed needs to increase interest rates to counteract/dampen the purchasing of the demand side…..

- The fines for violating COVID rules have an earned media dynamic: we know that the virus is spread through gatherings where one ore more participants has the virus. When someone gets an ‘arbitrary fine’ it effectively markets better than other forms of advertising such as digital. The injustice of the fine is earned media.

- There are Canadians under the false impression that government at the federal, provincial and municipal level are not allowed to make rules that ‘violate’ the Charter of Rights and Freedoms. Well, a constitution has to be enforced, my friend…

- This time will be different which was Carney’s number one lie in finance seems to be fillable here to say, why would you think that in a future pandemic in say 2055, that our children will be able to respond better then this time?

- Just are Carney fails to explain how the central bank manages the money supply, he too here fails to give a basic description of the “obvious’ nature of the COVID 19 virus. Its unique gestation period in which it sheds without the host having any symptoms for T+7 days is very novel unlike other viruses that are initially extremely aggressive, for example, ebola or SARS.

- The threat of future pandemics is very real until it isn’t at all. If COVID had the immune effects of HIV then the response would have been more severe in North America. However COVID can be contracted and the likelihood of death is 1 – 5% based on comorbidities. We’ve literally spent the last year talking about this virus. The next virus if it were HIV but airborne, the human race would be in full black plaque mode. Freedom loving + scientific illiteracy are a potent weapon.

- Lack of understanding the characteristics of the virus.

- In ability to connect barriers that create friction such as laws, walls and masks have the underlying same logic; they do not prevent all the negatives from happening but laws, walls and masks make the unwanted thing from happening, obviously.

Citations Worth Noting for Part 1: Chapter 9:

- John Locke, A Third Concerning Toleration, in Ian Shapiro (ed.), Two Treaties of Government and A Letter Concerning Toleration, 1689.

- Jean-Jacques Rousseau, The Social Contract.

- Thomas Piketty, Capital in the Twenty-First Century (Cambridge, Mass.: Harvard University Press, 2014).

- Derek Thompson, ‘What’s Behind South Korea’s COVID-19 Exceptionalism?’, Atlantic, 6 May 2020.

- A.E. Hofflander, ‘The Human Life Value: An Historical Perspective’, Journal of Risk and Insurance 33(1) (1966).

- Cass Sunstein, The Cost-Benefit Revolution (Cambridge, Mass.: MIT Press, 2018): OECD (2012).